Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Chief Financial Officer (CFO) at Daylight Ltd., Ms Lindiwe Khanya, is excited about the forthcoming meeting of her company's board of directors. She is

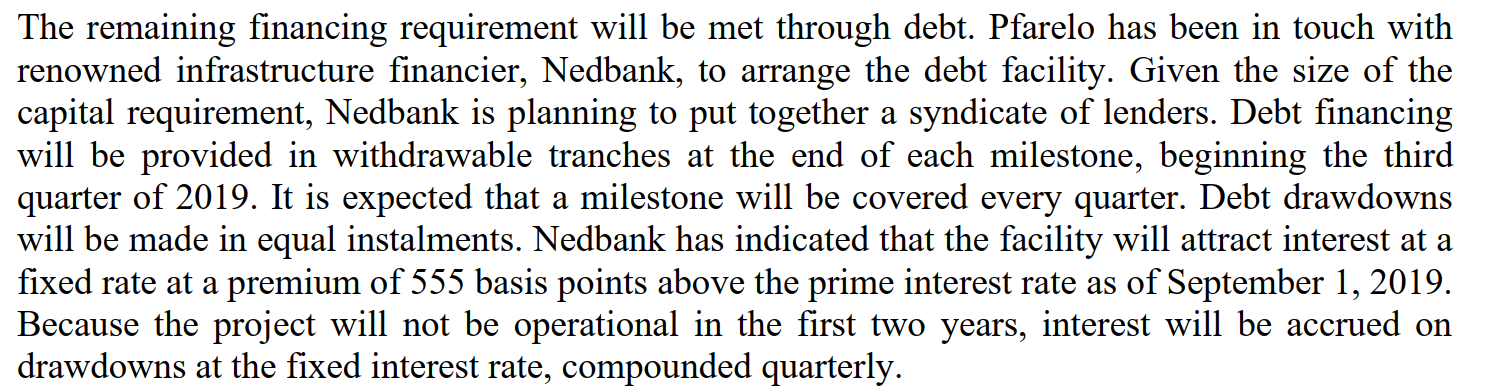

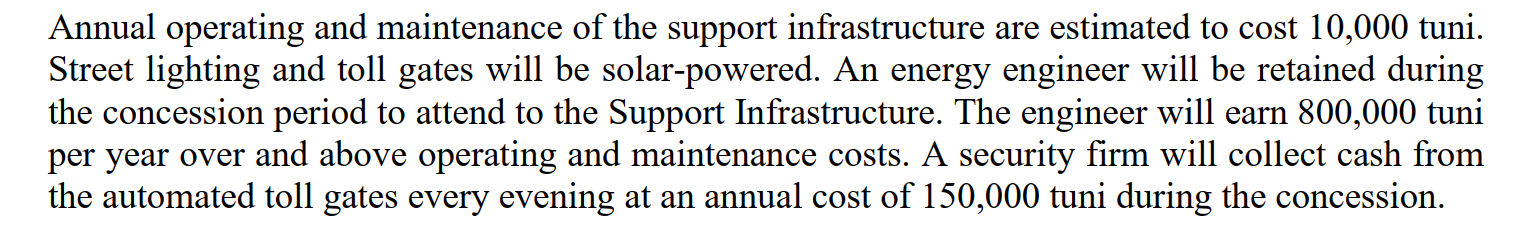

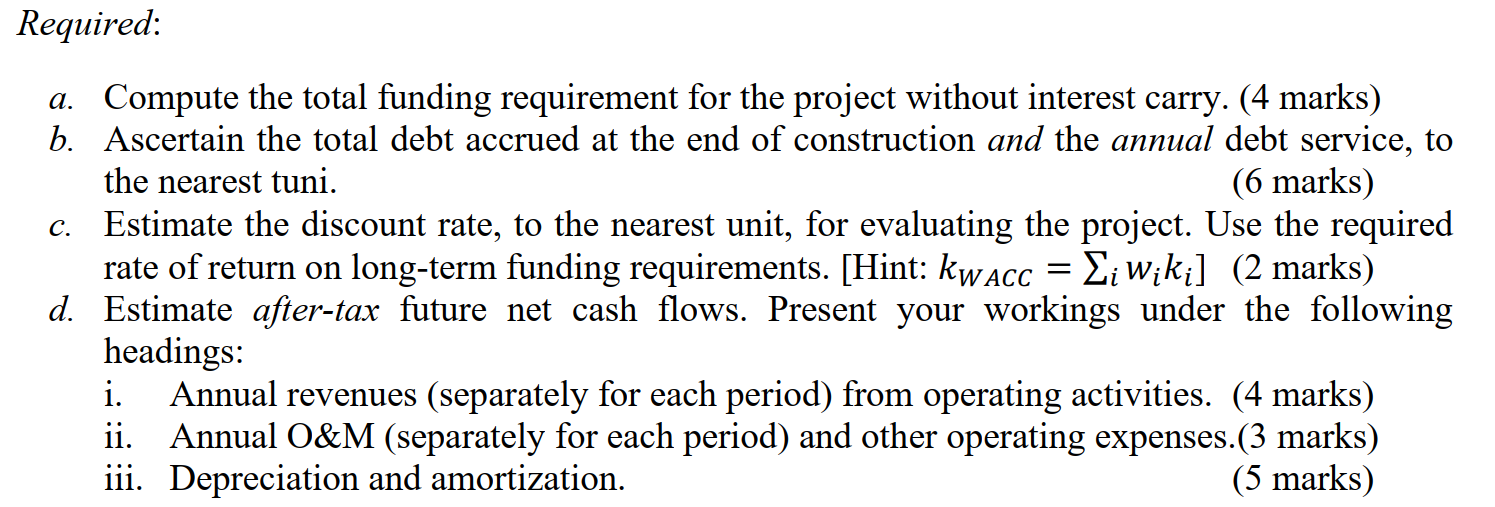

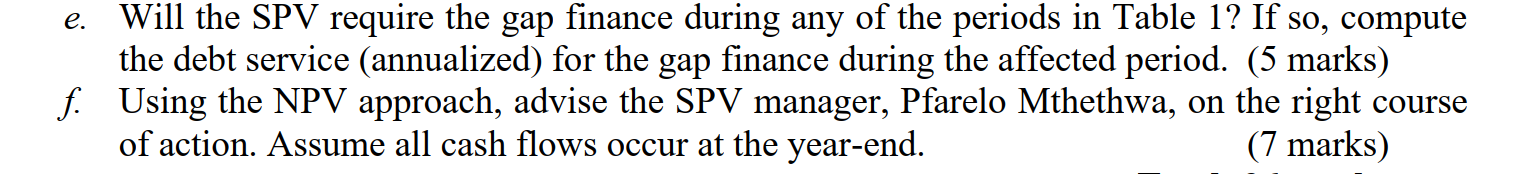

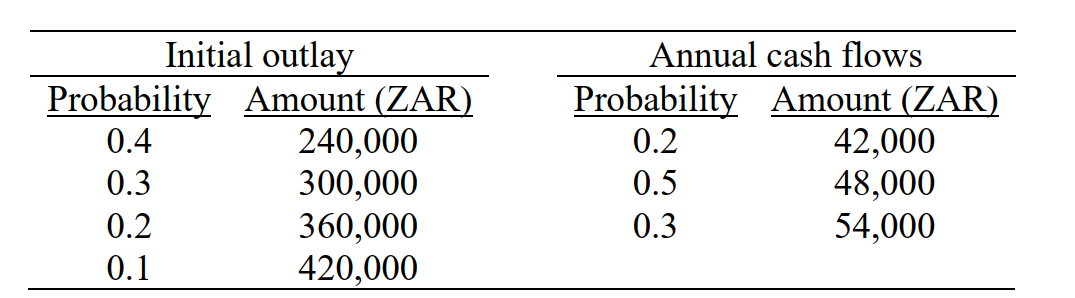

The Chief Financial Officer (CFO) at Daylight Ltd., Ms Lindiwe Khanya, is excited about the forthcoming meeting of her company's board of directors. She is scheduled to pitch the company's novel solar home-garden lighting solution, about which the company's production team has been researching over the last three years, to the board. The new product is designed as a suite comprising of a set of panels, energy-storage batteries, lamps and a programmable portable stand. The design allows the lighting suite to be programed to move around the garden at night in a way that mimics movements of a night guard on duty with a search light. According to the Production Manager, Sibsusiso Nxasana, research and development of the product has cost the Daylight ZAR 6 million to date. The Marketing Department has recently run a feasibility study, costing ZAR 3 million, which found that the product has sufficient market demand amongst homeowners within South Africa. The study also shows good demand within the upper echelons of society in several other African countries. During the feasibility study, the marketing team gathered that South African homeowners are willing to pay ZAR 140 for each unit of the lighting suite. Outside South Africa, the selling price would include import duty. For the average African country of interest, goods of the class similar to the lighting suite attract import duty at 2.0% of the landed cost (cost, insurance and freight); the cost base for computing landed cost excludes depreciation. The product would be shipped in 20 -ft containers, each with a capacity for 50 batches of the lighting suite. It is anticipated that 200 such containers will be shipped out each year. Insurance and freight costs USD 1.50 per container per nautical mile. The average freight distance to the other African markets is 700 The production department has reported that the product will be manufactured in production runs, each generating ten batches. Each batch contains 20 units of the lighting suite. The production capacity is five production runs per six-hour day. All units produced will be sold within the year of production. The production department has identified a 10,000MW plant that will work 300 days a year, with an expected downtime of approximately 5%. The plant, to be imported from Eindhoven, The Netherlands, is expected to cost 1 million euro including insurance and freight to the Port of Durban. The Eindhoven-based manufacturer has agreed to ship the plant in September 2018 against Daylight Ltd.'s Bankers' Acceptance (BA). The BA is expected to be arranged with Daylight's banker, Investec, at the beginning of September 2018. Because of the long relationship that Daylight has had with Investec, the bank has agreed to arrange the BA at no cost to Daylight. The bankers' acceptance will fall due at the end of December 2018. Lindiwe plans to use a currency futures contract to 'lock in' the rand-equivalent acquisition cost of the plant: December 2018 futures contracts are available for ZAR 15.80 per euro at a cost of 10% of the contract value. Shipment of the plant will take one month to the Port of Durban; then about two weeks by road to Johannesburg on a long-haul truck that will be hired for ZAR 1.8 million; installation and testing, expected to cost ZAR 