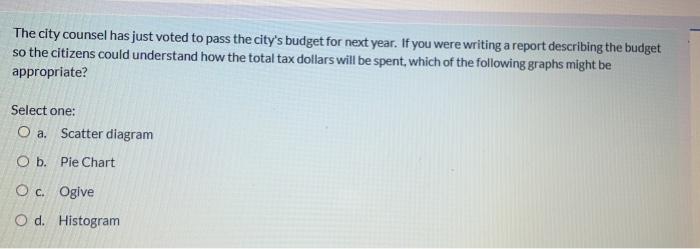

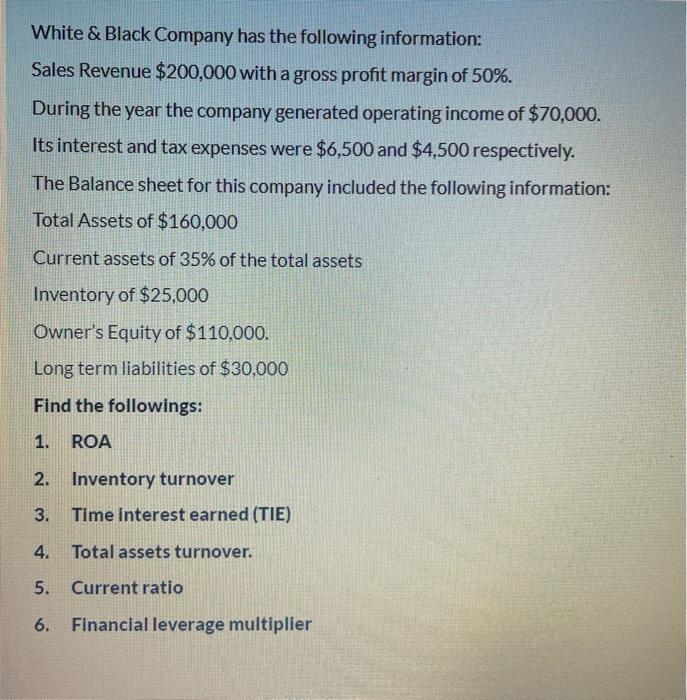

The city counsel has just voted to pass the city's budget for next year. If you were writing a report describing the budget so the citizens could understand how the total tax dollars will be spent, which of the following graphs might be appropriate? Select one: O a. Scatter diagram O b. Pie Chart Oc Ogive O d. Histogram White & Black Company has the following information: Sales Revenue $200,000 with a gross profit margin of 50%. During the year the company generated operating income of $70,000. Its interest and tax expenses were $6,500 and $4,500 respectively. The Balance sheet for this company included the following information: Total Assets of $160,000 Current assets of 35% of the total assets Inventory of $25,000 Owner's Equity of $110,000. Long term liabilities of $30,000 Find the followings: 1. ROA 2. Inventory turnover Time interest earned (TIE) 3. 4. Total assets turnover. 5. Current ratio 6. Financial leverage multiplier White & Black Company has the following information: Sales Revenue $200,000 with a gross profit margin of 50%. During the year the company generated operating income of $70,000. Its interest and tax expenses were $6,500 and $4,500 respectively. The Balance sheet for this company included the following information: Total Assets of $160,000 Current assets of 35% of the total assets Inventory of $25,000 Owner's Equity of $110,000. Long term liabilities of $30,000 Find the followings: 1. ROA 2. Inventory turnover 3. Time interest earned (TIE) 4. Total assets turnover. 5. Current ratio 6. Financial leverage multiplier 7 on White & Black Company has the following information: Sales Revenue $200,000 with a gross profit margin of 50%. During the year the company generated operating income of $70,000. Its interest and tax expenses were $6,500 and $4,500 respectively. The Balance sheet for this company included the following information: Total Assets of $160,000 Current assets of 35% of the total assets Inventory of $25,000 Owner's Equity of $110,000. Long term liabilities of $30.000 Find the followings: 1. ROA 2. Inventory turnover 3. Time Interest earned (TIE) 4. Total assets turnover. 5. Current ratio 6. Financial leverage multiplier