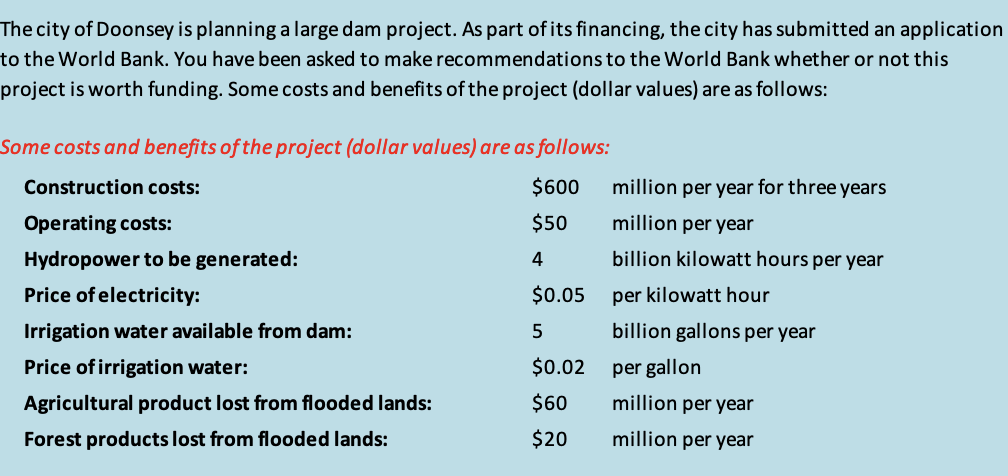

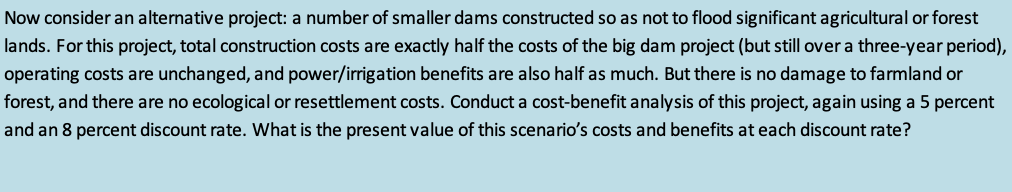

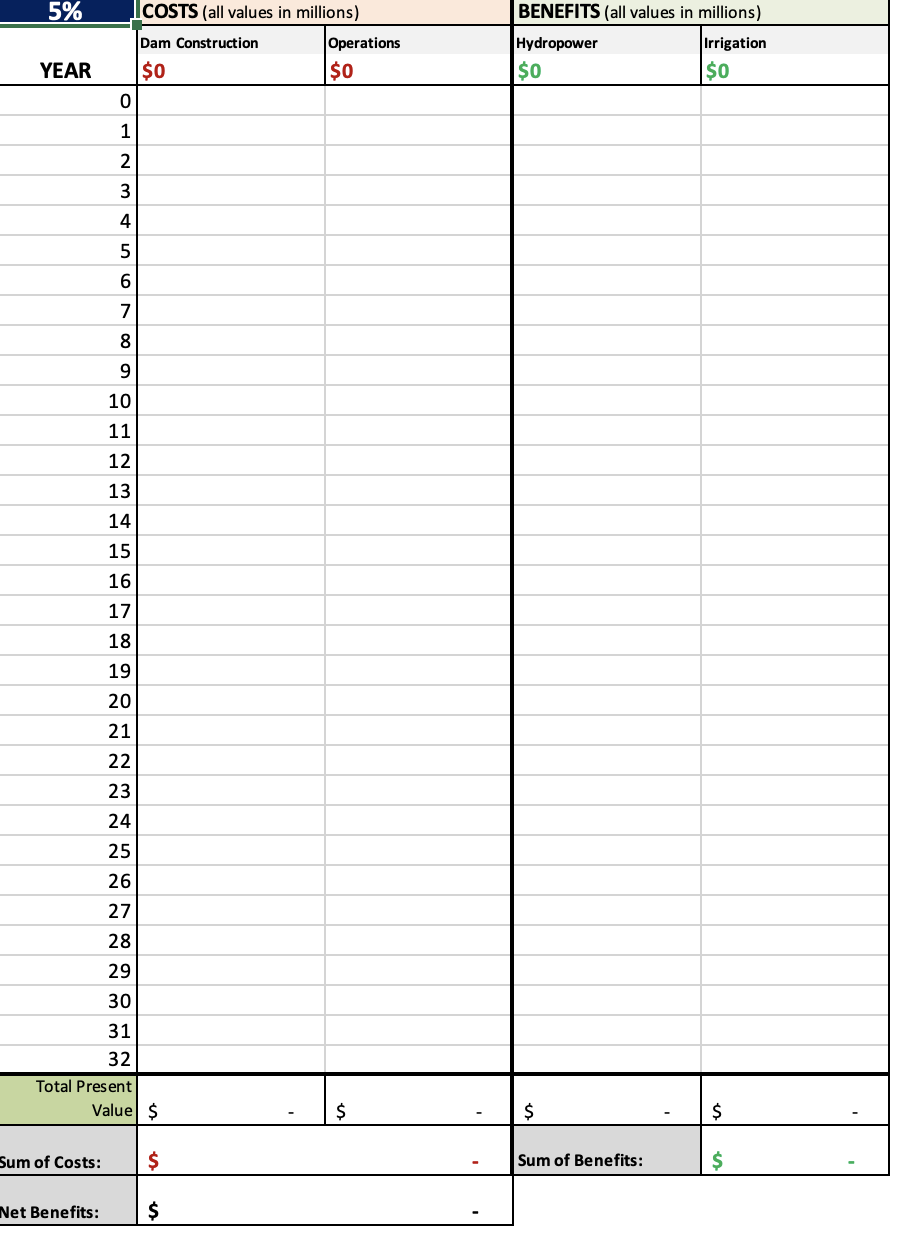

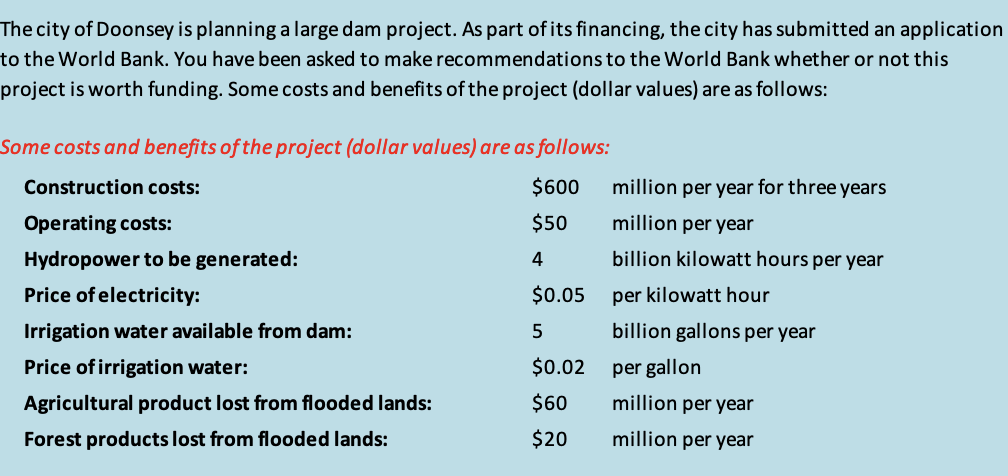

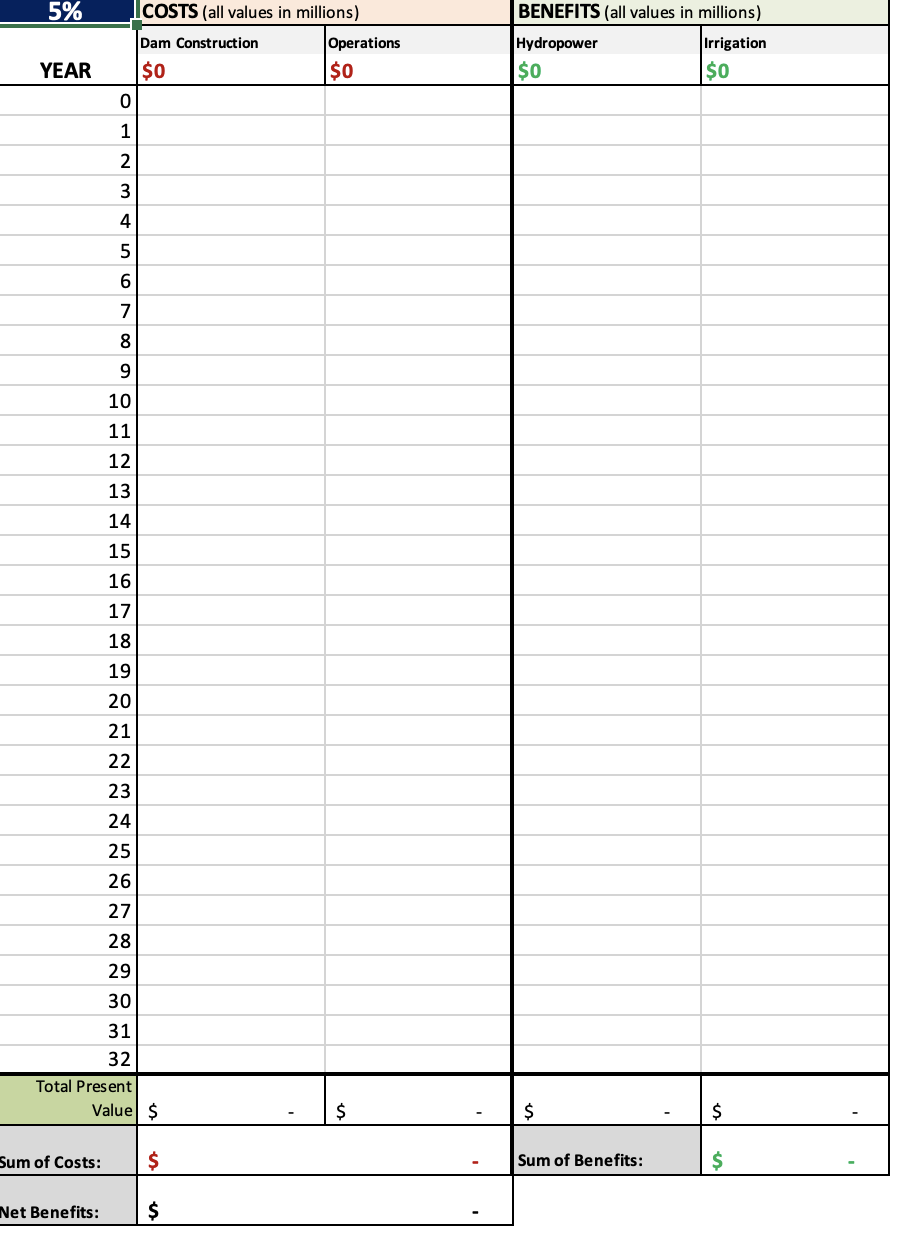

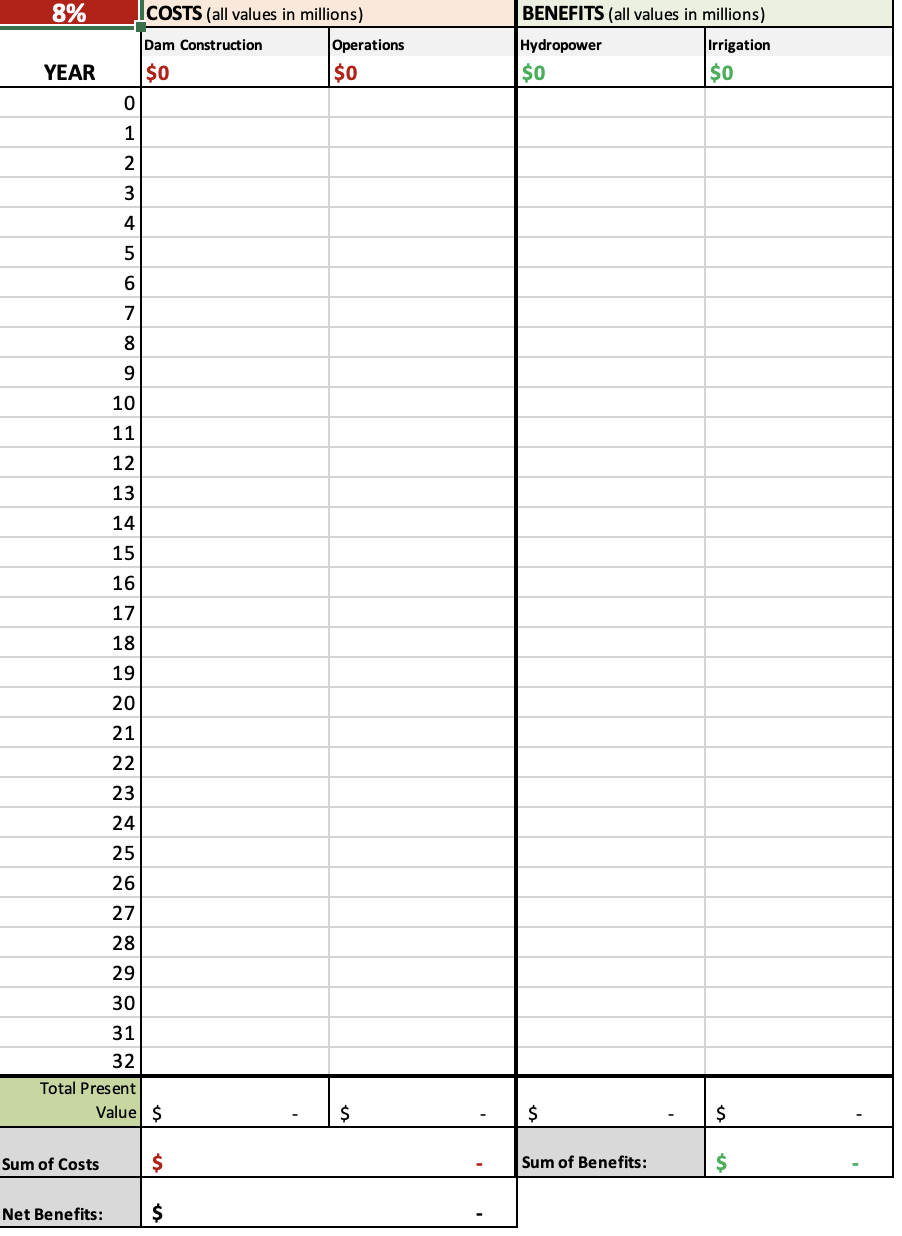

The city of Doonsey is planning a large dam project. As part of its financing, the city has submitted an application to the World Bank. You have been asked to make recommendations to the World Bank whether or not this project is worth funding. Some costs and benefits of the project (dollar values) are as follows: Some costs and benefits of the project (dollar values) are as follows: Construction costs: $600 million per year for three years Operating costs: $50 million per year Hydropower to be generated: 4 billion kilowatt hours per year Price of electricity: $0.05 per kilowatt hour Irrigation water available from dam: 5 billion gallons per year Price of irrigation water: $0.02 per gallon Agricultural product lost from flooded lands: $60 million per year Forest products lost from flooded lands: $20 million