1,725,400 will take about one month. Thus, if everything goes as planned, the plant is expected to be operational by January 1, 2019. The plant will be installed in the same rented premises currently housing Daylight's other manufacturing activities. The space is rented on a twenty-year contract ending December 2028 for a rental of ZAR 240,000 per year, payable monthly; the contract is renewable for a further twenty years. Rent is allocated based on space occupied; the new plant will occupy one-third of the space. The new plant will also be used to produce two other existing Daylight products. The two other products will utilize 60% of the capacity of the new plant. This proportion of usage will consume the same amount of overhead costs as the old plant. Thus, any additional overhead costs will be a direct consequence of production of the lighting suite. Sales revenues and operating costs associated with the two other products are not expected to change. The two products have been manufactured on a plant that is due to be retired at the end of 2018 . The plant was bought fifteen years ago for ZAR 10.5 million. At the time of its acquisition, the old plant was expected to have a scrape value of ZAR 1.5 million at the end of its life; it was being depreciated on a straight-line basis. The production department has indicated that the old plant can be dismantled and sold in several separate pieces for about ZAR 2.2 million at the end of December 2018. (An alternative plant that can produce the lighting suite has been identified in Ottawa, Canada; however, the plant is not multi-functional and therefore cannot be used to produce the two other products of Daylight Ltd. Consequently, if Daylight chooses this alternative, it will have to shop for a second plant to replace its old plant. The production team has indicated that the operating costs of two separate plants will not be different from those of one plant. However, factory safety is enhanced by using one plant to produce the three products.) The new plant will be operated by three (3) specialized personnel specifically working on the lighting suite, each earning ZAR 750,000 per year, total cost to employer. The average additional cost per MWh (megawatt-hour) of electric power is ZAR 3.50 to produce the lighting suite. Direct materials, to be purchased at the beginning of each year, are expected to cost 45% of the selling price per unit. Buffer materials over and above direct material usage requirements, equivalent to 10% of sales, will be purchased at the end of 2018 and will be held throughout the project. Buffer materials will be disposed of at their replacement value when the project ends. Unskilled labor charges for the lighting suite are expected to cost 25% of direct material usage. Daylight Ltd charges depreciation on a straight line basis. The new plant is expected to have a salvage value of 20% of its depreciable cost at the end of its four-year economic life. The relevant corporation tax rate for Daylight Ltd is 28%; capital gains tax rate is 13%. The expected exchange rate during 2019 is ZAR 13.50 to the US dollar. The rand is expected to depreciate against the US dollar by an average of 5% each year over the foreseeable future. Inflation, expected to affect labor and material costs, is expected to average 6% per year over the foreseeable future. For operating items, assume all sales are made, and all costs are incurred, at the end of each year. The discount rate for evaluating this project is 15%. Required: a. As the Financial Manager in charge of capital expenditure planning, you are required to prepare for Lindiwe a memorandum outlining the cash flows of the proposed project. Organize your