Question

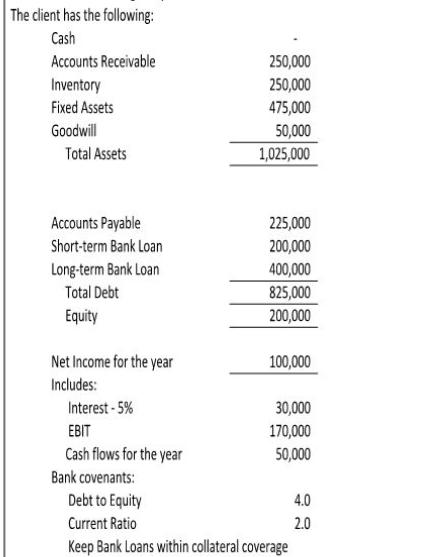

The client has the following: Cash Accounts Receivable 250,000 Inventory 250,000 Fixed Assets 475,000 Goodwill 50,000 Total Assets 1,025,000 Accounts Payable 225,000 Short-term Bank

The client has the following: Cash Accounts Receivable 250,000 Inventory 250,000 Fixed Assets 475,000 Goodwill 50,000 Total Assets 1,025,000 Accounts Payable 225,000 Short-term Bank Loan 200,000 Long-term Bank Loan 400,000 Total Debt 825,000 Equity 200,000 Net Income for the year 100,000 Includes: Interest -5% 30,000 EBIT 170,000 Cash flows for the year 50,000 Bank covenants: Debt to Equity Current Ratio Keep Bank Loans within collateral coverage 2.0 49 4.0 Question #3-Would you lend the company more funds? How much? Question #4 - Which two risks would you monitor regarding this company?

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether to lend the company more funds and how much we need to analyze the financial position and performance of the company Considering ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Financial Accounting

Authors: Christopher Burnley, Robert Hoskin, Maureen Fizzell, Donald

1st Canadian Edition

1118849388, 9781119048572, 978-1118849385

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App