Question

The City of Waterville applied for a grant from the state government to build a pedestrian bridge over the river inside the citys park. On

The City of Waterville applied for a grant from the state government to build a pedestrian bridge over the river inside the citys park. On May 1, the city was notified that it had been awarded a grant of up to $190,000 for the project. The state will provide reimbursement for allowable expenditures. On May 5, the special revenue fund entered into a short-term loan with the General Fund for $190,000 so it could start bridge construction. During the year, the special revenue fund expended $156,000 for allowable bridge construction costs, for which it submitted documentation to the state. Reimbursement was received from the state on December 13.

Required

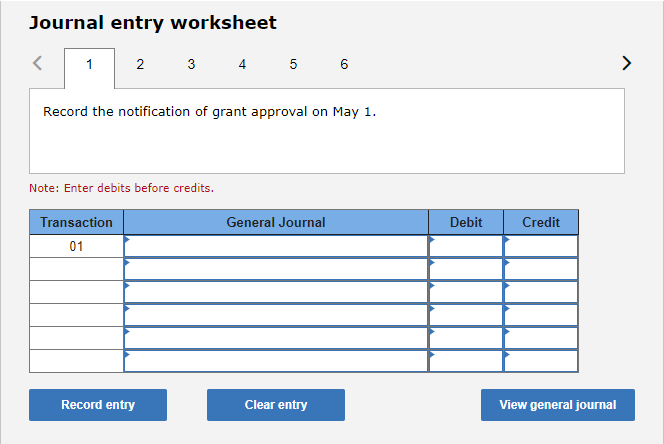

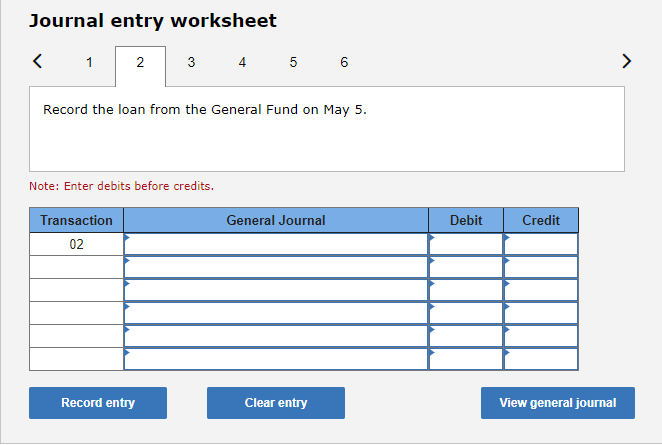

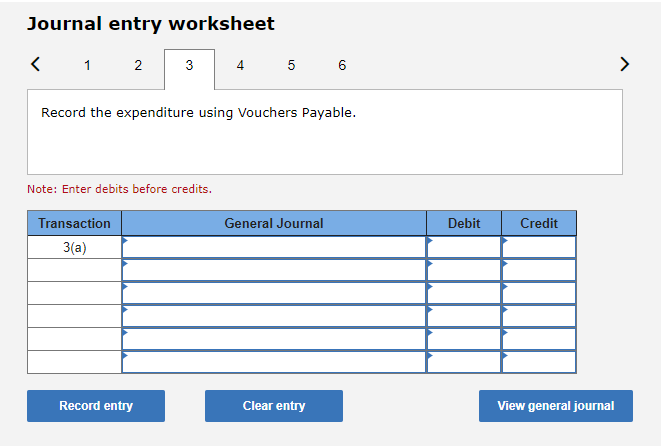

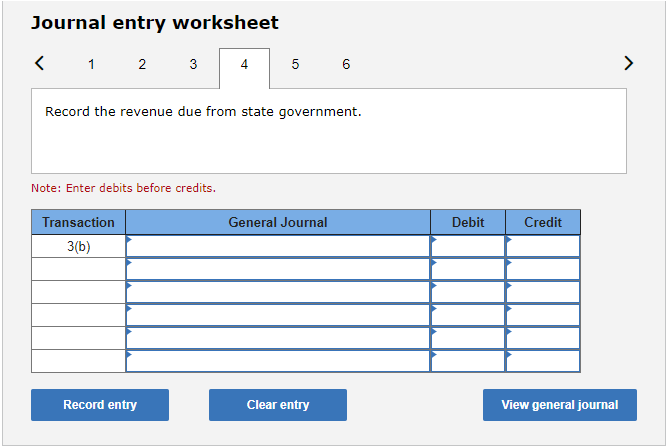

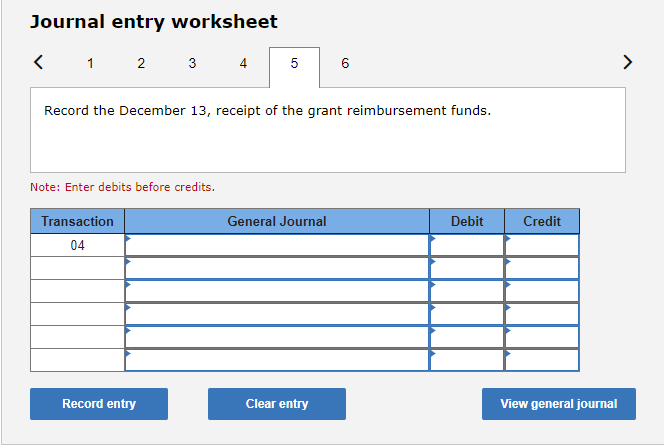

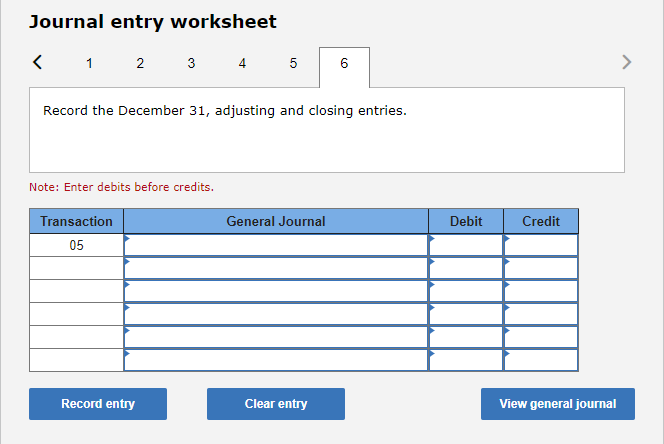

For the special revenue fund, provide the appropriate journal entries, if any, that would be made for the following. (Assume the city has a fiscal year-end of December 31.) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

- May 1, notification of grant approval.

- May 5, loan from General Fund.

- During the year, bridge expenditures and submission of reimbursement documentation.

- December 13, receipt of the grant reimbursement funds.

- December 31, adjusting and closing entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started