memorandum on three headings: initial cash outlay, operating cash flows and terminal cash flows. ( 37 marks) b. Based on the cash flow projections in part (a) above and using the NPV criterion, include your recommendation of Daylight's desired course of action. (3 marks Question TWO Alpha Enterprises, a civil engineering firm, has hitherto only done plant installation and testing for manufacturing firms in Otunia. Alpha has recently been approached by the County Government of Otunia to undertake construction of a new 5km-bridge linking Otunia's mainland to its island resort town under a build, operate and transfer (BOT) concession. Alpha will operate the bridge for ten years then transfer it to the County Government. The old bridge, nearing the end of its economic life, will be demolished, at a cost of 1.8 million tuni (Otunia currency), when the new bridge is completed. Nothing of value can be salvaged from the old bridge. To avoid contamination risk with its existing project portfolio, the board of Alpha has set up a special purpose vehicle (SPV), under the directorship of Pfarelo Mthethwa, to oversee the bridge project. Pfarelo is now undertaking feasibility studies and contacting potential partners and financiers. Construction is expected to take two years, from January 1, 2019. Alpha Enterprises will provide, in the second quarter of 2019 , equity amounting to 25% of the total funding requirement, which will be used for underwater works. Underwater works will take three months to complete. The County government will provide 5% of the total funding requirement through equity investment. 70% of this money will be availed, at the beginning of the project, for water pumping and earth movement. The remaining 30% will be availed at the end of 2020 to finance demolition of the old bridge. The remaining financing requirement will be met through debt. Pfarelo has been in touch with renowned infrastructure financier, Nedbank, to arrange the debt facility. Given the size of the capital requirement, Nedbank is planning to put together a syndicate of lenders. Debt financing will be provided in withdrawable tranches at the end of each milestone, beginning the third quarter of 2019. It is expected that a milestone will be covered every quarter. Debt drawdowns will be made in equal instalments. Nedbank has indicated that the facility will attract interest at a fixed rate at a premium of 555 basis points above the prime interest rate as of September 1, 2019. Because the project will not be operational in the first two years, interest will be accrued on drawdowns at the fixed interest rate, compounded quarterly. The prime rate of interest is forecasted to rise to 10.25% by the first quarter of 2019 and to remain at that level over the succeeding three years. The project is expected to start servicing the resulting debt obligation in equal end-of-month instalments over seven years from the beginning of 2021. Pfarelo is discussing the possibility of arranging a gap loan with Capitec Bank (not part of the lending syndicate) to meet debt servicing needs in case of unanticipated shortfalls in net operating cash inflows. Capitec has indicated that such a facility will attract 220 basis points above the interest rate charged by syndicate lenders. The gap loan must be repaid fully in four equal quarterly instalments. Equity financiers' required rate of return averages 23.25% per year. Part of the construction work is to set up two automated toll gates with physical barriers, one on either end of the bridge, where Alpha Enterprises will collect user fees from bridge users; user fees will remain constant over ten years for each category of users. Corporation tax rate is 30%. Projections