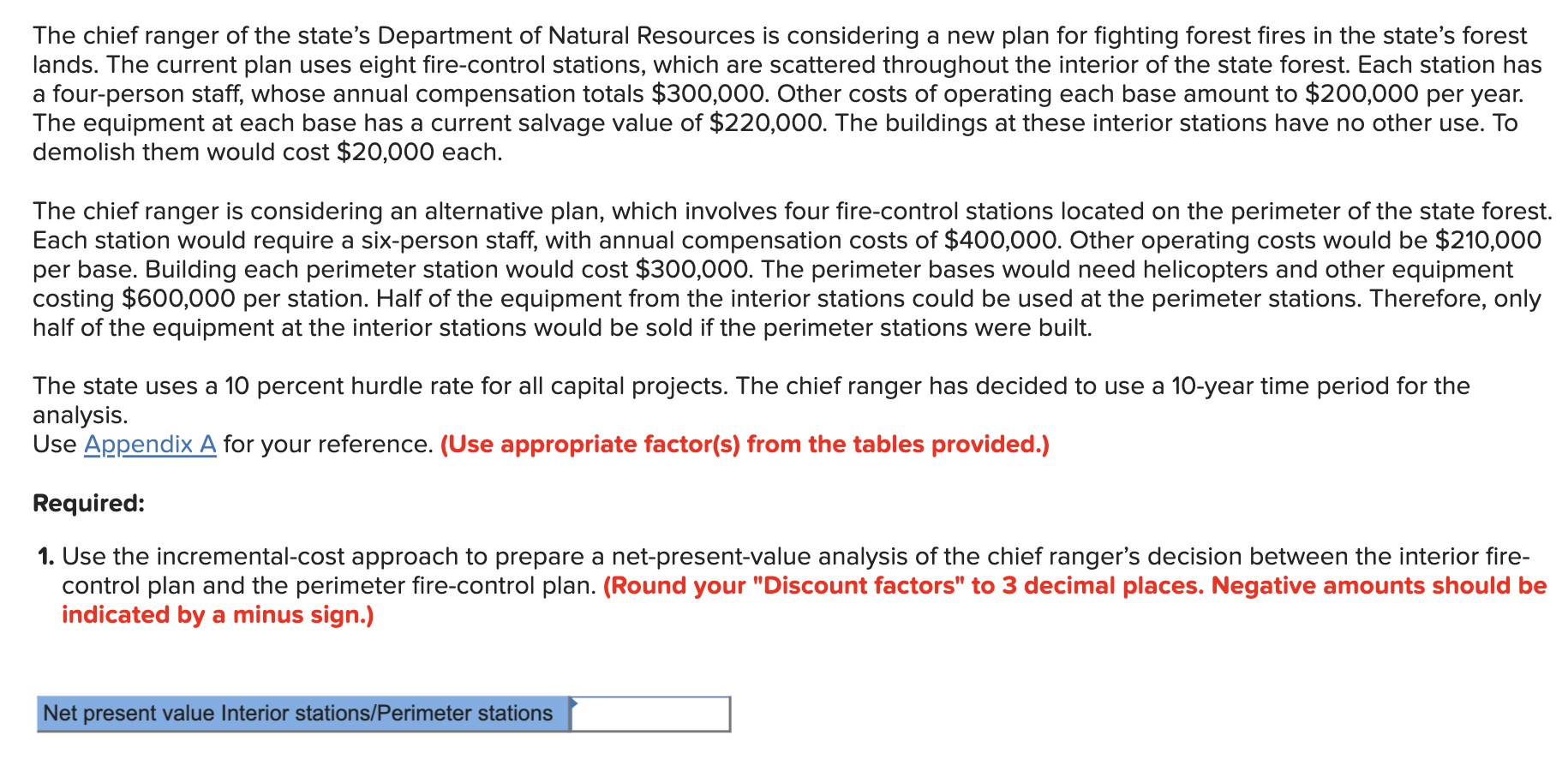

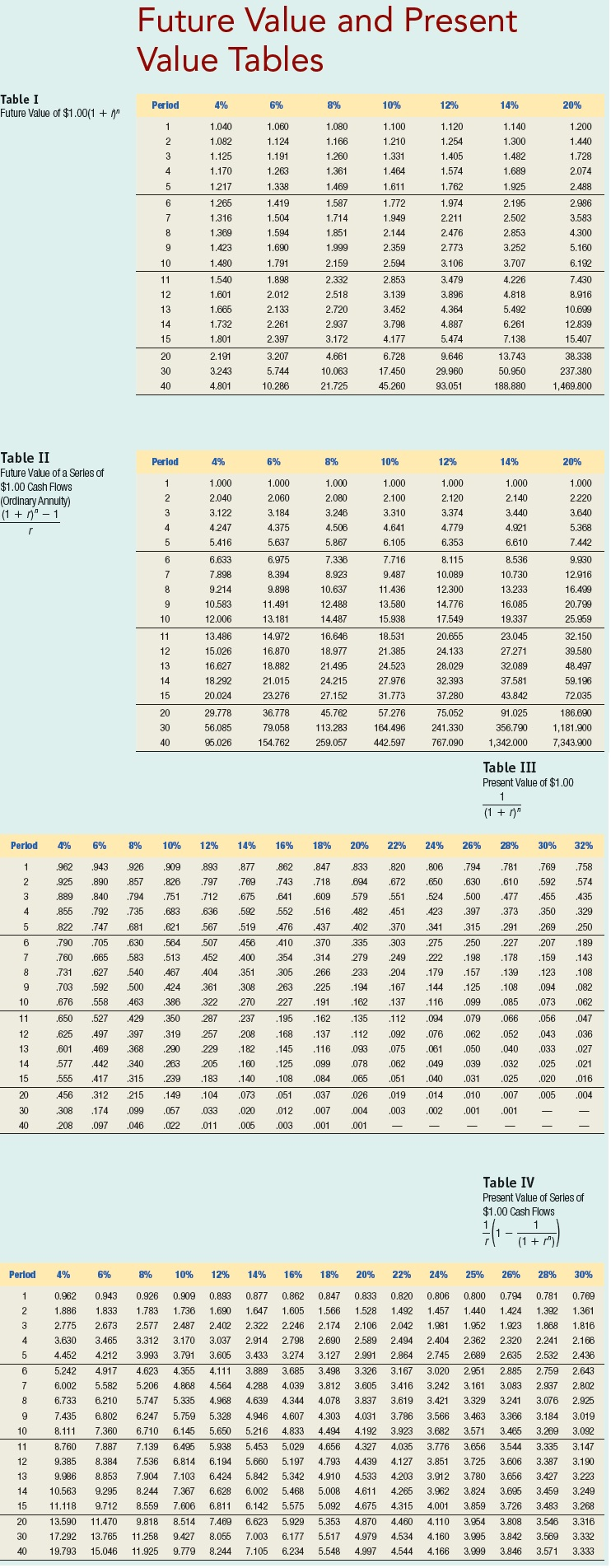

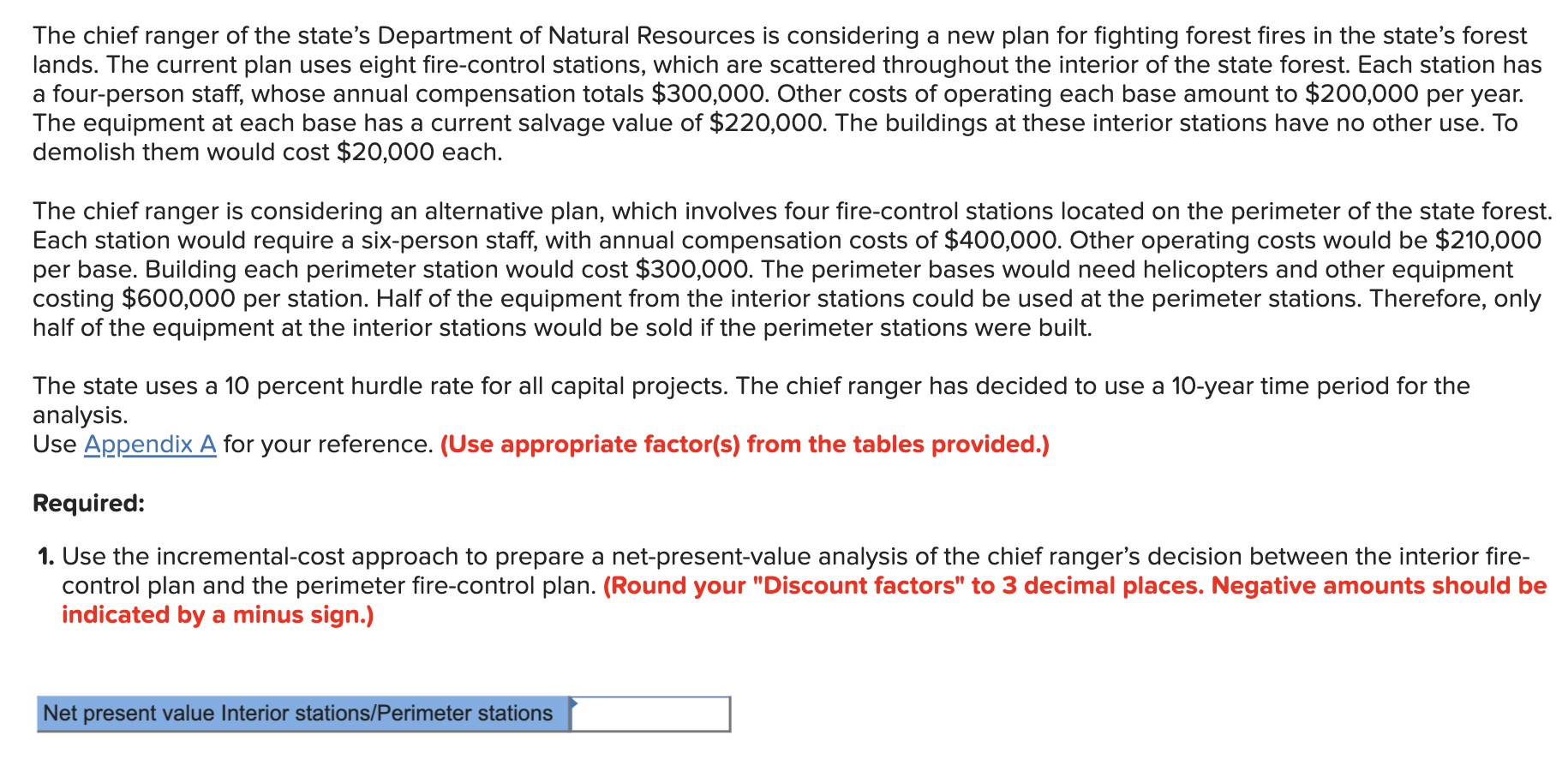

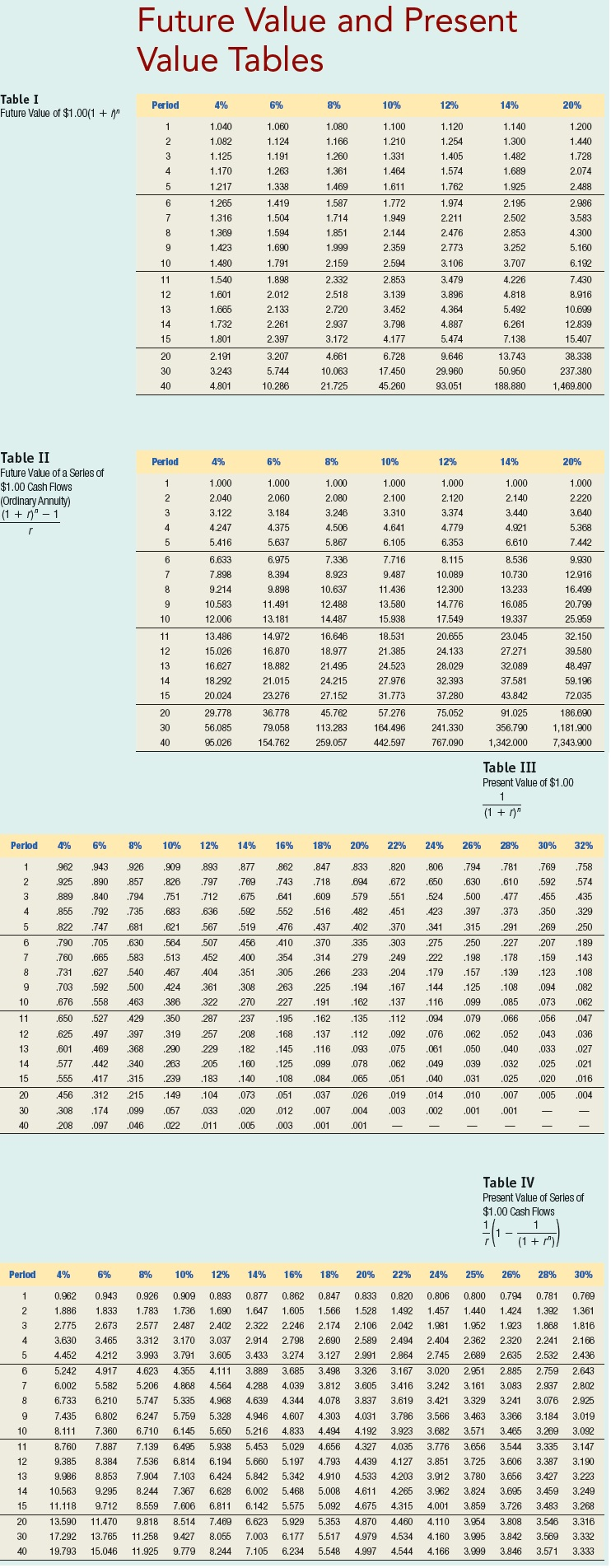

The chief ranger of the state's Department of Natural Resources is considering a new plan for fighting forest fires in the state's forest lands. The current plan uses eight fire-control stations, which are scattered throughout the interior of the state forest. Each station has a four-person staff, whose annual compensation totals $300,000. Other costs of operating each base amount to $200,000 per year. The equipment at each base has a current salvage value of $220,000. The buildings at these interior stations have no other use. To demolish them would cost $20,000 each. The chief ranger is considering an alternative plan, which involves four fire-control stations located on the perimeter of the state forest. Each station would require a six-person staff, with annual compensation costs of $400,000. Other operating costs would be $210,000 per base. Building each perimeter station would cost $300,000. The perimeter bases would need helicopters and other equipment costing $600,000 per station. Half of the equipment from the interior stations could be used at the perimeter stations. Therefore, only half of the equipment at the interior stations would be sold if the perimeter stations were built. The state uses a 10 percent hurdle rate for all capital projects. The chief ranger has decided to use a 10-year time period for the analysis. