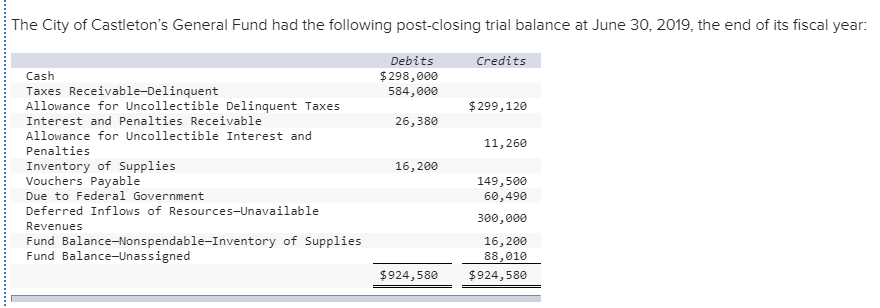

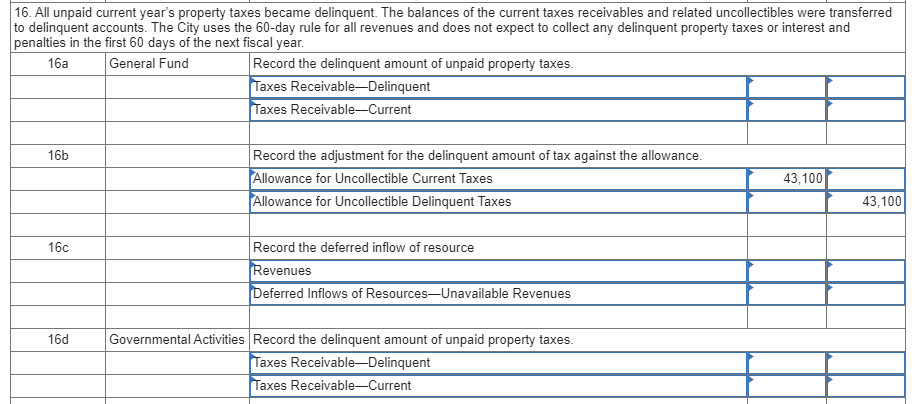

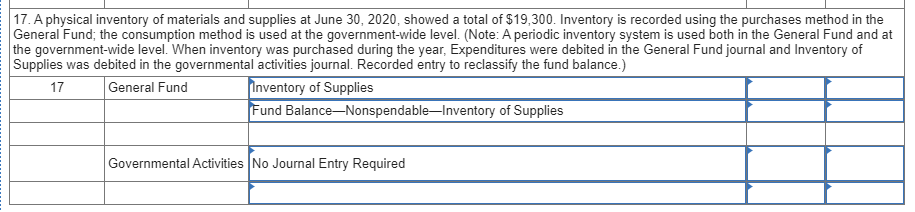

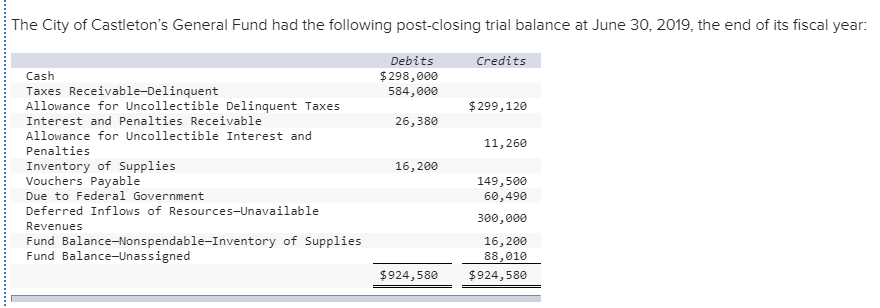

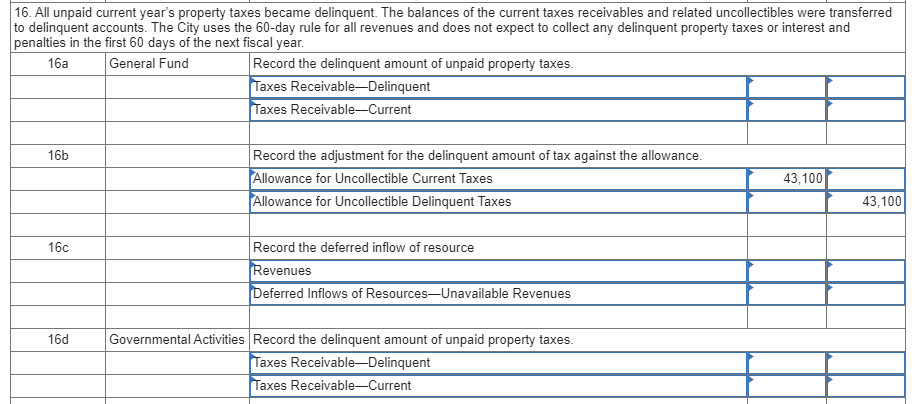

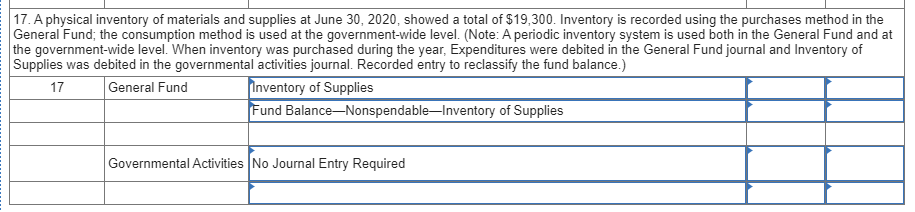

The City of Castleton's General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year: Credits Debits $ 298,000 584,000 $299,120 26,380 11,260 Cash Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent Taxes Interest and Penalties Receivable Allowance for Uncollectible Interest and Penalties Inventory of Supplies Vouchers Payable Due to Federal Government Deferred Inflows of Resources-Unavailable Revenues Fund Balance-Nonspendable-Inventory of Supplies Fund Balance-Unassigned 16,200 149,500 60,490 300,000 16,200 88,010 $924,580 $924,580 16. All unpaid current year's property taxes became delinquent. The balances of the current taxes receivables and related uncollectibles were transferred to delinquent accounts. The City uses the 60-day rule for all revenues and does not expect to collect any delinquent property taxes or interest and penalties in the first 60 days of the next fiscal year. 16a General Fund Record the delinquent amount of unpaid property taxes. Taxes Receivable-Delinquent Taxes ReceivableCurrent 16b Record the adjustment for the delinquent amount of tax against the allowance. Allowance for Uncollectible Current Taxes Allowance for Uncollectible Delinquent Taxes 43,100 43,100 160 Record the deferred inflow of resource Revenues Deferred Inflows of Resources-Unavailable Revenues 16d Governmental Activities Record the delinquent amount of unpaid property taxes. Taxes Receivable-Delinquent Taxes Receivable Current 17. A physical inventory of materials and supplies at June 30, 2020, showed a total of $19,300. Inventory is recorded using the purchases method in the General Fund; the consumption method is used at the government-wide level. (Note: A periodic inventory system is used both in the General Fund and at the government-wide level. When inventory was purchased during the year, Expenditures were debited in the General Fund journal and Inventory of Supplies was debited in the governmental activities journal. Recorded entry to reclassify the fund balance.) General