for the number of users, user fees and O\&M costs are given in Table 1. Table 1: Demand, user charges and operating and maintenance costs The new bridge (core and support infrastructure), estimated to be worth 100 million tuni at the end of construction, will be transferred at its assessed "market" value to the Otunia County government when the concession ends. The core infrastructure will be depreciated to zero, for tax purposes, over its fifty-year economic life. Support infrastructure (toll gates, barriers, street lights etc.) will constitute approximately 7% of the total value of the bridge at the end of construction. The support infrastructure is expected to suffer rapid obsolescence due to changing solar energy technology and is expected to be worthless at the end of 2027. At that time, the support infrastructure will be overhauled at a cost of 6.02 million tuni. This cost will be amortized on a straight line basis over the remaining life of the bridge. Annual operating and maintenance of the support infrastructure are estimated to cost 10,000 tuni. Street lighting and toll gates will be solar-powered. An energy engineer will be retained during the concession period to attend to the Support Infrastructure. The engineer will earn 800,000 tuni per year over and above operating and maintenance costs. A security firm will collect cash from the automated toll gates every evening at an annual cost of 150,000 tuni during the concession. a. Compute the total funding requirement for the project without interest carry. (4 marks) b. Ascertain the total debt accrued at the end of construction and the annual debt service, to the nearest tuni. (6 marks) c. Estimate the discount rate, to the nearest unit, for evaluating the project. Use the required rate of return on long-term funding requirements. [Hint: kWACC=iwiki ] (2 marks) d. Estimate after-tax future net cash flows. Present your workings under the following headings: i. Annual revenues (separately for each period) from operating activities. (4 marks) ii. Annual O\&M (separately for each period) and other operating expenses.(3 marks) iii. Depreciation and amortization. (5 marks) e. Will the SPV require the gap finance during any of the periods in Table 1 ? If so, compute the debt service (annualized) for the gap finance during the affected period. (5 marks) f. Using the NPV approach, advise the SPV manager, Pfarelo Mthethwa, on the right course of action. Assume all cash flows occur at the year-end. (7 marks) a. Clearly, and in a detailed manner, explain the roles and duties of the following parties in project finance: i. Financial advisor(s) ( 2 points) ii. Equity investor(s) ( 2 points) b. Discuss the following as they relate to project finance vis a vis traditional finance. i. Leveraged debt ( 2 points) ii. Risk allocation (2 points) iii. Non-recourse financing ( 2 points) Total: 10 marks Question FOUR a. What three reasons might one give for the existence of capital rationing in project analysis? (6 marks) b. Legico Ltd has an investment opportunity for which the initial outlay and cash flows are risky. The company's cost of capital is 12%; the project's economic life is expected to be ten years with zero salvage value. An analysis produced the following subjective probability assessments: \begin{tabular}{ccccc} \hline \multicolumn{2}{c}{ Initial outlay } & & \multicolumn{2}{c}{ Annual cash flows } \\ \cline { 1 - 2 } \cline { 4 - 5 } Probability & 240,000Amount(ZAR) & & Probability & Amount (ZAR) \\ 0.4 & & & 0.2 & 42,000 \\ 0.3 & 300,000 & & 0.5 & 48,000 \\ 0.2 & 360,000 & & 54,000 \\ 0.1 & 420,000 & & \\ \hline \end{tabular} Required: i. Construct a well-labelled decision tree for this investment. ( 2 marks) ii. Calculate the project's expected net present value and recommend the course of action for Lomnin Ltd with a suitable justification. (6 marks) Total: 14 marks