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Use the incremental-cost approach to prepare a net-present-value analysis of the chief ranger's decision between the interior fire- control plan and the perimeter fire-control plan. (Round your "Discount factors" to 3 decimal places. Negative amounts should be indicated by a minus sign.) Net present value Interior stations/Perimeter stations Future Value and Present Value Tables Table 1 Future Value of $1.00(1 + in Period 4% 14% 20% 8% 1.080 1.166 1.260 1.361 1.040 1.082 1.125 1.170 1.217 1.265 1.316 1.369 1.423 1.480 1.540 1.601 1.665 1.732 1.801 2.191 3.243 4.801 6% 1.060 1.124 1.191 1.263 1.338 1.419 1.504 1.594 1.690 1.791 1.898 2.012 2.133 2.261 2.397 3.207 5.744 10.286 1.469 1.587 1.714 1.851 1.999 2.159 2.332 2.518 2.720 2.937 3.172 4.661 10.063 21.725 10% 1.100 1.210 1.331 1.464 1.611 1.772 1.949 2.144 2.359 2.594 2.853 3.139 3.452 3.798 4.177 6.728 17.450 45.260 12% 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 3.106 3.479 3.896 4.364 4.887 5.474 9.646 29.960 93.051 1.140 1.300 1.482 1.689 1.925 2.195 2.502 2.853 3.252 3.707 4.226 4.818 5.492 6.261 7.138 13.743 50.950 