Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Chuma Ngumu Company needs to finance a seasonal rise in inventories of Sh.4 million. The funds are needed for six months. The company

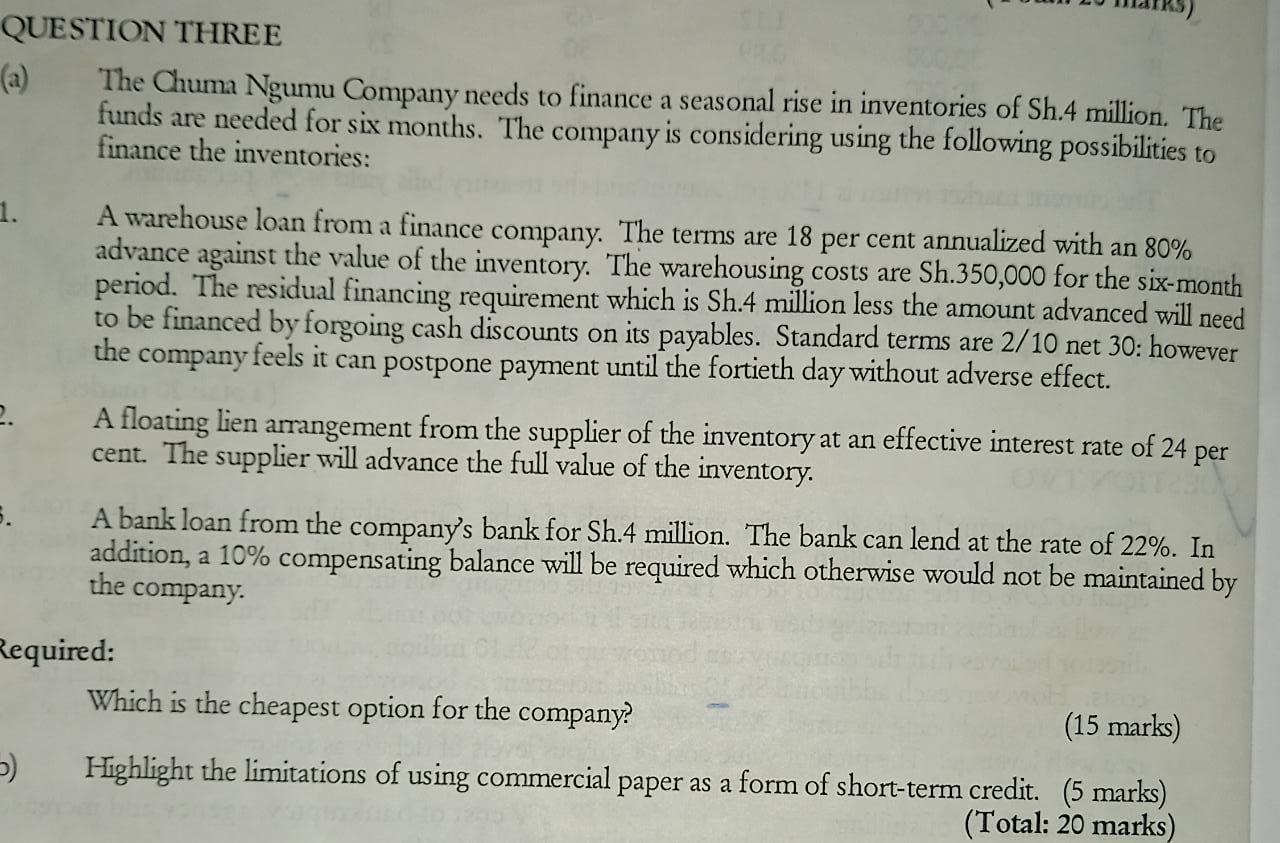

The Chuma Ngumu Company needs to finance a seasonal rise in inventories of Sh.4 million. The funds are needed for six months. The company is considering using the following possibilities to finance the inventories: 1. 2. 5. A warehouse loan from a finance company. The terms are 18 per cent annualized with an 80% advance against the value of the inventory. The warehousing costs are Sh.350,000 for the six-month period. The residual financing requirement which is Sh.4 million less the amount advanced will need to be financed by forgoing cash discounts on its payables. Standard terms are 2/10 net 30: however the company feels it can postpone payment until the fortieth day without adverse effect. 5) A floating lien arrangement from the supplier of the inventory at an effective interest rate of 24 per cent. The supplier will advance the full value of the inventory. A bank loan from the company's bank for Sh.4 million. The bank can lend at the rate of 22%. In addition, a 10% compensating balance will be required which otherwise would not be maintained by the company. Required: Which is the cheapest option for the company? (15 marks) Highlight the limitations of using commercial paper as a form of short-term credit. (5 marks) (Total: 20 marks)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started