The Chief Financial Officer (CFO) at Daylight Ltd., Ms Lindiwe Khanya, is excited about the forthcoming meeting of her company's board of directors. She is scheduled to pitch the company's novel solar home-garden lighting solution, about which the company's production team has been researching over the last three years, to the board. The new product is designed as a suite comprising of a set of panels, energy-storage batteries, lamps and a programmable portable stand. The design allows the lighting suite to be programed to move around the garden at night in a way that mimics movements of a night guard on duty with a search light. According to the Production Manager, Sibsusiso Nxasana, research and development of the product has cost the Daylight ZAR 6 million to date. The Marketing Department has recently run a feasibility study, costing ZAR 3 million, which found that the product has sufficient market demand amongst homeowners within South Africa. The study also shows good demand within the upper echelons of society in several other African countries. During the feasibility study, the marketing team gathered that South African homeowners are willing to pay ZAR 140 for each unit of the lighting suite. Outside South Africa, the selling price would include import duty. For the average African country of interest, goods of the class similar to the lighting suite attract import duty at 2.0% of the landed cost (cost, insurance and freight); the cost base for computing landed cost excludes depreciation. The product would be shipped in 20 -ft containers, each with a capacity for 50 batches of the lighting suite. It is anticipated that 200 such containers will be shipped out each year. Insurance and freight costs USD 1.50 per container per nautical mile. The average freight distance to the other African markets is 700 The production department has reported that the product will be manufactured in production runs, each generating ten batches. Each batch contains 20 units of the lighting suite. The production capacity is five production runs per six-hour day. All units produced will be sold within the year of production. The production department has identified a 10,000MW plant that will work 300 days a year, with an expected downtime of approximately 5%. The plant, to be imported from Eindhoven, The Netherlands, is expected to cost 1 million euro including insurance and freight to the Port of Durban. The Eindhoven-based manufacturer has agreed to ship the plant in September 2018 against Daylight Ltd.'s Bankers' Acceptance (BA). The BA is expected to be arranged with Daylight's banker, Investec, at the beginning of September 2018. Because of the long relationship that Daylight has had with Investec, the bank has agreed to arrange the BA at no cost to Daylight. The bankers' acceptance will fall due at the end of December 2018. Lindiwe plans to use a currency futures contract to 'lock in' the rand-equivalent acquisition cost of the plant: December 2018 futures contracts are available for ZAR 15.80 per euro at a cost of 10% of the contract value. Shipment of the plant will take one month to the Port of Durban; then about two weeks by road to Johannesburg on a long-haul truck that will be hired for ZAR 1.8 million; installation and testing, expected to cost ZAR 1,725,400 will take about one month. Thus, if everything goes as planned, the plant is expected to be operational by January 1, 2019. The plant will be installed in the same rented premises currently housing Daylight's other manufacturing