188.880 1.200 1.440 1.728 2.074 2.488 2.986 3.583 4.300 5.160 6.192 7.430 8.916 10.699 12.839 15.407 38.338 237.380 ,469.800 1 Period 4% 6% 8% 10% 12% 14% 20% Table II Future Value of a Series of $1.00 Cash Flows (Ordinary Annuity) (1 + 1" - 1 1.000 2.220 3.640 5.368 7.442 1.000 2.040 3.122 4.247 5.416 6.633 7.898 9.214 10.583 12.006 13.486 15.026 16.627 18.292 20.024 29.778 56.085 96.026 1.000 2.060 3.184 4.375 5.637 6.975 8.394 9.898 11.491 13.181 14.972 16.870 18.882 21.015 23.276 36.778 79.058 154.762 1.000 2.080 3.246 4.506 5.867 7.336 8.923 10.637 12.488 14.487 16.646 18.977 21.495 24.215 27.152 45.762 113.283 259.057 1.000 2.100 3.310 4.641 6.105 7.716 9.487 11.436 13.580 15.938 18.531 21.385 24.523 27.976 31.773 57.276 164.496 442.597 1.000 2.120 3.374 4.779 6.353 8.115 10.089 12.300 14.776 17.549 20.655 24.133 28.029 32.393 37.280 1.000 2.140 3.440 4.921 6.610 8.536 10.730 13.233 16.085 19.337 23.045 27.271 32.089 9.900 12.916 16.499 20.799 25.959 32.150 39.580 48.497 59.196 72.035 186.690 1,181.900 7,343.900 37.581 75.052 43.842 91.025 356.790 1,342.000 241.330 767.090 40 Table III Present Value of $1.00 (1 + )" Period 26% 28% 30% 32% .758 12% .893 .797 712 .636 14% 877 .769 .675 592 16% 862 .743 .641 552 574 781 .610 477 373 769 .592 455 .350 -567 .519 476 9 10 4% 962 .925 889 .855 .822 790 .760 .731 