Answered step by step

Verified Expert Solution

Question

1 Approved Answer

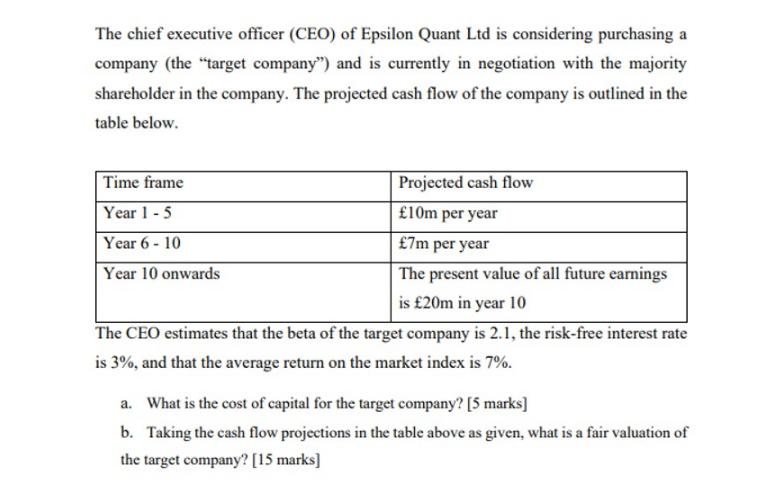

The chief executive officer (CEO) of Epsilon Quant Ltd is considering purchasing a company (the target company) and is currently in negotiation with the

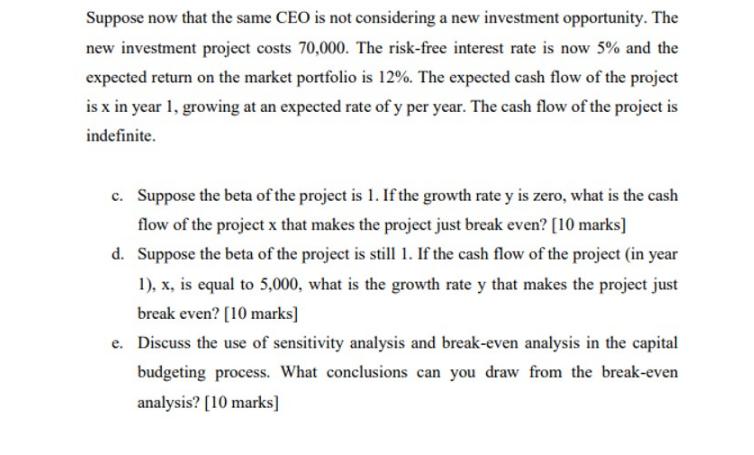

The chief executive officer (CEO) of Epsilon Quant Ltd is considering purchasing a company (the "target company") and is currently in negotiation with the majority shareholder in the company. The projected cash flow of the company is outlined in the table below. Time frame Year 1-5 Year 6-10 Year 10 onwards Projected cash flow 10m per year 7m per year The present value of all future earnings is 20m in year 10 The CEO estimates that the beta of the target company is 2.1, the risk-free interest rate is 3%, and that the average return on the market index is 7%. a. What is the cost of capital for the target company? [5 marks] b. Taking the cash flow projections in the table above as given, what is a fair valuation of the target company? [15 marks] Suppose now that the same CEO is not considering a new investment opportunity. The new investment project costs 70,000. The risk-free interest rate is now 5% and the expected return on the market portfolio is 12%. The expected cash flow of the project is x in year 1, growing at an expected rate of y per year. The cash flow of the project is indefinite. c. Suppose the beta of the project is 1. If the growth rate y is zero, what is the cash flow of the project x that makes the project just break even? [10 marks] d. Suppose the beta of the project is still 1. If the cash flow of the project (in year 1), x, is equal to 5,000, what is the growth rate y that makes the project just break even? [10 marks] e. Discuss the use of sensitivity analysis and break-even analysis in the capital budgeting process. What conclusions can you draw from the break-even analysis? [10 marks]

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The set of questions involves several financial concepts such as cost of capital valuation of cash flows breakeven analysis and sensitivity analysis Lets address each question step by step Part a What ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started