Answered step by step

Verified Expert Solution

Question

1 Approved Answer

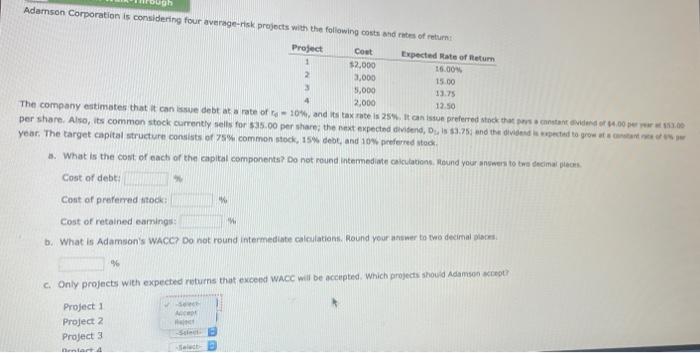

the company Adarnson Corporation is considering four average-risk projects with the following costs and rates of return Project Cost Expected rate of Return 1 $2,000

the company

Adarnson Corporation is considering four average-risk projects with the following costs and rates of return Project Cost Expected rate of Return 1 $2,000 16.00 2 3,000 15.00 3 5,000 13.75 4 2.000 12.50 The company estimates that it can issue debt at a rate of 10% and its tax rates 25. It issur preferred stock that and 64.00 per share. Also, its common stock currently sells for $35.00 per share the next expected dividend, I $3.75 and the dividended to grow year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred to 1. What is the cont of each of the capital components? Do not round intermediate calculations. Round your answers to tredecimal pecats Cost of debt Cost of preferred stocki M Cost of retained earnings b. What is Adamson's WACC? Do not round intermediate calculations, Round your answer to two decimal Only projects with expected returns that excond WACC will be accepted. Which projects should Adamson ! Project Project 2 Project 3 4 Salut

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started