Answered step by step

Verified Expert Solution

Question

1 Approved Answer

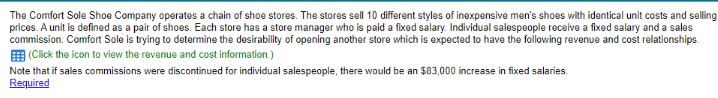

The Comfort Sole Shoe Company operates a chain of shoe stores. The stores sell 10 different styles of inexpensive men's shoes with identical unit

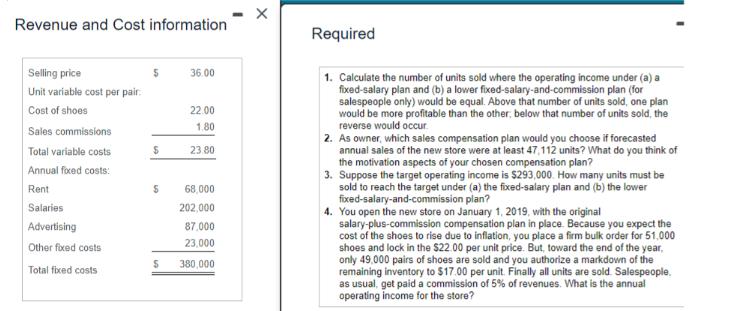

The Comfort Sole Shoe Company operates a chain of shoe stores. The stores sell 10 different styles of inexpensive men's shoes with identical unit costs and selling prices. A unit is defined as a pair of shoes. Each store has a store manager who is paid a fixed salary. Individual salespeople receive a fixed salary and a sales commission. Comfort Sole is trying to determine the desirability of opening another store which is expected to have the following revenue and cost relationships. (Click the icon to view the revenue and cost information.) Note that if sales commissions were discontinued for individual salespeople, there would be an $83,000 increase in fixed salaries. Required Revenue and Cost information Selling price 36.00 Unit variable cost per pair Cost of shoes 22.00 1.80 Sales commissions Total variable costs $ 23.80 Annual fixed costs: Rent $ 68,000 Salaries 202,000 Advertising 87,000 23,000 Other fixed costs $ 380,000 Total fixed costs Required 1. Calculate the number of units sold where the operating income under (a) a fixed-salary plan and (b) a lower fixed-salary-and-commission plan (for salespeople only) would be equal. Above that number of units sold, one plan would be more profitable than the other, below that number of units sold, the reverse would occur 2. As owner, which sales compensation plan would you choose if forecasted annual sales of the new store were at least 47,112 units? What do you think of the motivation aspects of your chosen compensation plan? 3. Suppose the target operating income is $293,000. How many units must be sold to reach the target under (a) the fixed-salary plan and (b) the lower fixed-salary-and-commission plan? 4. You open the new store on January 1, 2019, with the original salary-plus-commission compensation plan in place. Because you expect the cost of the shoes to rise due to inflation, you place a firm bulk order for 51.000 shoes and lock in the $22.00 per unit price. But, toward the end of the year, only 49,000 pairs of shoes are sold and you authorize a markdown of the remaining inventory to $17.00 per unit. Finally all units are sold. Salespeople. as usual, get paid a commission of 5% of revenues. What is the annual operating income for the store?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing the Shoe Stores Revenue and Costs Understanding the Problem The shoe store is considering two compensation plans for its salespeoplea fixed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started