activities. The space is rented on a twenty-year contract ending December 2028 for a rental of ZAR 240,000 per year, payable monthly; the contract is renewable for a further twenty years. Rent is allocated based on space occupied; the new plant will occupy one-third of the space. The new plant will also be used to produce two other existing Daylight products. The two other products will utilize 60% of the capacity of the new plant. This proportion of usage will consume the same amount of overhead costs as the old plant. Thus, any additional overhead costs will be a direct consequence of production of the lighting suite. Sales revenues and operating costs associated with the two other products are not expected to change. The two products have been manufactured on a plant that is due to be retired at the end of 2018 . The plant was bought fifteen years ago for ZAR 10.5 million. At the time of its acquisition, the old plant was expected to have a scrape value of ZAR 1.5 million at the end of its life; it was being depreciated on a straight-line basis. The production department has indicated that the old plant can be dismantled and sold in several separate pieces for about ZAR 2.2 million at the end of December 2018. (An alternative plant that can produce the lighting suite has been identified in Ottawa, Canada; however, the plant is not multi-functional and therefore cannot be used to produce the two other products of Daylight Ltd. Consequently, if Daylight chooses this alternative, it will have to shop for a second plant to replace its old plant. The production team has indicated that the operating costs of two separate plants will not be different from those of one plant. However, factory safety is enhanced by using one plant to produce the three products.) The new plant will be operated by three (3) specialized personnel specifically working on the lighting suite, each earning ZAR 750,000 per year, total cost to employer. The average additional cost per MWh (megawatt-hour) of electric power is ZAR 3.50 to produce the lighting suite. Direct materials, to be purchased at the beginning of each year, are expected to cost 45% of the selling price per unit. Buffer materials over and above direct material usage requirements, equivalent to 10% of sales, will be purchased at the end of 2018 and will be held throughout the project. Buffer materials will be disposed of at their replacement value when the project ends. Unskilled labor charges for the lighting suite are expected to cost 25% of direct material usage. Daylight Ltd charges depreciation on a straight line basis. The new plant is expected to have a salvage value of 20% of its depreciable cost at the end of its four-year economic life. The relevant corporation tax rate for Daylight Ltd is 28%; capital gains tax rate is 13%. The expected exchange rate during 2019 is ZAR 13.50 to the US dollar. The rand is expected to depreciate against the US dollar by an average of 5% each year over the foreseeable future. Inflation, expected to affect labor and material costs, is expected to average 6% per year over the foreseeable future. For operating items, assume all sales are made, and all costs are incurred, at the end of each year. The discount rate for evaluating this project is 15%. Required: a. As the Financial Manager in charge of capital expenditure planning, you are required to prepare for Lindiwe a memorandum outlining the cash flows of the proposed project. Organize your memorandum on three headings: initial cash outlay, operating cash flows and terminal cash flows. ( 37 marks) b. Based on the cash flow projections in part (a) above and using the NPV criterion, include your recommendation of Daylight's