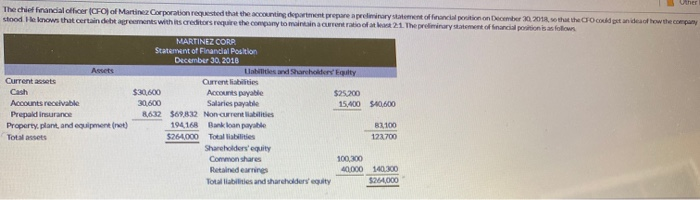

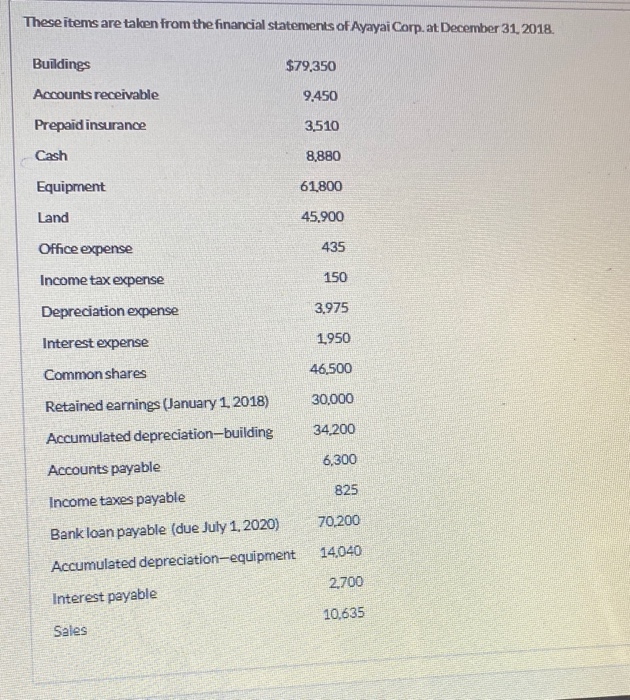

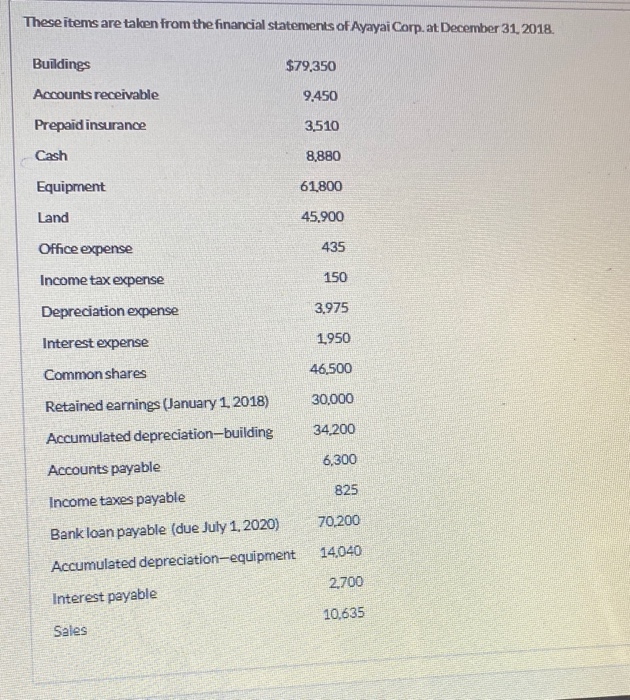

The chief Financial officer (CFO of Martinez Corporation requested that the accounting department prepare a preliminary statement of financial position on December 30, 2018, so that the could get an idea of how the company stood He knows that certain debt agreements with its creditors require the company to maintain a current ratio of a 21. The preliminary statement of financial portion is as follow MARTINEZ CORR Statement of Financial Position December 30, 2018 Assets Untities and Shareholder Equity Currentes Current liabilities Cash $30,600 Accounts payable $25.200 Accounts receivable 30.600 Salaries payable 15,400 $40,600 Prepaid insurance 8632 $69,832 Non current liabilities Property.plant, and equipment (net) 194 168 Bank loan payable 83100 Total assets $264.000 Total liabilities 123.700 Shareholders' equity Common shares 100,300 Retained earrings 40000 140,300 Total abilities and shareholders' equity $264,000 These items are taken from the financial statements of Ayayai Corp. at December 31, 2018. Buildings $79,350 Accounts receivable 9.450 Prepaid insurance 3,510 Cash 8,880 Equipment 61,800 Land 45.900 Office expense 435 Income tax expense 150 Depreciation expense 3.975 Interest expense 1950 Common shares 46,500 30,000 Retained earnings (January 1, 2018) Accumulated depreciation-building Accounts payable 34,200 6,300 825 Income taxes payable 70,200 Bank loan payable (due July 1, 2020) Accumulated depreciation-equipment 14,040 2,700 Interest payable 10,635 Sales The chief Financial officer (CFO of Martinez Corporation requested that the accounting department prepare a preliminary statement of financial position on December 30, 2018, so that the could get an idea of how the company stood He knows that certain debt agreements with its creditors require the company to maintain a current ratio of a 21. The preliminary statement of financial portion is as follow MARTINEZ CORR Statement of Financial Position December 30, 2018 Assets Untities and Shareholder Equity Currentes Current liabilities Cash $30,600 Accounts payable $25.200 Accounts receivable 30.600 Salaries payable 15,400 $40,600 Prepaid insurance 8632 $69,832 Non current liabilities Property.plant, and equipment (net) 194 168 Bank loan payable 83100 Total assets $264.000 Total liabilities 123.700 Shareholders' equity Common shares 100,300 Retained earrings 40000 140,300 Total abilities and shareholders' equity $264,000 These items are taken from the financial statements of Ayayai Corp. at December 31, 2018. Buildings $79,350 Accounts receivable 9.450 Prepaid insurance 3,510 Cash 8,880 Equipment 61,800 Land 45.900 Office expense 435 Income tax expense 150 Depreciation expense 3.975 Interest expense 1950 Common shares 46,500 30,000 Retained earnings (January 1, 2018) Accumulated depreciation-building Accounts payable 34,200 6,300 825 Income taxes payable 70,200 Bank loan payable (due July 1, 2020) Accumulated depreciation-equipment 14,040 2,700 Interest payable 10,635 Sales