Answered step by step

Verified Expert Solution

Question

1 Approved Answer

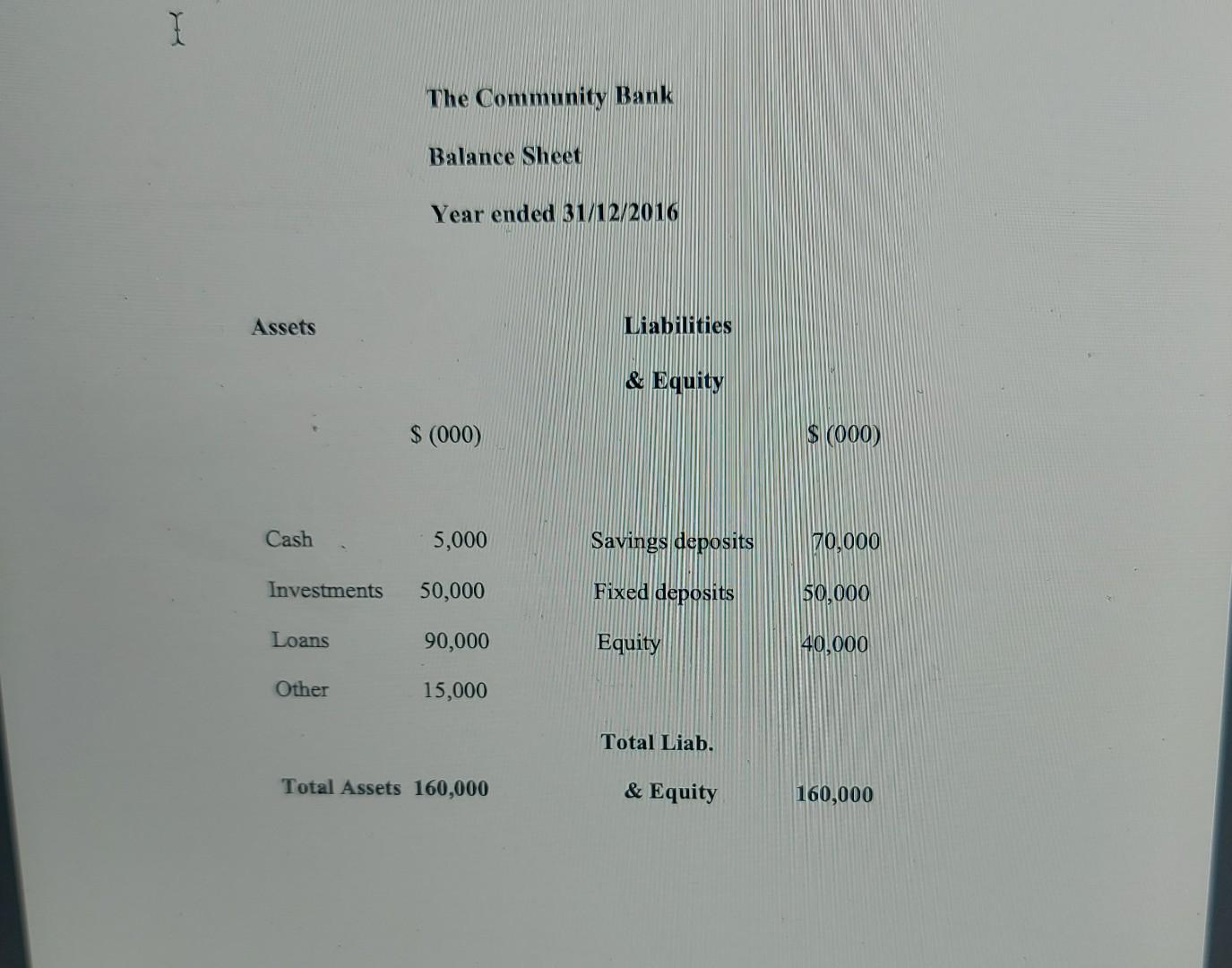

The Community Bank Balance Sheet Year ended 31/12/2016 Assets Liabilities & Equity $(000) Other 15,000 Total Liab. Total Assets 160,000 & Equity 160,000 The Community

