Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The City of Merced is considering a plan to cover some major budget deficit, which will required the issuance of $2, 300,000, 8%, 10-year bond

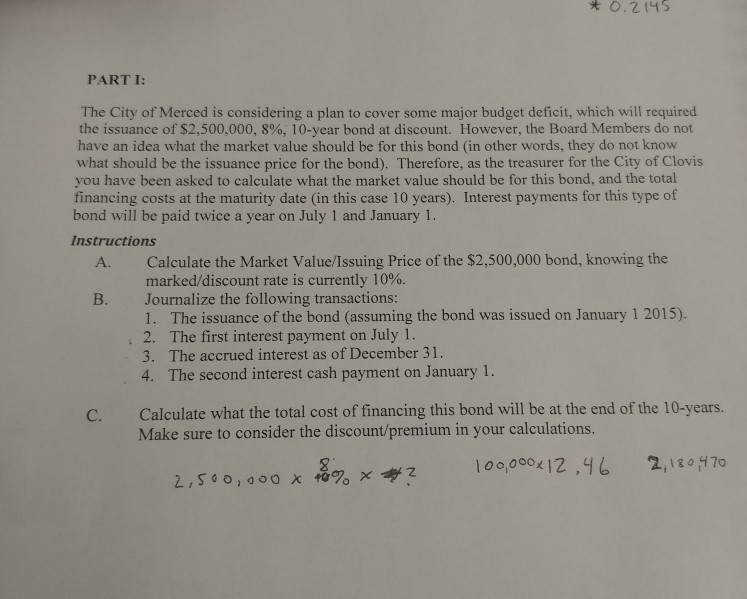

The City of Merced is considering a plan to cover some major budget deficit, which will required the issuance of $2, 300,000, 8%, 10-year bond at discount. However, the Board Members do not have an idea what the market value should be for this bond (in other words, they do not know what should be the issuance price for the bond). Therefore, as the treasurer for the City of Clovis you have been asked to calculate what the market value should be for this bond, and the total financing costs at the maturity date (in this case 10 years). Interest payments for this type of bond will be paid twice a year on July 1 and January 1. A. Calculate the Market Value/Issuing Price of the $2, 500,000 bond, knowing the marked/discount rate is currently 10%. B. Journalize the following transactions: The issuance of the bond (assuming the bond was issued on January 1 2015). The first interest payment on July 1. The accrued interest as of December 31. The second interest cash payment on January 1. C. Calculate what the total cost of financing this bond will be at the end of the 10-years. Make sure to consider the discount/premium in your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started