Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CityCrafters Company manufactures Skateboards. The company set up its balance sheet on December 1 , 2 0 2 3 by selling $ 4 ,

The CityCrafters Company manufactures Skateboards. The company set up its

balance sheet on December by selling $ in common stock. Some

of the cash raised from selling the stock was then used to purchase land costing

$ and Building Improvements and Equipment costing $ with the

remaining cash being used to fund the startup operations of the company. After

setting up its balance sheet the company began operations on January

Data Section

The company has assembled the following information to assist you in the budget

preparation process for the first quarter months of The company has

estimated the following budgeted unit sales for the first months of the year:

Jan Apr

Feb May

Mar

The selling price of the snowboard is $ per unit. Thirty percent of sales are cash

sales and the balance is on credit. The credit sales are collected as follows: in

the month of sale, in the second month of sale and the balance in the third

month of sale.

The company maintains a finished goods inventory of of the following months

unit sales. There is no beginning inventory of finished goods. Each snowboard

requires the following raw material and direct labor:

Wood feet at $ per foot

Direct labor hours per snowboard at $ per hour

Management would like to end each month with an inventory of raw direct

materials equal to of the following months production needs. There is no

beginning inventory of raw materials. The company pays of raw material

purchases in the month of purchase, in the second month and the balance in

the third month.

Variable manufacturing overhead is $ per direct manufacturing labor hour.

The fixed manufacturing overhead cost per quarter is $ The only noncash

element of manufacturing overhead is depreciation which is $ per quarter.

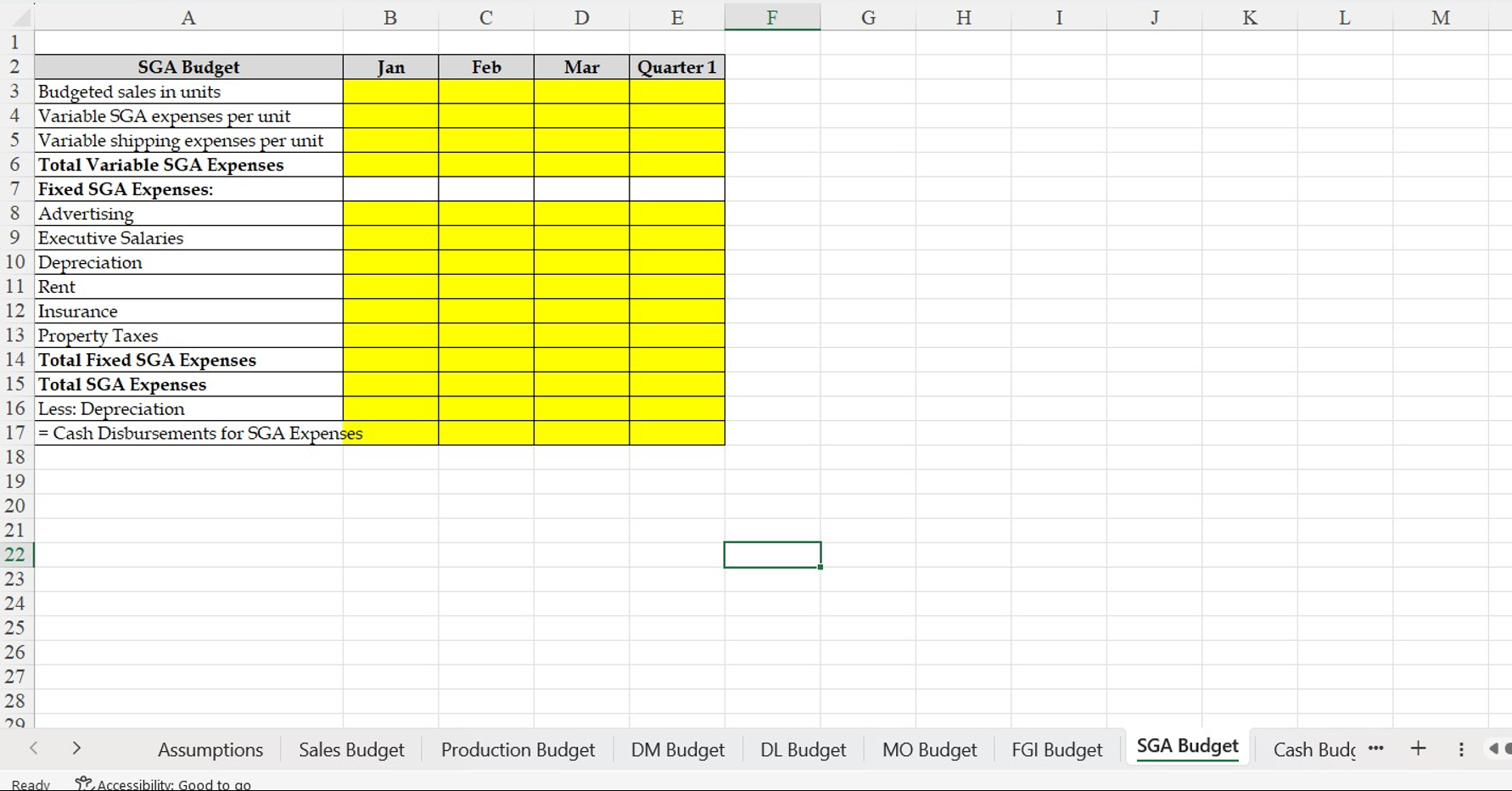

The companys variable selling and administrative expense per unit is $ In

addition, variable shipping expenses are $ per unit. Fixed selling and

administrative expenses include the following: advertising expenses of $ per

month, executive salaries of $ per month, depreciation of $ per

month. Rental payment for the manufacturing facility is estimated at $ per

month. Additionally, insurance payment total $ per month while property

taxes total $ per month.

The beginning cash balance on January is $ Management plans

to spend some money on capital expenditures fixed assets on remodeling the

building it is renting. This remodeling project would cost $ and would be

depreciated straight line over its year useful life with no salvage value. Of this

remodeling project, of the project is related to administrative offices in the

building, and the remaining of the project is to remodel the manufacturing

area of the building.

The companys board of directors has also approved cash dividends of $ paid

in cash in the month of March

The company requires a minimum cash balance of at least $ at the end of

each month. If the ending cash balance is insufficient, the company would obtain a

shortterm loan from a local bank. The bank has agreed to extend financing to

Hansen at an annual interest rate of per year. Any borrowing would occur at

the beginning of the current month and any payment interest and principal will be

made in the beginning of the following month if sufficient cash surplus is available

for such payments Interest must be paid first on any outstanding loan balance

before any principal payments are made.

Project Requirements

This project will be due on Sunday, October th at :pm You will be using

the template that is given to you that already includes all of the assumptions from

the Data Section above to create all of the required schedules to develop a full

master budget for CityCrafters. The requirements for the master budget are as

follows:

Using the excel template provided, you will complete the following

worksheets:

a Sales budget

b Production budget

c Direct materials budget

d Direct labor budget

e Manufacturing overhead budget

f Finished goods inventory budget

g Selling, general & administrative budget

h Cash budget

i Income statement

j Balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started