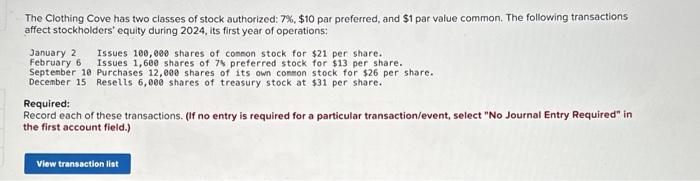

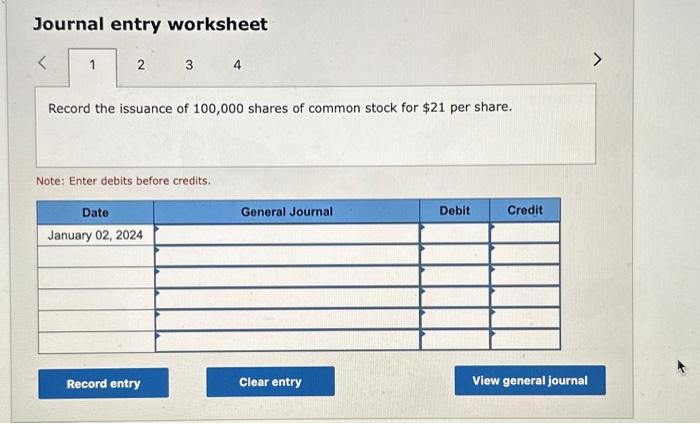

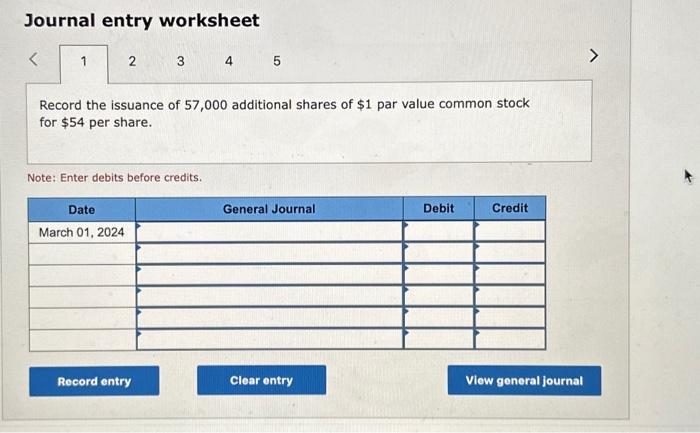

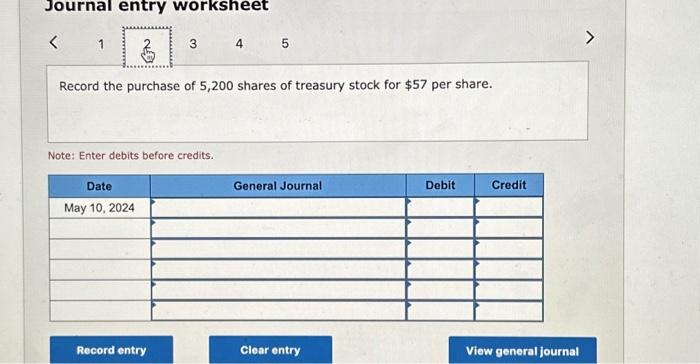

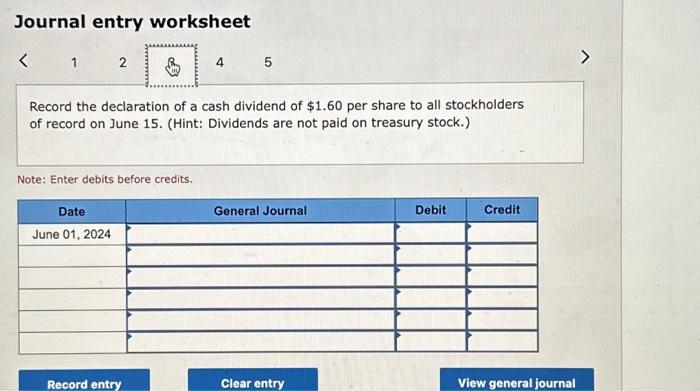

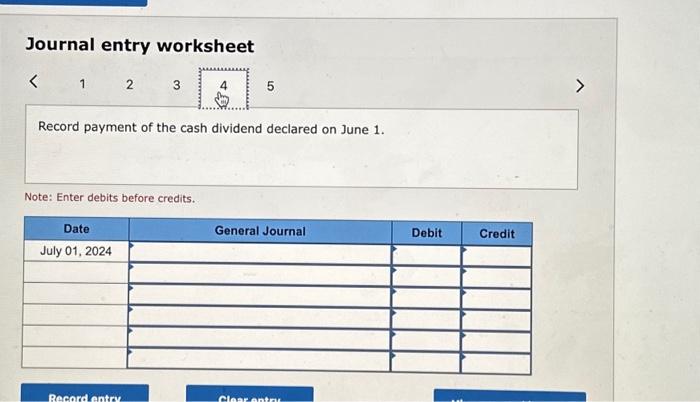

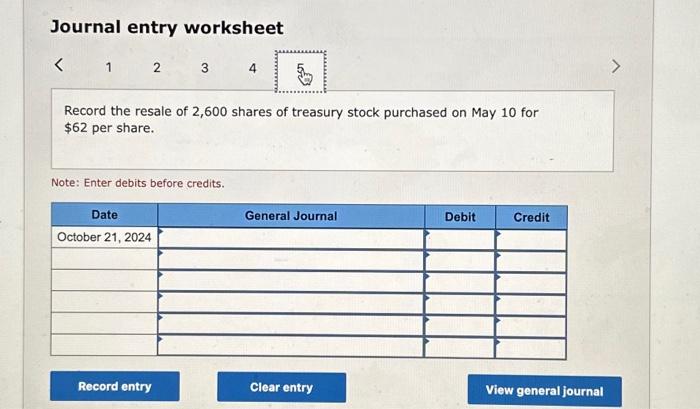

The Clothing Cove has two classes of stock authorized: 7%,$10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2 Issues 100,000 shares of connon stock for $21 per share. February 6 Issues 1,600 shares of 75 preferred stock for $13 per share. Septenber 10 Purchases 12, 0 e shares of its own conmon stock for $26 per share. December 15 Resells 6,000 shares of treasury stock at $31 per share. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the issuance of 100,000 shares of common stock for $21 per share. Note: Enter debits before credits. Journal entry worksheet Record the issuance of 57,000 additional shares of $1 par value common stock for $54 per share. Note: Enter debits before credits. Journal entry worksheet Record the purchase of 5,200 shares of treasury stock for $57 per share. Note: Enter debits before credits. Journal entry worksheet Record the declaration of a cash dividend of $1.60 per share to all stockholders of record on June 15 . (Hint: Dividends are not paid on treasury stock.) Note: Enter debits before credits. Journal entry worksheet Record payment of the cash dividend declared on June 1. Note: Enter debits before credits. Journal entry worksheet 1 Record the resale of 2,600 shares of treasury stock purchased on May 10 for $62 per share. Note: Enter debits before credits. The Clothing Cove has two classes of stock authorized: 7%,$10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2 Issues 100,000 shares of connon stock for $21 per share. February 6 Issues 1,600 shares of 75 preferred stock for $13 per share. Septenber 10 Purchases 12, 0 e shares of its own conmon stock for $26 per share. December 15 Resells 6,000 shares of treasury stock at $31 per share. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the issuance of 100,000 shares of common stock for $21 per share. Note: Enter debits before credits. Journal entry worksheet Record the issuance of 57,000 additional shares of $1 par value common stock for $54 per share. Note: Enter debits before credits. Journal entry worksheet Record the purchase of 5,200 shares of treasury stock for $57 per share. Note: Enter debits before credits. Journal entry worksheet Record the declaration of a cash dividend of $1.60 per share to all stockholders of record on June 15 . (Hint: Dividends are not paid on treasury stock.) Note: Enter debits before credits. Journal entry worksheet Record payment of the cash dividend declared on June 1. Note: Enter debits before credits. Journal entry worksheet 1 Record the resale of 2,600 shares of treasury stock purchased on May 10 for $62 per share. Note: Enter debits before credits