703 .676 .650 .625 .601 .577 .555 .456 .308 208 6% 943 .890 .840 792 .747 .705 .665 .627 592 558 .527 497 469 442 .417 312 174 .097 8% 926 857 .794 735 .681 .630 .583 540 500 463 429 397 368 340 315 215 .099 .046 10% 909 .826 751 .683 .621 564 .513 467 424 386 350 .319 290 263 239 149 .057 .022 507 452 404 361 322 287 257 229 205 .183 104 .033 .011 456 400 351 .308 2 70 237 208 182 .160 .140 .073 .020 .005 410 .354 305 263 227 195 168 145 .125 .108 .051 .012 .003 18% 847 .718 .609 .516 .437 370 .314 266 225 191 162 137 116 .099 .084 .037 .007 .001 20% 833 .694 579 482 402 335 279 233 194 162 .135 112 .093 .078 .065 .026 .004 .001 22% 820 .672 .551 451 .370 303 249 204 167 137 .112 .092 .075 .062 .051 019 .003 - 24% 806 .650 524 423 341 275 .222 .179 144 116 .094 .076 .061 .049 .040 014 .002 - 7 94 .630 .500 .397 .315 250 .198 .157 125 099 .079 062 .050 .039 .031 010 .001 - 227 .178 139 108 085 .066 .052 .040 .032 .025 .007 .001 - 207 .159 .123 .094 .073 .056 .043 .033 .025 .020 .005 - 435 329 .250 189 .143 108 082 062 047 036 .027 021 .016 .004 13 14 15 Table IV Present Value of Series of $1.00 Cash Flows 111 - 1 71 (1 + r) Period 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% 26% 28% 30% 2 3 6 4 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 0.943 0.926 0.909 1.833 1.783 1.736 2.673 2.577 2.487 