Answered step by step

Verified Expert Solution

Question

1 Approved Answer

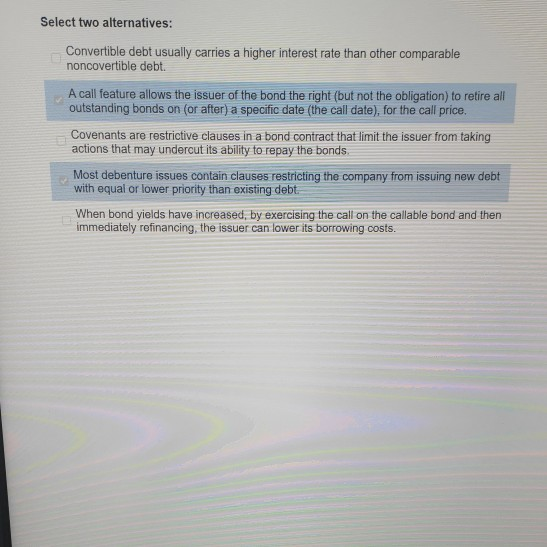

The chosen answers may not be correct. Please share your knowledge Which one is correct? Select two alternatives: Convertible debt usually carries a higher interest

The chosen answers may not be correct. Please share your knowledge

Which one is correct?

Select two alternatives: Convertible debt usually carries a higher interest rate than other comparable noncovertible debt. A call feature allows the issuer of the bond the right (but not the obligation) to retire all outstanding bonds on (or after) a specific date (the call date), for the call price. Covenants are restrictive clauses in a bond contract that limit the issuer from taking actions that may undercut its ability to repay the bonds Most debenture issues contain clauses restricting the company from issuing new debt with equal or lower priority than existing debt When bond yields have increased, by exercising the call on the callable bond and then immediately refinancing, the issuer can lower its borrowing costsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started