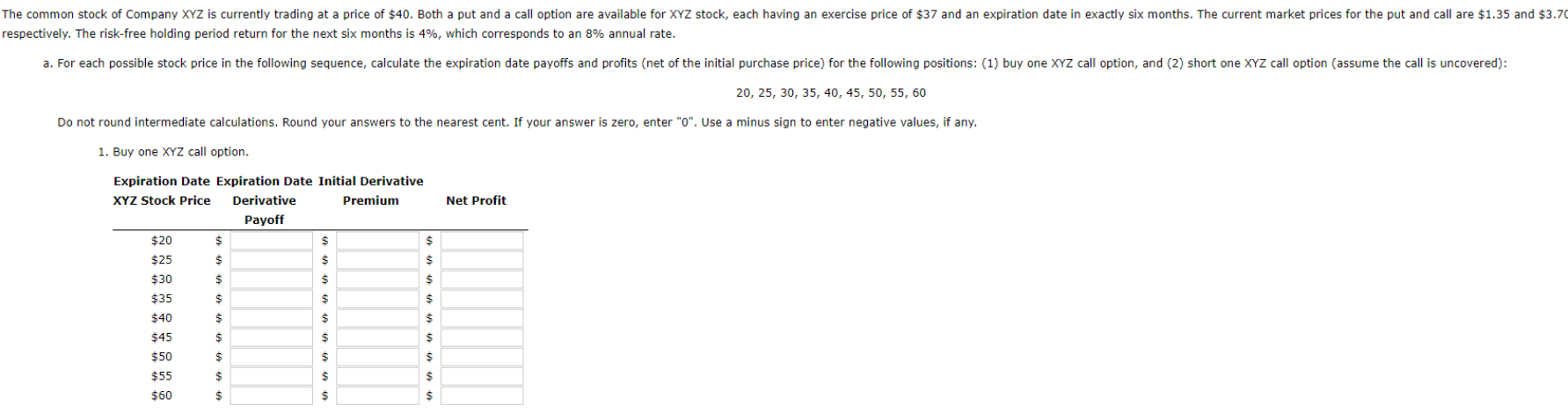

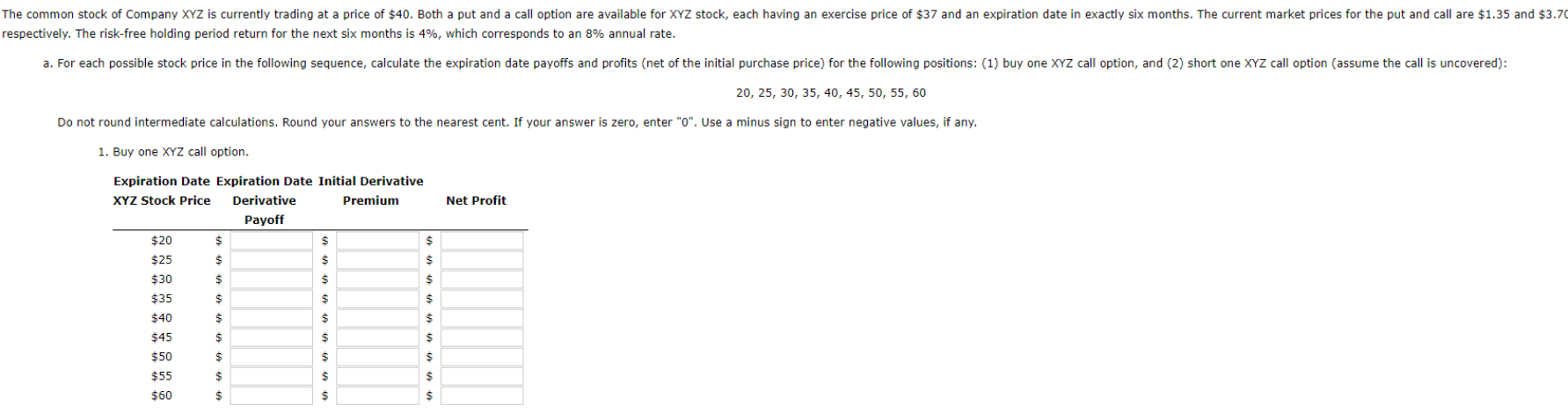

The common stock of Company XYZ is currently trading at a price of $40. Both a put and a call option are available for XYZ stock, each having an exercise price of $37 and an expiration date in exactly six months. The current market prices for the put and call are $1.35 and $3.70 respectively. The risk-free holding period return for the next six months is 4%, which corresponds to an 8% annual rate. a. For each possible stock price in the following sequence, calculate the expiration date payoffs and profits (net of the initial purchase price) for the following positions: (1) buy one XYZ call option, and (2) short one XYZ call option (assume the call is uncovered): 20, 25, 30, 35, 40, 45, 50, 55, 60 Do not round intermediate calculations. Round your answers to the nearest cent. If your answer is zero, enter "0". Use a minus sign to enter negative values, if any. 1. Buy one XYZ call option. Net Profit Expiration Date Expiration Date Initial Derivative XYZ Stock Price Derivative Premium Payoff $20 $ $ $ $25 $ $ $ $30 $ $ $ $35 $ $ $ $40 $ $ $ $45 $ $ $ $50 $ $ $ $55 $ $ $ $60 $ $ $ The common stock of Company XYZ is currently trading at a price of $40. Both a put and a call option are available for XYZ stock, each having an exercise price of $37 and an expiration date in exactly six months. The current market prices for the put and call are $1.35 and $3.70 respectively. The risk-free holding period return for the next six months is 4%, which corresponds to an 8% annual rate. a. For each possible stock price in the following sequence, calculate the expiration date payoffs and profits (net of the initial purchase price) for the following positions: (1) buy one XYZ call option, and (2) short one XYZ call option (assume the call is uncovered): 20, 25, 30, 35, 40, 45, 50, 55, 60 Do not round intermediate calculations. Round your answers to the nearest cent. If your answer is zero, enter "0". Use a minus sign to enter negative values, if any. 1. Buy one XYZ call option. Net Profit Expiration Date Expiration Date Initial Derivative XYZ Stock Price Derivative Premium Payoff $20 $ $ $ $25 $ $ $ $30 $ $ $ $35 $ $ $ $40 $ $ $ $45 $ $ $ $50 $ $ $ $55 $ $ $ $60 $ $ $