3.465 3.312 3.170 4.212 3.993 3.791 .917 4.623 4.355 5.5825.206 4.868 6.210 5.747 5.335 6.802 6.247 5.759 7.360 6.710 6.145 7.887 7.139 6.495 8.384 7.536 6.814 8.853 7.904 7.103 9.295 8.244 7.367 9.712 8.5597.606 11.470 9.818 8.514 13.765 11.258 9.427 15.046 11.925 9.779 0.89 1.690 2.402 3.037 3.606 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 7.469 8.055 8.244 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.623 7.003 7.105 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.929 6.177 6.234 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 5.353 5.517 5.548 0.833 0.820 1.528 1.492 2.106 2.042 2.589 2.494 2.991 2.864 3.326 3.167 3.605 3.416 3.837 3.619 4.031 3.786 4.1923.923 4.327 4.035 4.4394.127 4.533 4.203 4.611 4.265 4.675 4.315 4.870 4.460 4.979 4.534 4.997 4.544 0.806 0.800 1.457 1.440 1.981 1.952 2.404 2.362 2.745 2.689 3.020 2.951 3.2423.161 3.421 3.329 3.566 3.463 3.682 3.571 3.776 3.656 3.851 3.725 3.912 3.780 3.962 3.824 4.001 3.859 4.110 3.954 4.160 3.995 4.166 3.999 0.794 1.424 1.923 2.320 2.635 2.885 3.083 3.241 3.366 3.465 3.544 3.606 3.656 3.695 3.726 3.808 3.842 3.846 0.781 1.392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.546 3.569 3.571 0.769 1.361 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 3.268 3.316 3.332 3.333 11 20 10.563 11.118 13.590 17.292 19.793 40