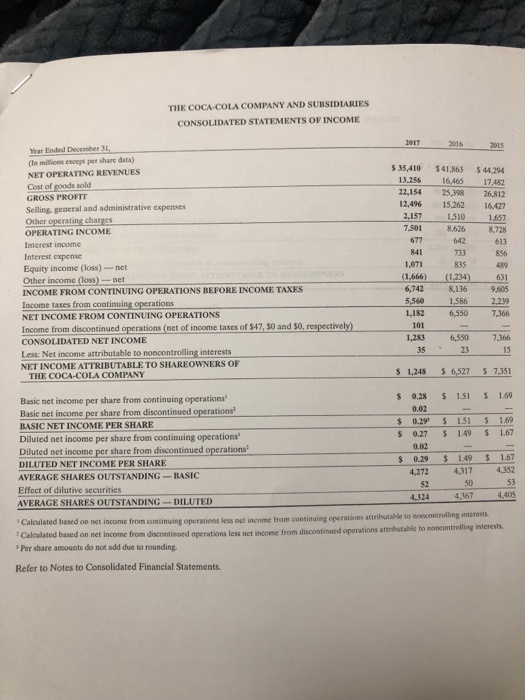

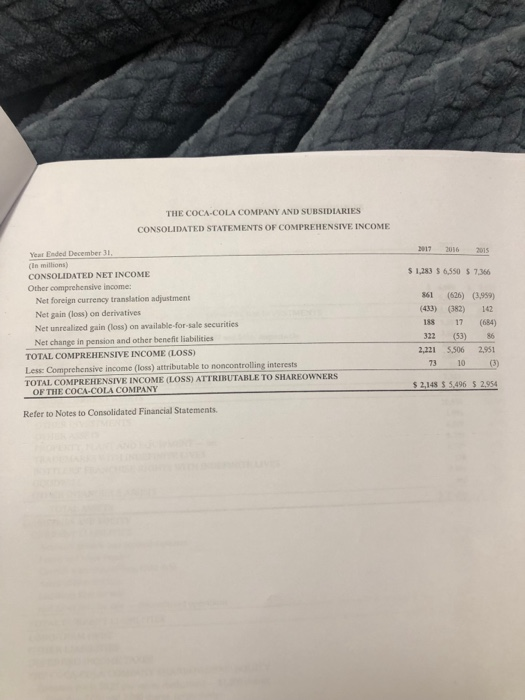

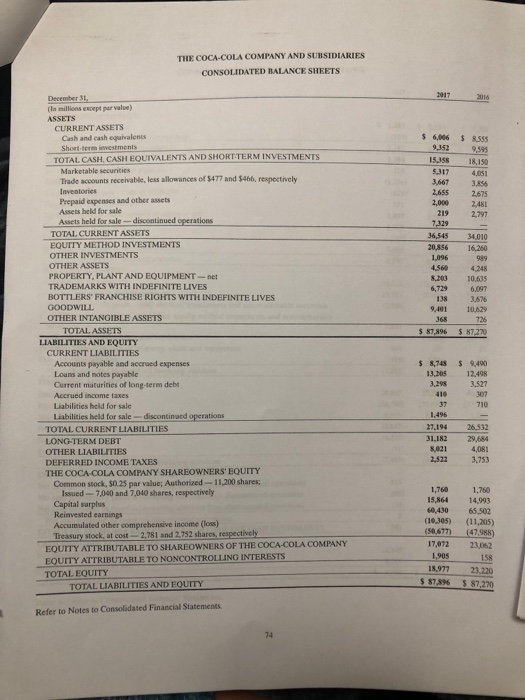

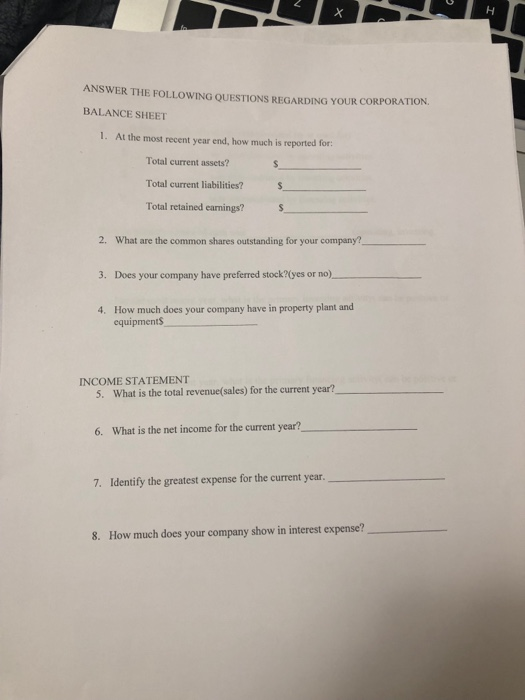

THE COCA COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME 2016 2015 Year Ended December 31, (In millions except per share data) 35,410 41,863 $44.294 13.256 16465 17482 NET OPERATING REVENUES Cost of goods sold GROSS PROFTT Selling, general and administrative expenses Other operating chargss OPERATING INCOME Interest income Interest expense Equity income (loss)nct Other income (loss)-net INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income from CONSOLIDATED NET INCOME Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF 22,154 25,398 26,812 12,496 15,262 16.427 1,657 2,157 1510 7,501 8,626 8728 677 642 613 733 835 1,666) (1234) 631 8,136 841 1,071 856 6,742 5,560 1,586 2,29 1,182 6,550 7,366 discontinued operations (et of income taxes of $47, 50 and s0 1,283 6,550 7.366 3523 15 S 1,248 S 6527 7.351 s 0.28 151 S 1.69 S 0.29 S 131 1.69 THE COCA-COLA COMPANY Basic net income per share from continuing operations Basic net income per share from discontinued operations BASIC NET INCOME PER SHARE Diluted net income per share from continuing operations Diluted net income per share from discontinued operations DILUTED NET INCOME PER SHARE AVERAGE SHARES OUTSTANDING-BASIC Effect of dilutive securities AVERAGE SHARES OUTSTANDING-DILUTED 0.02 0.27 149 1.67 0.02 3 0.29 1.49 1,67 4,272 4,317 4,352 50 4 367 4.324 4.408 Calculated based on net income from continuing operations less net income from continuing operations att Calculated based on net income from discontinued operations less net income from discontinued operations a " Per share amouats do not add due to rounding ributable to noncontrolling interests ttributable to noncontrolling interests Refer to Notes to Consolidated Financial Statements. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 17 2016 2015 Year Ended December 31, (In millions) CONSOLIDATED NET INCOME Other comperehensive income: 1,283 $ 6550 $ 7,366 Net foreign currency translation adjustment Net gain (loss) on derivatives Net unrealized gain (loss) on available-for-sale securities Net change in pension and other benefic liabilities 861 (626) (3,959) (433) (382) 142 188 17 (684) 322 (53) 86 2,221 5,506 2,951 TOTAL COMPREHENSIVE INCOME (LOSS) 73 10 Less: Comprehensi TOTAL COMPREHENSIVE NCOME (LOSS) ATTRIBUTABLE TO SHAREOWNERS ve income (loss) attributable to noncontrolling interests S2,148 $ 5,496 2,954 OF THE COCA-COLA COMPANY Refer to Notes to Consolidated Financial Statements. