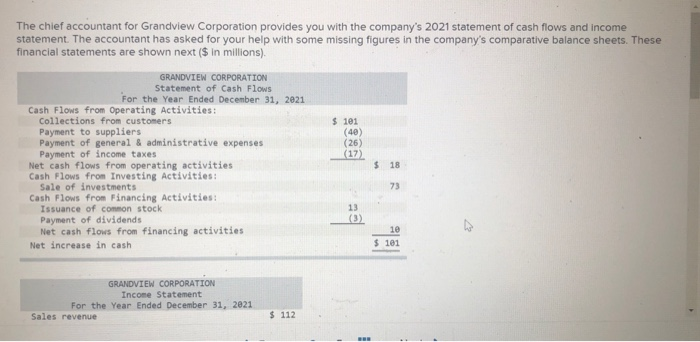

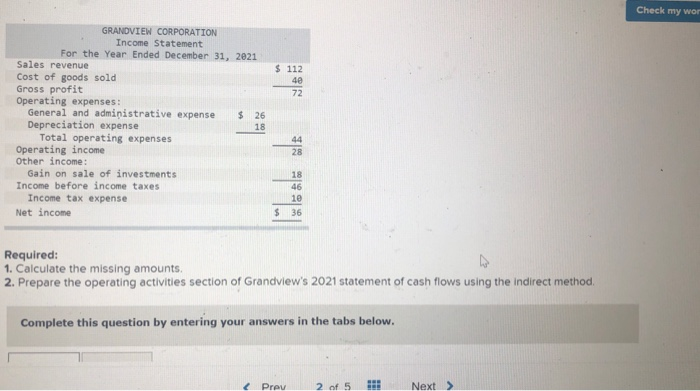

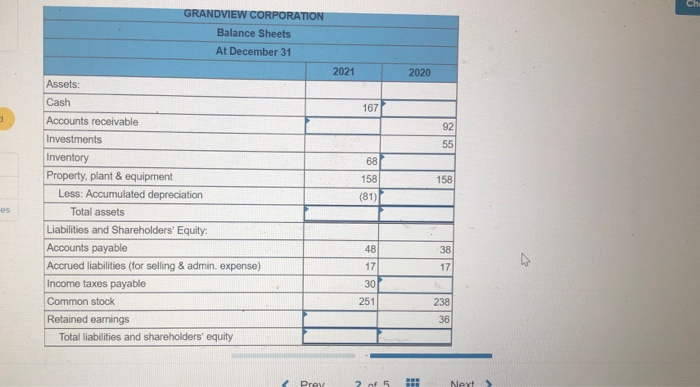

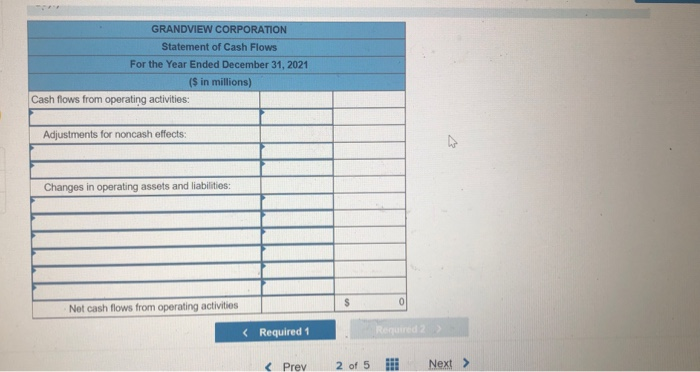

The chief accountant for Grandview Corporation provides you with the company's 2021 statement of cash flows and income statement. The accountant has asked for your help with some missing figures in the company's comparative balance sheets. These financial statements are shown next($ in millions) $ 101 (40) (26) (17) GRANDVIEW CORPORATION Statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities Collections from customers Payment to suppliers Payment of general & administrative expenses Payment of income taxes Net cash flows from operating activities Cash Flows from Investing Activities: Sale of investments Cash Flows from Financing Activities: Issuance of common stock Payment of dividends Net cash flows from financing activities Net increase in cash GRANDVIEW CORPORATION Income Statement For the Year Ended December 31, 2021 Sales revenue Check my wor $ 112 GRANDVIEW CORPORATION Income Statement For the Year Ended December 31, 2021 Sales revenue Cost of goods sold Gross profit Operating expenses: General and administrative expense Depreciation expense Total operating expenses Operating income Other income: Gain on sale of investments Income before income taxes Income tax expense Net income LE Required: 1. Calculate the missing amounts. 2. Prepare the operating activities section of Grandview's 2021 statement of cash flows using the indirect method. Complete this question by entering your answers in the tabs below. GRANDVIEW CORPORATION Balance Sheets At December 31 2021 2020 167 68 158 (81) Assets: Cash Accounts receivable Investments Inventory Property, plant & equipment Less: Accumulated depreciation Total assets Liabilities and Shareholders' Equity Accounts payable Accrued liabilities (for selling & admin. exponse) Income taxes payable Common stock Retained earnings Total liabilities and shareholders' equity 17 30 251 5 ! Navt GRANDVIEW CORPORATION Statement of Cash Flows For the Year Ended December 31, 2021 ($ in millions) Cash flows from operating activities: Adjustments for noncash effects: Changes in operating assets and liabilities: Not cash flows from operating activities (Required 1 Required 2