desired course of action. (3 marks Question TWO Alpha Enterprises, a civil engineering firm, has hitherto only done plant installation and testing for manufacturing firms in Otunia. Alpha has recently been approached by the County Government of Otunia to undertake construction of a new 5km-bridge linking Otunia's mainland to its island resort town under a build, operate and transfer (BOT) concession. Alpha will operate the bridge for ten years then transfer it to the County Government. The old bridge, nearing the end of its economic life, will be demolished, at a cost of 1.8 million tuni (Otunia currency), when the new bridge is completed. Nothing of value can be salvaged from the old bridge. To avoid contamination risk with its existing project portfolio, the board of Alpha has set up a special purpose vehicle (SPV), under the directorship of Pfarelo Mthethwa, to oversee the bridge project. Pfarelo is now undertaking feasibility studies and contacting potential partners and financiers. Construction is expected to take two years, from January 1, 2019. Alpha Enterprises will provide, in the second quarter of 2019 , equity amounting to 25% of the total funding requirement, which will be used for underwater works. Underwater works will take three months to complete. The County government will provide 5% of the total funding requirement through equity investment. 70% of this money will be availed, at the beginning of the project, for water pumping and earth movement. The remaining 30% will be availed at the end of 2020 to finance demolition of the old bridge. The remaining financing requirement will be met through debt. Pfarelo has been in touch with renowned infrastructure financier, Nedbank, to arrange the debt facility. Given the size of the capital requirement, Nedbank is planning to put together a syndicate of lenders. Debt financing will be provided in withdrawable tranches at the end of each milestone, beginning the third quarter of 2019. It is expected that a milestone will be covered every quarter. Debt drawdowns will be made in equal instalments. Nedbank has indicated that the facility will attract interest at a fixed rate at a premium of 555 basis points above the prime interest rate as of September 1, 2019. Because the project will not be operational in the first two years, interest will be accrued on drawdowns at the fixed interest rate, compounded quarterly. The prime rate of interest is forecasted to rise to 10.25% by the first quarter of 2019 and to remain at that level over the succeeding three years. The project is expected to start servicing the resulting debt obligation in equal end-of-month instalments over seven years from the beginning of 2021. Pfarelo is discussing the possibility of arranging a gap loan with Capitec Bank (not part of the lending syndicate) to meet debt servicing needs in case of unanticipated shortfalls in net operating cash inflows. Capitec has indicated that such a facility will attract 220 basis points above the interest rate charged by syndicate lenders. The gap loan must be repaid fully in four equal quarterly instalments. Equity financiers' required rate of return averages 23.25% per year. Part of the construction work is to set up two automated toll gates with physical barriers, one on either end of the bridge, where Alpha Enterprises will collect user fees from bridge users; user fees will remain constant over ten years for each category of users. Corporation tax rate is 30%. Projections for the number of users, user fees and O\&M costs are given in Table 1. Table 1: Demand, user charges and operating and maintenance costs The new bridge (core and support infrastructure), estimated to be worth 100 million tuni at