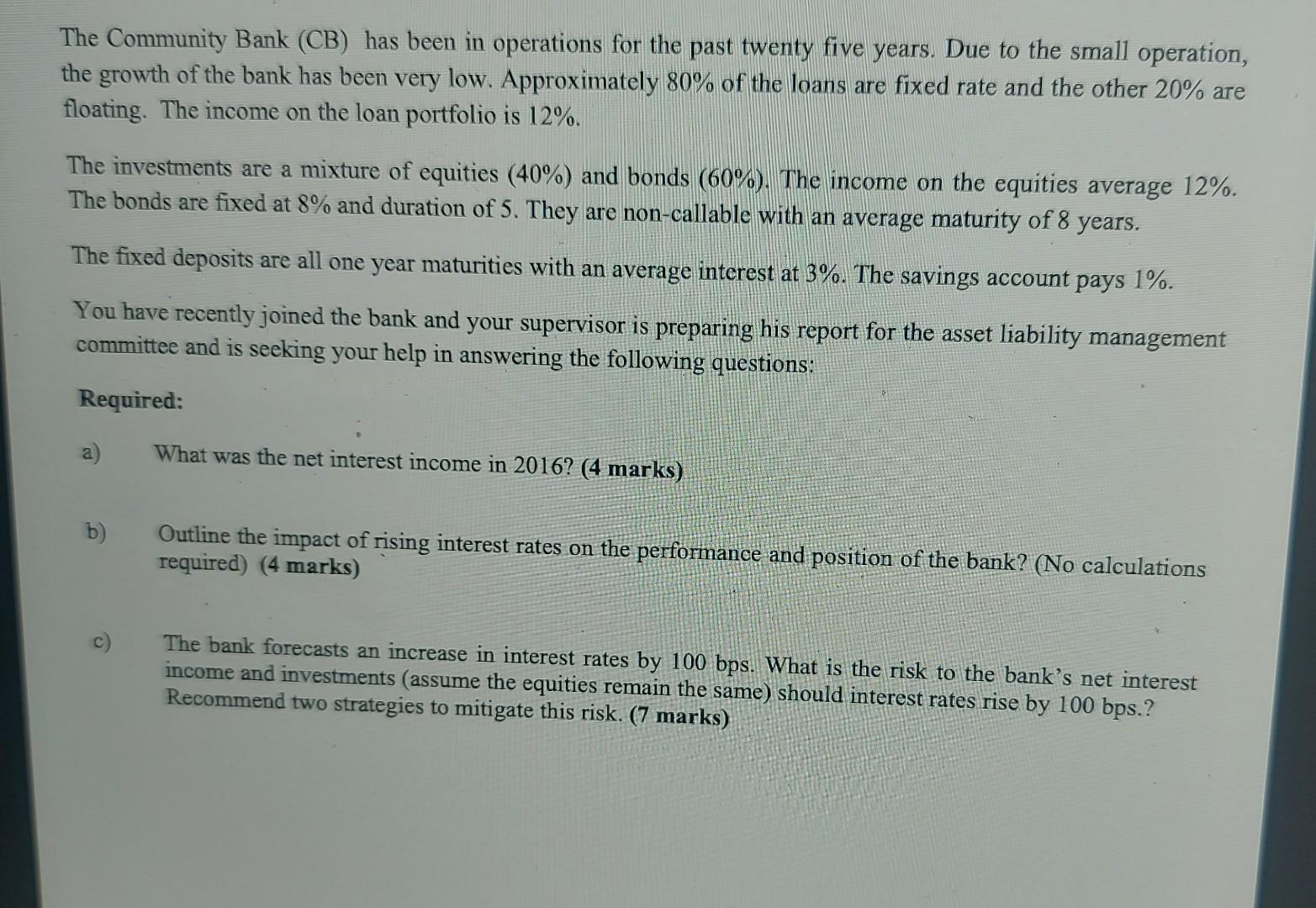

The Community Bank Balance Sheet Year ended 31/12/2016 Assets Liabilities \& Equity $(000) Other 15,000 Total Liab. Total Assets 160,000 \& Equity 160,000 The Community Bank (CB) has been in operations for the past twenty five years. Due to the small operation, the growth of the bank has been very low. Approximately 80% of the loans are fixed rate and the other 20% are floating. The income on the loan portfolio is 12%. The investments are a mixture of equities (40%) and bonds (60%). The income on the equities average 12%. The bonds are fixed at 8% and duration of 5 . They are non-callable with an average maturity of 8 years. The fixed deposits are all one year maturities with an average interest at 3%. The savings account pays 1%. You have recently joined the bank and your supervisor is preparing his report for the asset liability management committee and is seeking your help in answering the following questions: Required: a) What was the net interest income in 2016?(4marks) b) Outline the impact of rising interest rates on the performance and position of the bank? (No calculations c) The bank forecasts an increase in interest rates by 100bps. What is the risk to the bank's net interest Recomme investments (assume the equities remain the same) should interest rates rise by 100 bps

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started