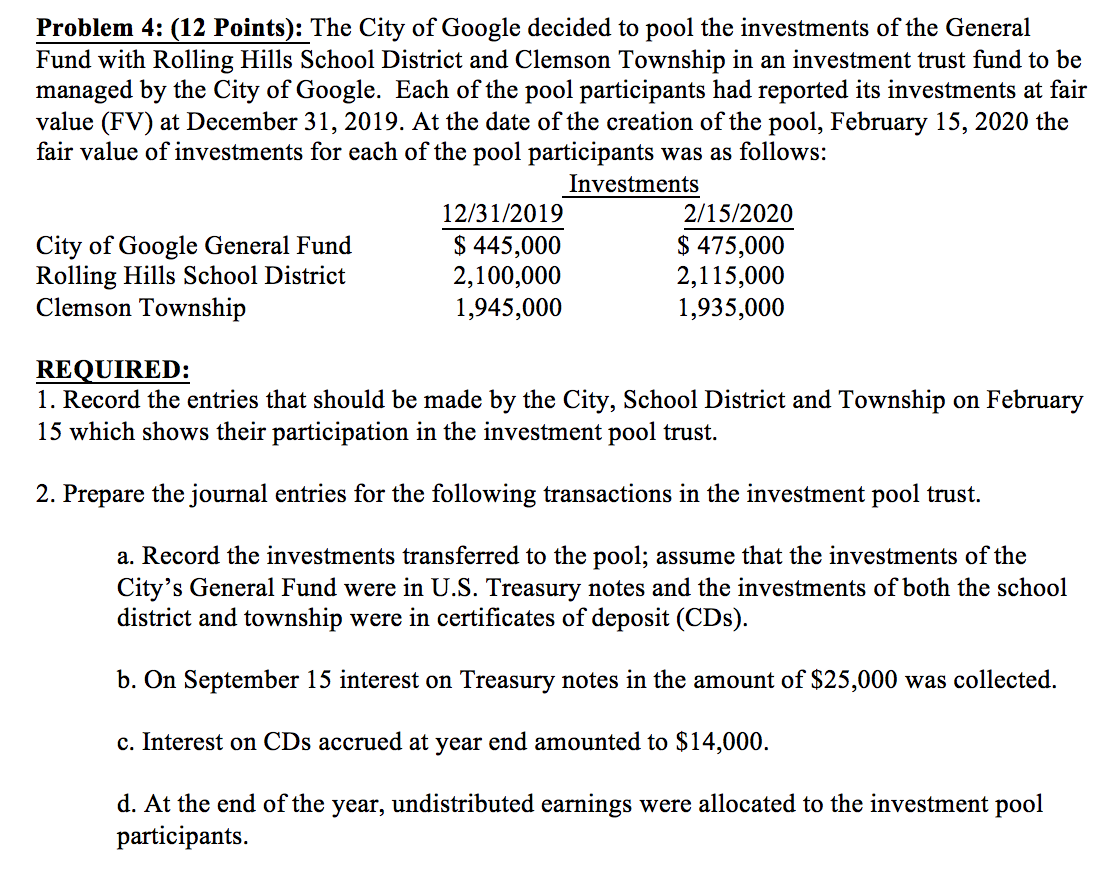

The City of Google decided to pool the investments of the General Fund with Rolling Hills School District and Clemson Township in an investment trust fund to be managed by the City of Google. Each of the pool participants had reported its investments at fair value (FV) at December 31, 2019. At the date of the creation of the pool, February 15, 2020 the fair value of investments for each of the pool participants was as follows:

