Question

The ComfyLinks to an external site. is a product dreamed by the Speciale brothers, Michael and Brian. The Speciale Brothers hit the jackpot on Shark

The ComfyLinks to an external site. is a product dreamed by the Speciale brothers, Michael and Brian. The Speciale Brothers hit the jackpot on Shark Tank and agreed to sell a 30% stake in their business for $50,000 on Dec 31, 2020. The first year went amazing! The company went from just a few protypes they made to over $15 million in sales. The companys first year results are given below. The retail price of a Comfy is $40, but the wholesale price (what they sell to stores for) is $30.

They have a negotiated contract with a manufacturer in Bangladesh for the following orders:

Production Costs | |||

| Monthly Production Bill with under 20,000 order | $13/Comfy | ||

| Monthly Production Bill with under 20,001-99,999 order | $12/Comfy | ||

| Monthly Production Bill with 100,000+ order | $11/Comfy |

Shipping costs are $4 per Comfy (either to the customer directly or to the store/QVC).

Additionally, the brothers have rolled out an advertising platform and website: thecomfy.comLinks to an external site.. Customer acquisition costs (the cost of accepting credit cards and advertising on Facebook) are approximately $6 per comfy and occur the same month as the sale, regardless of the venue sold.

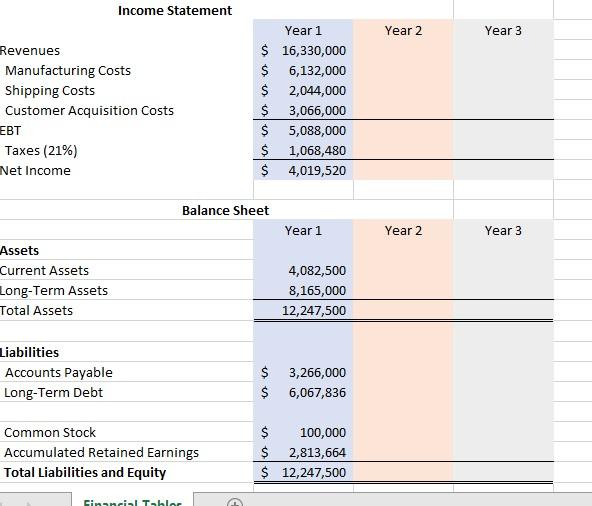

Creating a Comfy Proforma

Using the percentage of sales approach and the companys expectations of sales in the chart below, create a proforma income statement and balance sheet. Determine any additional funding needed in order to sustain the projected growth rate. The Shark wants her 30% of profits in the form of a cash dividend paid out. The Speciale brothers have promised to re-invest their money into the business for the first three years.

Product Sale Forecast | |||

| Online | Home Shopping Network | Bed Bath and Beyond | |

| YR 1 | 100,000 | 400,000 | 275,000 |

| YR 2 | 150,000 | 580,000 | 250,000 |

| Current Assets, Long-term assets, and account payable are 25%, 50%, and 20% of sales, respectively. Long-term debt and equity are not fixed in relation to sales. |

Project Instructions

Excel File

- Download this templateDownload this template

- Using the template and the information above, create a pro forma for The Comfy.

- Name your file: Comfy_YourName.xls

Word Document

- Create a Word Document explaining your expectations for additional funding to the Shark.

- Name your file: Comfy_YourName.docx

- In your memo, either explain how the cash coming in is going to be sufficient to fund growth OR outline how much additional cash will be needed.

- You will most likely need to make up a few small charts to make your plan clear and readable.

- Address what you believe should be done with any excess cash (for example: pay it out to the Speciale Brothers, keep it for a rainy day in cash, etc.) OR if you think the company should issue debt, equity, or a combination of both to fund the shortfall.

- Note: Points will be given not based on your choice but rather your justification of which you choose.

Submission Instructions

- Submit your Excel file

- Submit your Word file

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started