the end of construction, will be transferred at its assessed "market" value to the Otunia County government when the concession ends. The core infrastructure will be depreciated to zero, for tax purposes, over its fifty-year economic life. Support infrastructure (toll gates, barriers, street lights etc.) will constitute approximately 7% of the total value of the bridge at the end of construction. The support infrastructure is expected to suffer rapid obsolescence due to changing solar energy technology and is expected to be worthless at the end of 2027. At that time, the support infrastructure will be overhauled at a cost of 6.02 million tuni. This cost will be amortized on a straight line basis over the remaining life of the bridge. Annual operating and maintenance of the support infrastructure are estimated to cost 10,000 tuni. Street lighting and toll gates will be solar-powered. An energy engineer will be retained during the concession period to attend to the Support Infrastructure. The engineer will earn 800,000 tuni per year over and above operating and maintenance costs. A security firm will collect cash from the automated toll gates every evening at an annual cost of 150,000 tuni during the concession. a. Compute the total funding requirement for the project without interest carry. (4 marks) b. Ascertain the total debt accrued at the end of construction and the annual debt service, to the nearest tuni. (6 marks) c. Estimate the discount rate, to the nearest unit, for evaluating the project. Use the required rate of return on long-term funding requirements. [Hint: kWACC=iwiki ] (2 marks) d. Estimate after-tax future net cash flows. Present your workings under the following headings: i. Annual revenues (separately for each period) from operating activities. (4 marks) ii. Annual O\&M (separately for each period) and other operating expenses.(3 marks) iii. Depreciation and amortization. (5 marks) e. Will the SPV require the gap finance during any of the periods in Table 1 ? If so, compute the debt service (annualized) for the gap finance during the affected period. (5 marks) f. Using the NPV approach, advise the SPV manager, Pfarelo Mthethwa, on the right course of action. Assume all cash flows occur at the year-end. (7 marks) a. Clearly, and in a detailed manner, explain the roles and duties of the following parties in project finance: i. Financial advisor(s) ( 2 points) ii. Equity investor(s) ( 2 points) b. Discuss the following as they relate to project finance vis a vis traditional finance. i. Leveraged debt ( 2 points) ii. Risk allocation (2 points) iii. Non-recourse financing ( 2 points) Total: 10 marks Question FOUR a. What three reasons might one give for the existence of capital rationing in project analysis? (6 marks) b. Legico Ltd has an investment opportunity for which the initial outlay and cash flows are risky. The company's cost of capital is 12%; the project's economic life is expected to be ten years with zero salvage value. An analysis produced the following subjective probability assessments: \begin{tabular}{ccccc} \hline \multicolumn{2}{c}{ Initial outlay } & & \multicolumn{2}{c}{ Annual cash flows } \\ \cline { 1 - 2 } \cline { 4 - 5 } Probability & 240,000Amount(ZAR) & & Probability & Amount (ZAR) \\ 0.4 & & & 0.2 & 42,000 \\ 0.3 & 300,000 & & 0.5 & 48,000 \\ 0.2 & 360,000 & & 54,000 \\ 0.1 & 420,000 & & \\ \hline \end{tabular} Required: i. Construct a well-labelled decision tree for this investment. ( 2 marks) ii. Calculate the project's expected net present value and recommend the course of action for Lomnin Ltd with a suitable justification. (6 marks) Total: 14 marks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started