Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Chihiro Co. is considering two investments to move materials and supplies around its factory: 1) a conveyor belt system; and 2) a fleet

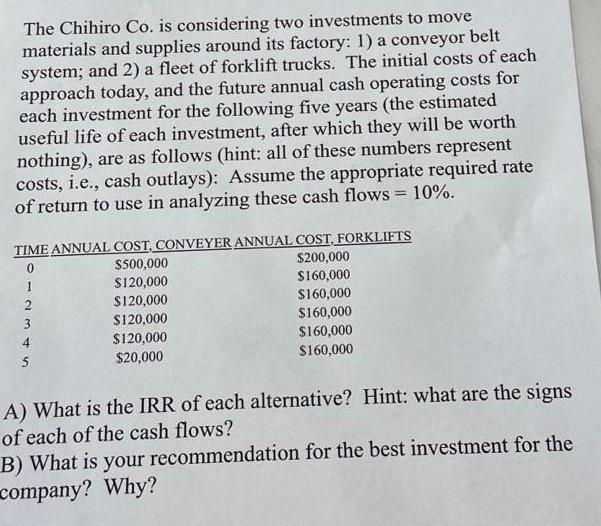

The Chihiro Co. is considering two investments to move materials and supplies around its factory: 1) a conveyor belt system; and 2) a fleet of forklift trucks. The initial costs of each approach today, and the future annual cash operating costs for each investment for the following five years (the estimated useful life of each investment, after which they will be worth nothing), are as follows (hint: all of these numbers represent costs, i.e., cash outlays): Assume the appropriate required rate of return to use in analyzing these cash flows = 10%. TIME ANNUAL COST, CONVEYER ANNUAL COST, FORKLIFTS 0 $500,000 $120,000 $120,000 $120,000 $120,000 $20,000 1 2 3 45 $200,000 $160,000 $160,000 $160,000 $160,000 $160,000 A) What is the IRR of each alternative? Hint: what are the signs of each of the cash flows? B) What is your recommendation for the best investment for the company? Why?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the Internal Rate of Return IRR for each alternative we need to determine the net cash flows for each year and then solve for the discount rate that makes the net present value N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started