Question

The City of Boxborough is preparing its government-wide financial statements from its fund financial statements. The City identifies Capital Assets with a book value of

The City of Boxborough is preparing its government-wide financial statements from its fund financial statements.

The City identifies Capital Assets with a book value of $800,000 (all numbers in $1,000s) at the beginning of the year that are depreciated at the rate of $40,000 per year. Its records also indicate that it spent $480,000 on new Capital Assets during the year. What two reconciliation entries must the City include in its government-wide financial statements relating to Capital Assets?

Please show work, so I can follow along and learn - thank you!!

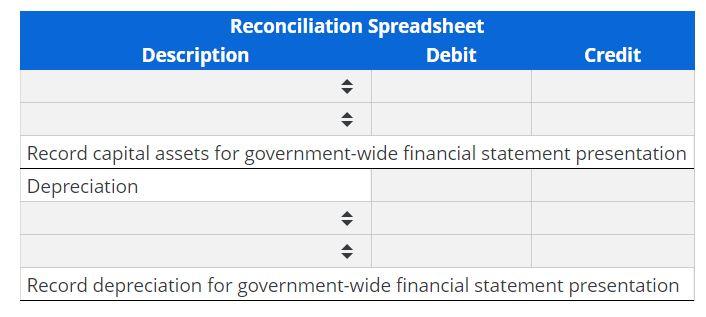

Reconciliation Spreadsheet Description Debit Credit Record capital assets for government-wide financial statement presentation Depreciation Record depreciation for government-wide financial statement presentation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started