Question

The City of Little River had the following transactions related to the construction of a new courthouse: a.January 2, 2017 : 20-year, 6%, general-obligation serial

The City of Little River had the following transactions related to the construction of a new courthouse:

a.January 2, 2017: 20-year, 6%, general-obligation serial bonds with a face value of $2,000,000 are issued at 101. Interest payments are made on January 1 and July 1 of each year. The premium was transferred into the debt-service fund. The general fund will fully fund each payment as it becomes due.

b.March 1, 2017: Land is purchased for a new park at a cost of $200,000.

c. March 1, 2017: A contract is signed for landscaping and construction of various structures in the park in the amount of $1,800,000.

d. June 15, 2017: $110,000 is transferred from the general fund for the July 1 payment due on the courthouse-fund serial bonds.

e. July 1, 2017: Interest ($60,000) and principal ($50,000) are paid on the courthouse-fund serial bonds.

f. December 1, 2017: The city receives an invoice for progress completed to date on the courthouse construction project in the amount of $385,000.

g. December 27, 2017: $58,500 is transferred from the general fund for the January 1, 2018 interest payment due on the courthouse-fund serial bonds.

h.Interest is accrued as of December 31, 2017, following the exception permitted by the GASB.

Required:

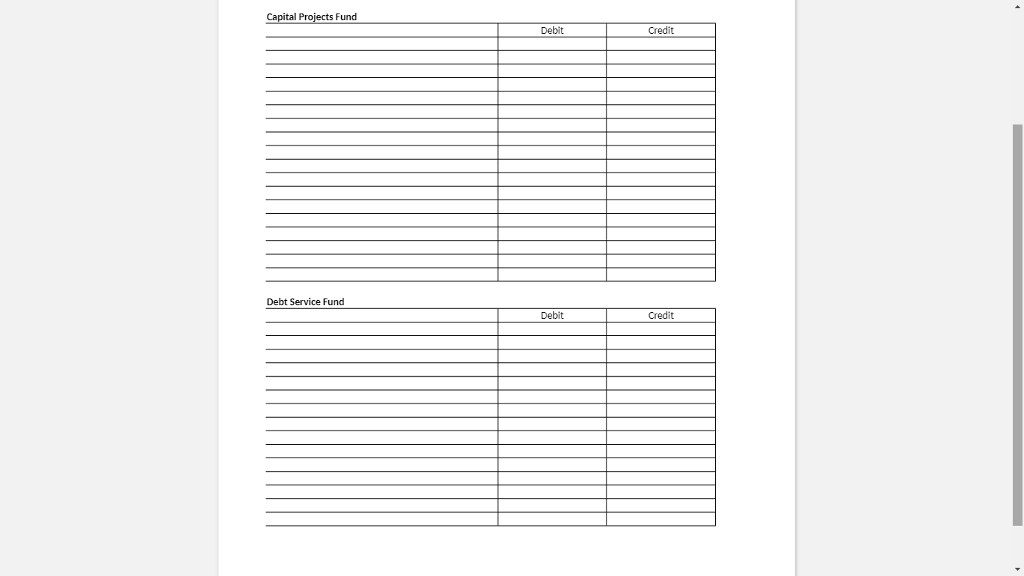

Prepare the journal entries required in both the capital-projects fund and the debt-service fund using the template

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started