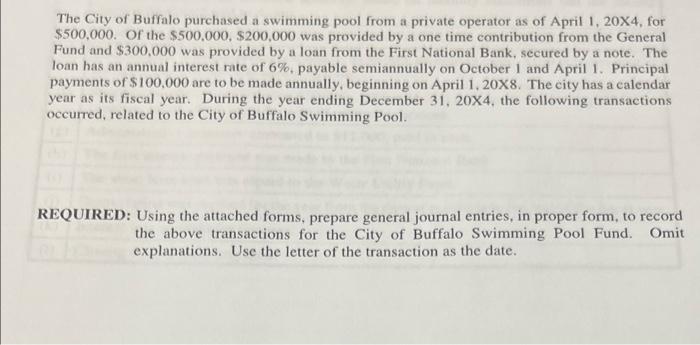

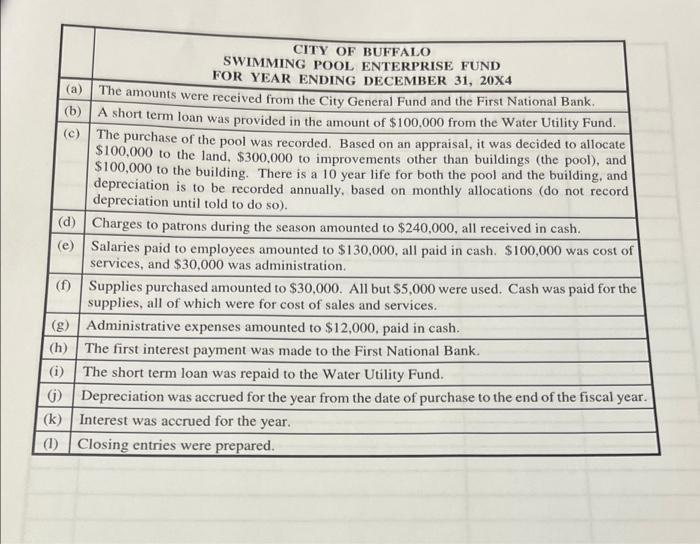

The City of Buffalo purchased a swimming pool from a private operator as of April 1, 20X4, for $500,000. Of the $500,000. $200,000 was provided by a one time contribution from the General Fund and $300,000 was provided by a loan from the First National Bank, secured by a note. The loan has an annual interest rate of 6% payable semiannually on October 1 and April 1. Principal payments of $100.000 are to be made annually, beginning on April 1, 20X8. The city has a calendar year as its fiscal year. During the year ending December 31, 20X4, the following transactions occurred, related to the City of Buffalo Swimming Pool REQUIRED: Using the attached forms, prepare general journal entries, in proper form, to record the above transactions for the City of Buffalo Swimming Pool Fund. Omit explanations. Use the letter of the transaction as the date. CITY OF BUFFALO SWIMMING POOL ENTERPRISE FUND FOR YEAR ENDING DECEMBER 31, 20X4 (a) The amounts were received from the City General Fund and the First National Bank. (b) A short term loan was provided in the amount of $100,000 from the Water Utility Fund. (c) The purchase of the pool was recorded. Based on an appraisal, it was decided to allocate $100,000 to the land, $300,000 to improvements other than buildings (the pool), and $100,000 to the building. There is a 10 year life for both the pool and the building, and depreciation is to be recorded annually, based on monthly allocations (do not record depreciation until told to do so). (d) Charges to patrons during the season amounted to $240,000, all received in cash. (e) Salaries paid to employees amounted to $130,000, all paid in cash. $100,000 was cost of services, and $30,000 was administration, (1) Supplies purchased amounted to $30,000. All but $5,000 were used. Cash was paid for the supplies, all of which were for cost of sales and services. (g) Administrative expenses amounted to $12,000, paid in cash. (h) The first interest payment was made to the First National Bank. (i) The short term loan was repaid to the Water Utility Fund. 0 Depreciation was accrued for the year from the date of purchase to the end of the fiscal year. (k) Interest was accrued for the year. (1) Closing entries were prepared. CITY OF BUFFALO GENERAL JOURNAL SWIMMING POOL ENTERPRISE FUND FOR YEAR ENDING DECEMBER 31, 20X4 Explanation Debit Date Credit