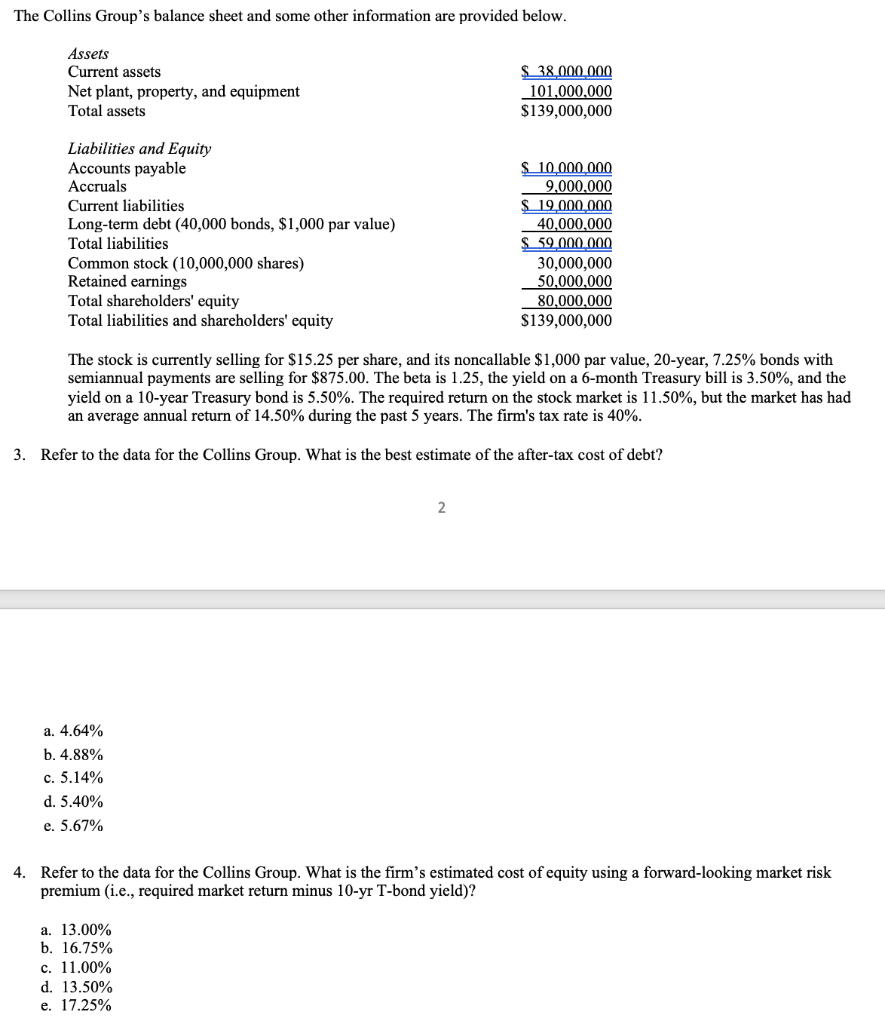

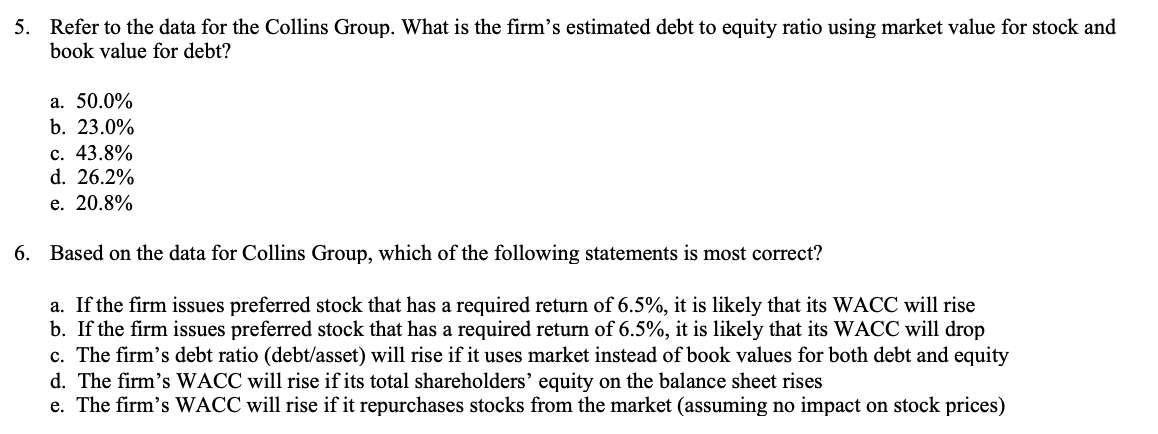

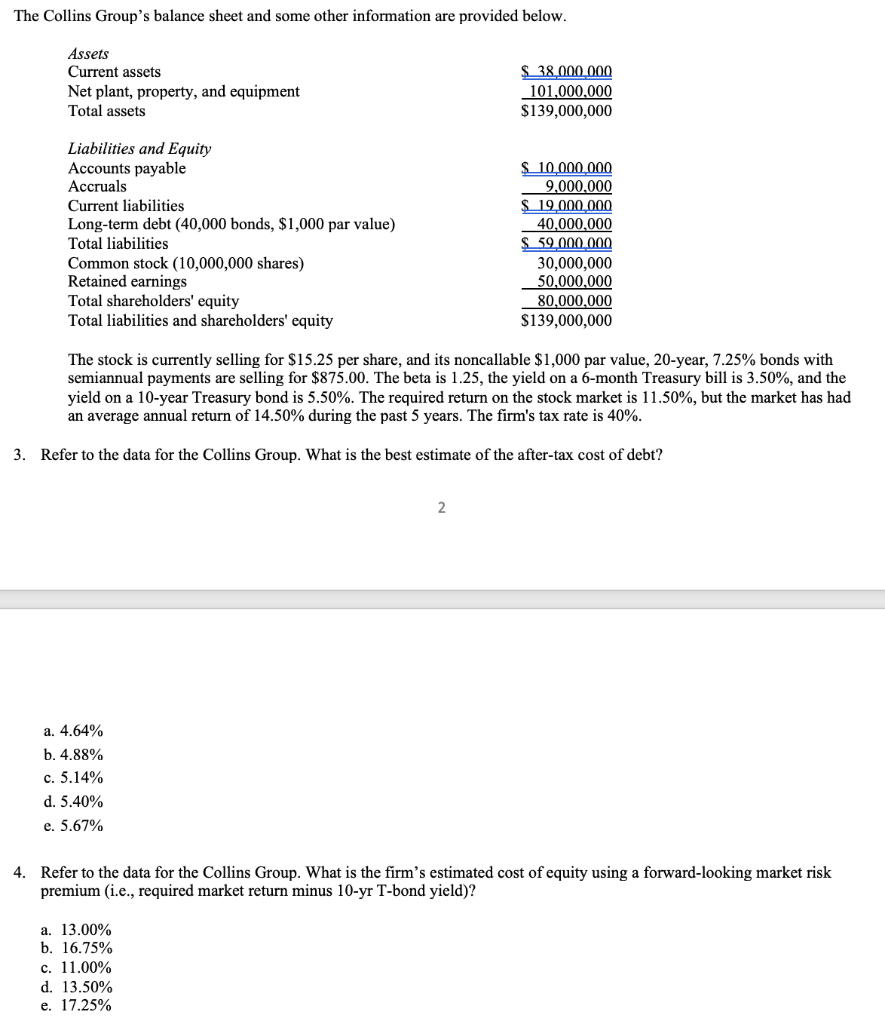

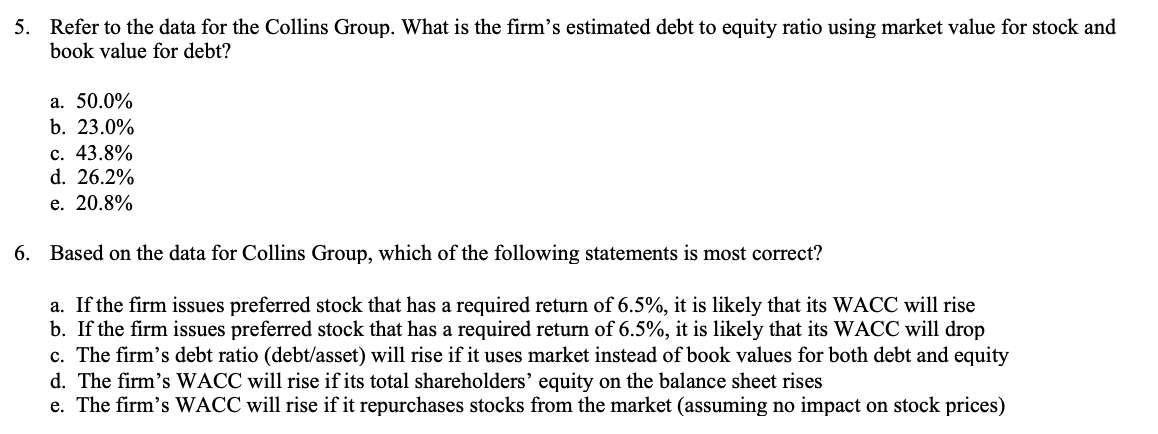

The Collins Group's balance sheet and some other information are provided below. Assets Current assets Net plant, property, and equipment Total assets $_38.000.000 101,000,000 $139,000,000 Liabilities and Equity Accounts payable Accruals Current liabilities Long-term debt (40,000 bonds, $1,000 par value) Total liabilities Common stock (10,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 10.000.000 9,000,000 19.000.000 40,000,000 S 59.000.000 30,000,000 50,000,000 80,000,000 $139,000,000 The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 10-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%. 3. Refer to the data for the Collins Group. What is the best estimate of the after-tax cost of debt? 2 a. 4.64% b. 4.88% c. 5.14% d. 5.40% e. 5.67% 4. Refer to the data for the Collins Group. What is the firm's estimated cost of equity using a forward-looking market risk premium (i.e., required market return minus 10-yr T-bond yield)? a. 13.00% b. 16.75% c. 11.00% d. 13.50% e. 17.25% 5. Refer to the data for the Collins Group. What is the firm's estimated debt to equity ratio using market value for stock and book value for debt? a. 50.0% b. 23.0% c. 43.8% d. 26.2% e. 20.8% 6. Based on the data for Collins Group, which of the following statements is most correct? a. If the firm issues preferred stock that has a required return of 6.5%, it is likely that its WACC will rise b. If the firm issues preferred stock that has a required return of 6.5%, it is likely that its WACC will drop c. The firm's debt ratio (debt/asset) will rise if it uses market instead of book values for both debt and equity d. The firm's WACC will rise if its total shareholders' equity on the balance sheet rises e. The firm's WACC will rise if it repurchases stocks from the market (assuming no impact on stock prices)