Answered step by step

Verified Expert Solution

Question

1 Approved Answer

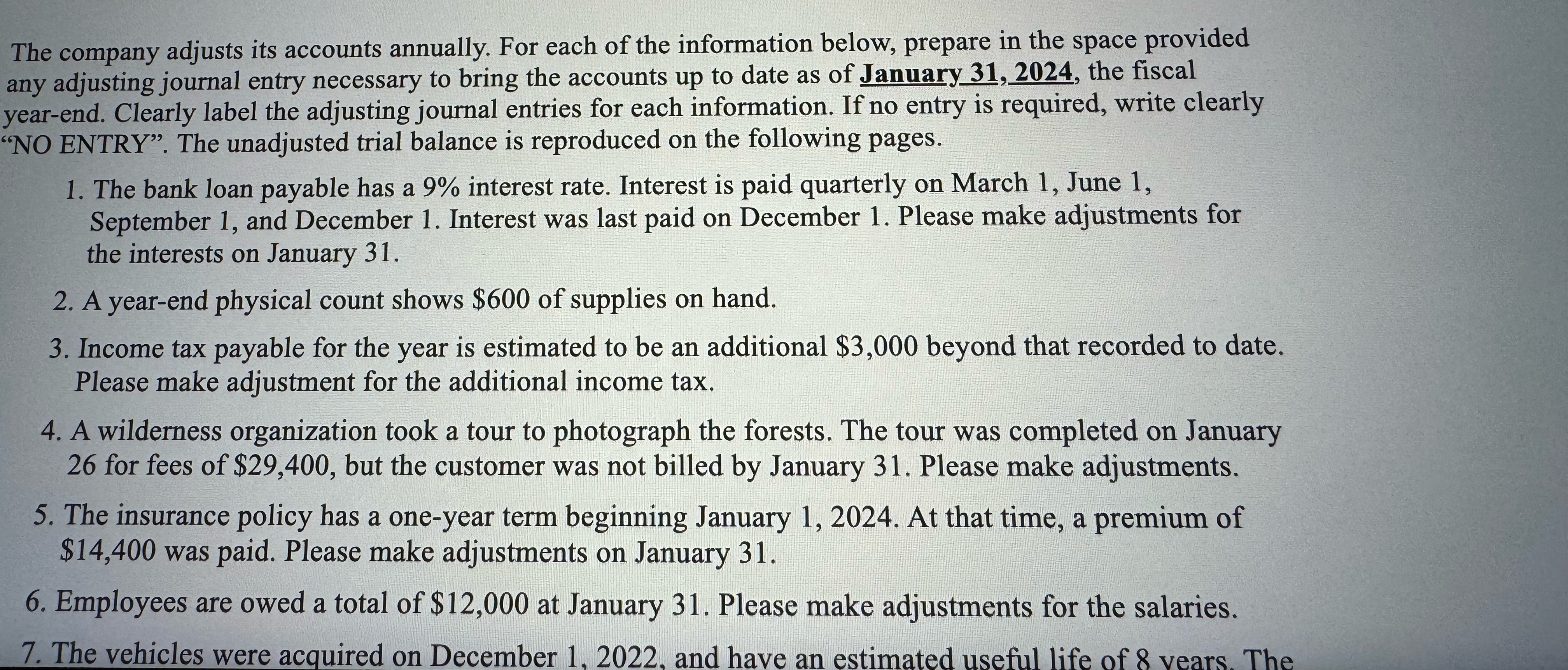

The company adjusts its accounts annually. For each of the information below, prepare in the space provided any adjusting journal entry necessary to bring the

The company adjusts its accounts annually. For each of the information below, prepare in the space provided any adjusting journal entry necessary to bring the accounts up to date as of January the fiscal yearend. Clearly label the adjusting journal entries for each information. If no entry is required, write clearly NO ENTRY". The unadjusted trial balance is reproduced on the following pages.

The bank loan payable has a interest rate. Interest is paid quarterly on March June September and December Interest was last paid on December Please make adjustments for the interests on January

A yearend physical count shows $ of supplies on hand.

Income tax payable for the year is estimated to be an additional $ beyond that recorded to date. Please make adjustment for the additional income tax.

A wilderness organization took a tour to photograph the forests. The tour was completed on January for fees of $ but the customer was not billed by January Please make adjustments.

The insurance policy has a oneyear term beginning January At that time, a premium of $ was paid. Please make adjustments on January

Employees are owed a total of $ at January Please make adjustments for the salaries.

The vehicles were acquired on December and have an estimated useful life of vears. The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started