Fund Inventory of Supplies Fund Balance-NonspendableInventory of Supplies Governmental Activities No Journal Entry Required The City of Castleton's General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year: Credits Debits $ 298,000 584,000 $299,120 26,380 11,260 Cash Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent Taxes Interest and Penalties Receivable Allowance for Uncollectible Interest and Penalties Inventory of Supplies Vouchers Payable Due to Federal Government Deferred Inflows of Resources-Unavailable Revenues Fund Balance-Nonspendable-Inventory of Supplies Fund Balance-Unassigned 16,200 149,500 60,490 300,000 16,200 88,010 $924,580 $924,580 16. All unpaid current year's property taxes became delinquent. The balances of the current taxes receivables and related uncollectibles were transferred to delinquent accounts. The City uses the 60-day rule for all revenues and does not expect to collect any delinquent property taxes or interest and penalties in the first 60 days of the next fiscal year. 16a General Fund Record the delinquent amount of unpaid property taxes. Taxes Receivable-Delinquent Taxes ReceivableCurrent 16b Record the adjustment for the delinquent amount of tax against the allowance. Allowance for Uncollectible Current Taxes Allowance for Uncollectible Delinquent Taxes 43,100 43,100 160 Record the deferred inflow of resource Revenues Deferred Inflows of Resources-Unavailable Revenues 16d Governmental Activities Record the delinquent amount of unpaid property taxes. Taxes Receivable-Delinquent Taxes Receivable Current 17. A physical inventory of materials and supplies at June 30, 2020, showed a total of $19,300. Inventory is recorded using the purchases method in the General Fund; the consumption method is used at the government-wide level. (Note: A periodic inventory system is used both in the General Fund and at the government-wide level. When inventory was purchased during the year, Expenditures were debited in the General Fund journal and Inventory of Supplies was debited in the governmental activities journal. Recorded entry to reclassify the fund balance.) General Fund Inventory of Supplies Fund Balance-NonspendableInventory of Supplies Governmental Activities No Journal Entry Required