per year Now consider an alternative project: a number of smaller dams constructed so as not to flood significant agricultural or forest lands. For this project, total construction costs are exactly half the costs of the big dam project (but still over a three-year period), operating costs are unchanged, and power/irrigation benefits are also half as much. But there is no damage to farmland or forest, and there are no ecological or resettlement costs. Conduct a cost-benefit analysis of this project, again using a 5 percent and an 8 percent discount rate. What is the present value of this scenario's costs and benefits at each discount rate? 5% COSTS (all values in millions) BENEFITS (all values in millions) Dam Construction Operations $0 Hydropower $0 Irrigation $0 YEAR $0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Total Present Value $ $ $ $ Sum of Costs: Sum of Benefits: $ Net Benefits: $ 8% COSTS (all values in millions) BENEFITS (all values in millions) Dam Construction Operations $0 Hydropower $0 Irrigation $0 YEAR $0 2 4 000 WNO 5 9 | 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Total Present Value $ $ $ $ Sum of Costs $ Sum of Benefits: $ Net Benefits: $ The city of Doonsey is planning a large dam project. As part of its financing, the city has submitted an application to the World Bank. You have been asked to make recommendations to the World Bank whether or not this project is worth funding. Some costs and benefits of the project (dollar values) are as follows: Some costs and benefits of the project (dollar values) are as follows: Construction costs: $600 million per year for three years Operating costs: $50 million per year Hydropower to be generated: 4 billion kilowatt hours per year Price of electricity: $0.05 per kilowatt hour Irrigation water available from dam: 5 billion gallons per year Price of irrigation water: $0.02 per gallon Agricultural product lost from flooded lands: $60 million per year Forest products lost from flooded lands: $20 million per year Now consider an alternative project: a number of smaller dams constructed so as not to flood significant agricultural or forest lands. For this project, total construction costs are exactly half the costs of the big dam project (but still over a three-year period), operating costs are unchanged, and power/irrigation benefits are also half as much. But there is no damage to farmland or forest, and there are no ecological or resettlement costs. Conduct a cost-benefit analysis of this project, again using a 5 percent and an 8 percent discount rate. What is the present value of this scenario's costs and benefits at each discount rate? 5% COSTS (all values in millions) BENEFITS (all values in millions) Dam Construction Operations $0 Hydropower $0 Irrigation $0 YEAR $0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Total Present Value $ $ $ $ Sum of Costs: Sum of Benefits: $ Net Benefits: $ 8% COSTS (all values in millions) BENEFITS (all values in millions) Dam Construction Operations $0 Hydropower $0 Irrigation $0 YEAR $0 2 4 000 WNO 5 9 | 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Total Present Value $ $ $ $ Sum of Costs $ Sum of Benefits: $ Net Benefits: $