Investments

12/31/2019 2/15/2020

City of Google General Fund $ 445,000 $ 475,000

Rolling Hills School District 2,100,000 2,115,000

Clemson Township 1,945,000 1,935,000

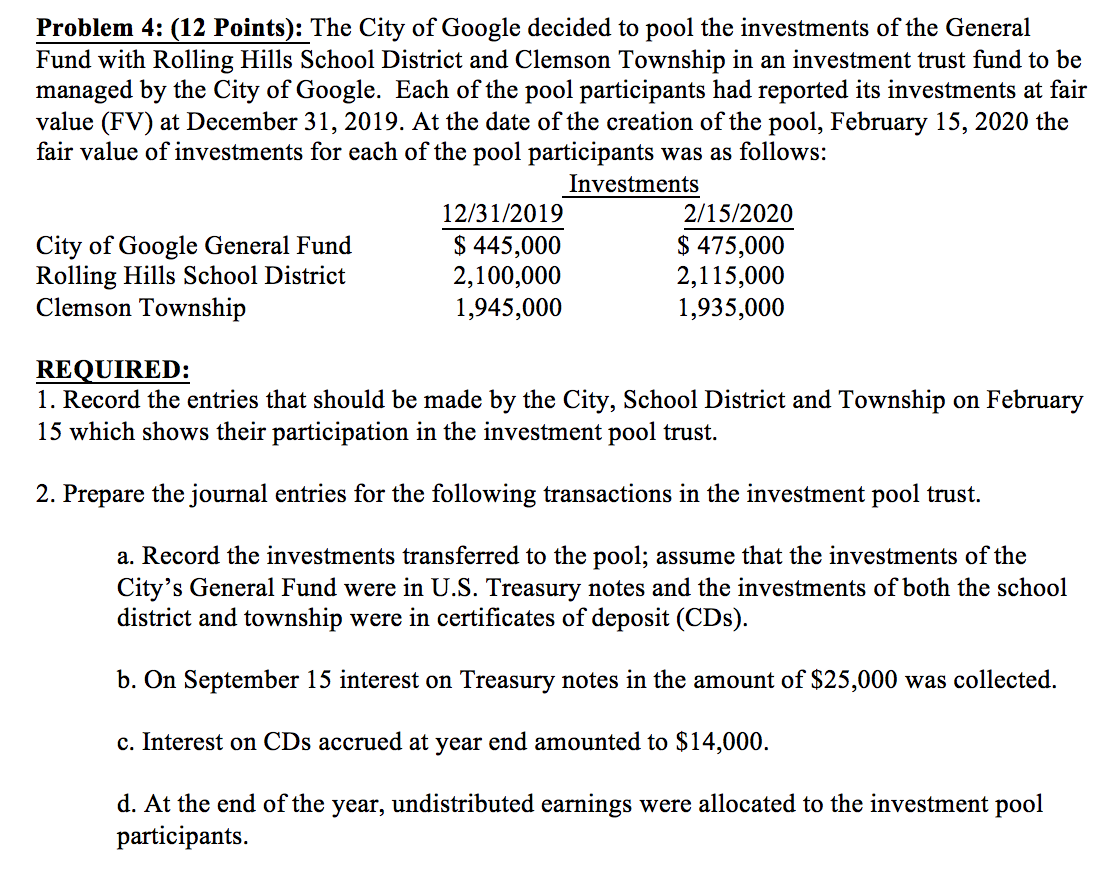

Problem 4: (12 Points): The City of Google decided to pool the investments of the General Fund with Rolling Hills School District and Clemson Township in an investment trust fund to be managed by the City of Google. Each of the pool participants had reported its investments at fair value (FV) at December 31, 2019. At the date of the creation of the pool, February 15, 2020 the fair value of investments for each of the pool participants was as follows: Investments 12/31/2019 2/15/2020 City of Google General Fund $ 445,000 $ 475,000 Rolling Hills School District 2,100,000 2,115,000 Clemson Township 1,945,000 1,935,000 REQUIRED: 1. Record the entries that should be made by the City, School District and Township on February 15 which shows their participation in the investment pool trust. 2. Prepare the journal entries for the following transactions in the investment pool trust. a. Record the investments transferred to the pool; assume that the investments of the City's General Fund were in U.S. Treasury notes and the investments of both the school district and township were in certificates of deposit (CDs). b. On September 15 interest on Treasury notes in the amount of $25,000 was collected. c. Interest on CDs accrued at year end amounted to $14,000. d. At the end of the year, undistributed earnings were allocated to the investment pool participants. Problem 4: (12 Points): The City of Google decided to pool the investments of the General Fund with Rolling Hills School District and Clemson Township in an investment trust fund to be managed by the City of Google. Each of the pool participants had reported its investments at fair value (FV) at December 31, 2019. At the date of the creation of the pool, February 15, 2020 the fair value of investments for each of the pool participants was as follows: Investments 12/31/2019 2/15/2020 City of Google General Fund $ 445,000 $ 475,000 Rolling Hills School District 2,100,000 2,115,000 Clemson Township 1,945,000 1,935,000 REQUIRED: 1. Record the entries that should be made by the City, School District and Township on February 15 which shows their participation in the investment pool trust. 2. Prepare the journal entries for the following transactions in the investment pool trust. a. Record the investments transferred to the pool; assume that the investments of the City's General Fund were in U.S. Treasury notes and the investments of both the school district and township were in certificates of deposit (CDs). b. On September 15 interest on Treasury notes in the amount of $25,000 was collected. c. Interest on CDs accrued at year end amounted to $14,000. d. At the end of the year, undistributed earnings were allocated to the investment pool participants