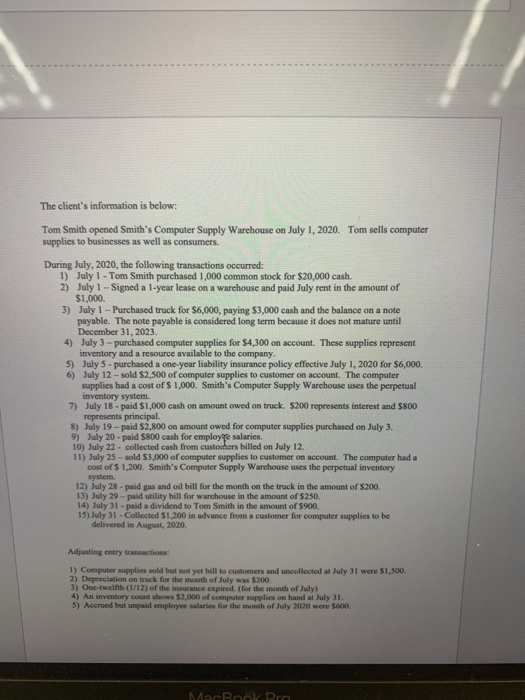

The client's information is below: Tom Smith opened Smith's Computer Supply Warehouse on July 1, 2020. Tom sells computer supplies to businesses as well as consumers. During July, 2020, the following transactions occurred: 1) July 1 - Tom Smith purchased 1,000 common stock for $20,000 cash. 2) July 1 - Signed a 1-year lease on a warehouse and paid July rent in the amount of $1,000 3) July 1 - Purchased truck for $6,000, paying $3,000 cash and the balance on a note payable. The note payable is considered long term because it does not mature until December 31, 2023. 4) July 3-purchased computer supplies for $4,300 on account. These supplies represent inventory and a resource available to the company. 5) July 5 - purchased a one-year liability insurance policy effective July 1, 2020 for $6,000. 6) July 12-sold 2,500 of computer supplies to customer on account. The computer supplies had a cost of $1,000. Smith's Computer Supply Warehouse uses the perpetual inventory system 7) July 18 - paid $1,000 cash on amount owed on truck. $200 represents interest and $800 represents principal. 8) July 19-paid $2,800 on amount owed for computer supplies purchased on July 3. 9) July 20 - paid $800 cash for employee salaries. 10) July 22 - collected cash from customers billed on July 12. 11) July 25-sold $3,000 of computer supplies to customer on account. The computer had a cost of $ 1,200. Smith's Computer Supply Warehouse uses the perpetual inventory system 12) July 28 - paid gas and oil bill for the month on the truck in the amount of $200. 13) July 29-paid utility bill for warehouse in the amount of $250. 14) July 31 - paid a dividend to Tom Smith in the amount of $900. 15) July 31 - Collected $1.200 in advance from a customer for computer supplies to be delivered in August, 2020 Adjusting entry transactions: 1) Computer supplies sold but not yet bill to customers and uncollected at July 31 were $1,500 2) Depreciation on truck for the month of July was 5200 3) One-twelfth (1/12) of the insurance expired. (for the month of July) 4) An inventory count shows 52,000 of computer supplies on hand at July 31. 5) Accrued but unpaid employee salaries for the month of July 2020 were $600. MACRO Dro Requirements: Attached to this information are transactions needed for journal entries and adjusting journal entries as well as student requirements and due date. 1) Client transactions for the month of July 2020 a. Student Responsibility - Prepare all Journal Entries associated with the transactions that occurred in July 2020 in a General Journal. Post all journal to T-Accounts