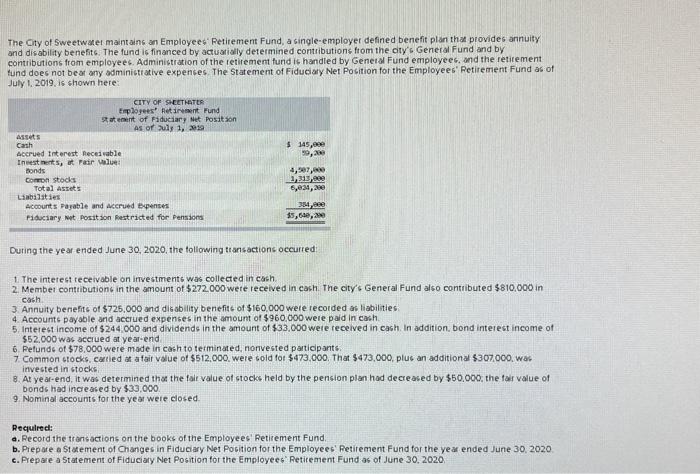

The City of Sweetwatet maintains an Employees' Fetitement Fund, a single-employet defined benefit plan that provides annuity, and disability benefits. The fund is financed by actuatialy determined contributions ftom the city's General Fund and by contributions from employees. Administration of the retirement fund is handled by Genetal Fund employeec. and the retirement tund does not beat ony odministiative expenses. The Statement of Fiduciary Net Position for the Employees' Retirememt Fund as of July 1,2019, is shown here: Duting the year ended June 30,2020 , the toliowing transactions occurted: 1. The interest receivable on irrvestments was collected in cash. 2. Membet contributions in the amount of $272.000 wete received in cash. The city's. General Fund also contributed $810,000 in cosh 3. Annuity benefits of $725,000 and disability benefitc of $150,000 were recorded as liabilities 4. Accounts payoble and accrued expenses in the amoum of $960,000 were paid in cash. 5 . Intetest income of $244,000 and dividends in the amount of $33,000 were received in cash. In addition, bond interest income of $52,000 was acciued at year-end 6. Refunds of $78,000 were made in cach to terminated, nonvested participants. 7. Common stocks, caried at afait value of $512,000, were 6old fo: $473,000. That $473,000, plus an additional $307,000, war invested in stocks. 8. At ye ar-end, it was determined tha the fait value of stocks held by the pension plan had decreased by $50,000, the far value of bonds had increased by $33,000 9. Nominal accounts for the year were closed Reculred: a. Record the transactions on the books of the Employees' Retirement Fund. b. Prepare a Statement of Changes in Fiduciary Net Position for the Employees' Fetirement Fund for the ye ar ended June 30 , 2020 c. Prepare a Statement of Fiducialy Net Position tor the Employees' Retirement Fund as of June 30, 2020. The City of Sweetwatet maintains an Employees' Fetitement Fund, a single-employet defined benefit plan that provides annuity, and disability benefits. The fund is financed by actuatialy determined contributions ftom the city's General Fund and by contributions from employees. Administration of the retirement fund is handled by Genetal Fund employeec. and the retirement tund does not beat ony odministiative expenses. The Statement of Fiduciary Net Position for the Employees' Retirememt Fund as of July 1,2019, is shown here: Duting the year ended June 30,2020 , the toliowing transactions occurted: 1. The interest receivable on irrvestments was collected in cash. 2. Membet contributions in the amount of $272.000 wete received in cash. The city's. General Fund also contributed $810,000 in cosh 3. Annuity benefits of $725,000 and disability benefitc of $150,000 were recorded as liabilities 4. Accounts payoble and accrued expenses in the amoum of $960,000 were paid in cash. 5 . Intetest income of $244,000 and dividends in the amount of $33,000 were received in cash. In addition, bond interest income of $52,000 was acciued at year-end 6. Refunds of $78,000 were made in cach to terminated, nonvested participants. 7. Common stocks, caried at afait value of $512,000, were 6old fo: $473,000. That $473,000, plus an additional $307,000, war invested in stocks. 8. At ye ar-end, it was determined tha the fait value of stocks held by the pension plan had decreased by $50,000, the far value of bonds had increased by $33,000 9. Nominal accounts for the year were closed Reculred: a. Record the transactions on the books of the Employees' Retirement Fund. b. Prepare a Statement of Changes in Fiduciary Net Position for the Employees' Fetirement Fund for the ye ar ended June 30 , 2020 c. Prepare a Statement of Fiducialy Net Position tor the Employees' Retirement Fund as of June 30, 2020