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In millions espept par value) ASSETS CURRENT ASSETS 6,006 8sss 9.3529,59 15358 18,150 5317 4,051 3,667 3,856 2,655 2675 2,000 248 219 2,797 Cash and cash equivalenss Short-term investments TOTAL CASH, CASH EQUIVALENTS AND SHORT TERM INVESTMENTS Marketable secunnties Trade accounts receivable, less allowances of $477 and $466, respectively Prepaid expenses and other assets Assets held for sale Assets held for sale-discontinued operations TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS OTHER ASSETS PROPERTY, PLANT AND EQUIPMENT-ne TRADEMARKS WITH INDEFINITE LIVES BOTTLERS' FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS 36,545 34010 20,856 16,260 1,096 4,5604,248 8,203 10,635 6,097 138 3,676 9,401 10,629 726 87,896 $87.270 6,729 368 TOTALASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt s 8,748 $ 9,490 3,205 12.498 3,298 3,527 307 710 ncome taxes Liabilities held for sale Liabilities held for salediscontinaed operations 37 1.496 7,19426.532 TOTAL CURRENT LIABILITIES LONG TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA COLA COMPANY SHAREOWNERS EQUITY 31,182 29,684 4,081 3,753 3,021 2,522 Common stock, $0.25 par valuc; Authorized-11,200 shares; issued 7,040 and 7,040 shares, respectively Capital sarplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost-2,.781 and 2.752 shares, respectively 1,760 1,760 15,864 14,993 64,430 65,502 (10,305) (11,205) 50,677) (47988) 17,072 23062 158 18,977 23,220 $ 87,896 $ 87,270 NERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO SHAREOW EOUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL BQUITY 1,905 TOTAL LIABILITIES AND EQUITY Refer to Notes to Consolidated Financial Statements ANSWER THE FOLLOWING QUESTIONS REGARDING YOUR CORPORATION BALANCE SHEET 1. At the most recent year end, how much is reported for: Total current assets? Total current liabilities? Total retained earnings? 2. What are the common shares outstanding for your company? 3. Does your yes or no) 4. How much does your company have in property plant and company have preferred stock?0 equipments INCOME STATEMENT 5. What is the total revenue(sales) for the current year? 6. What is the net income for the current year? 7. Identify the greatest expense for the current year 8. How much does your company show in interest expense