Question

The company begins operations on January 1, 2020. The company is started by issuing 500,000 shares of common stock for $50,000,000 ($1 Par value stock)

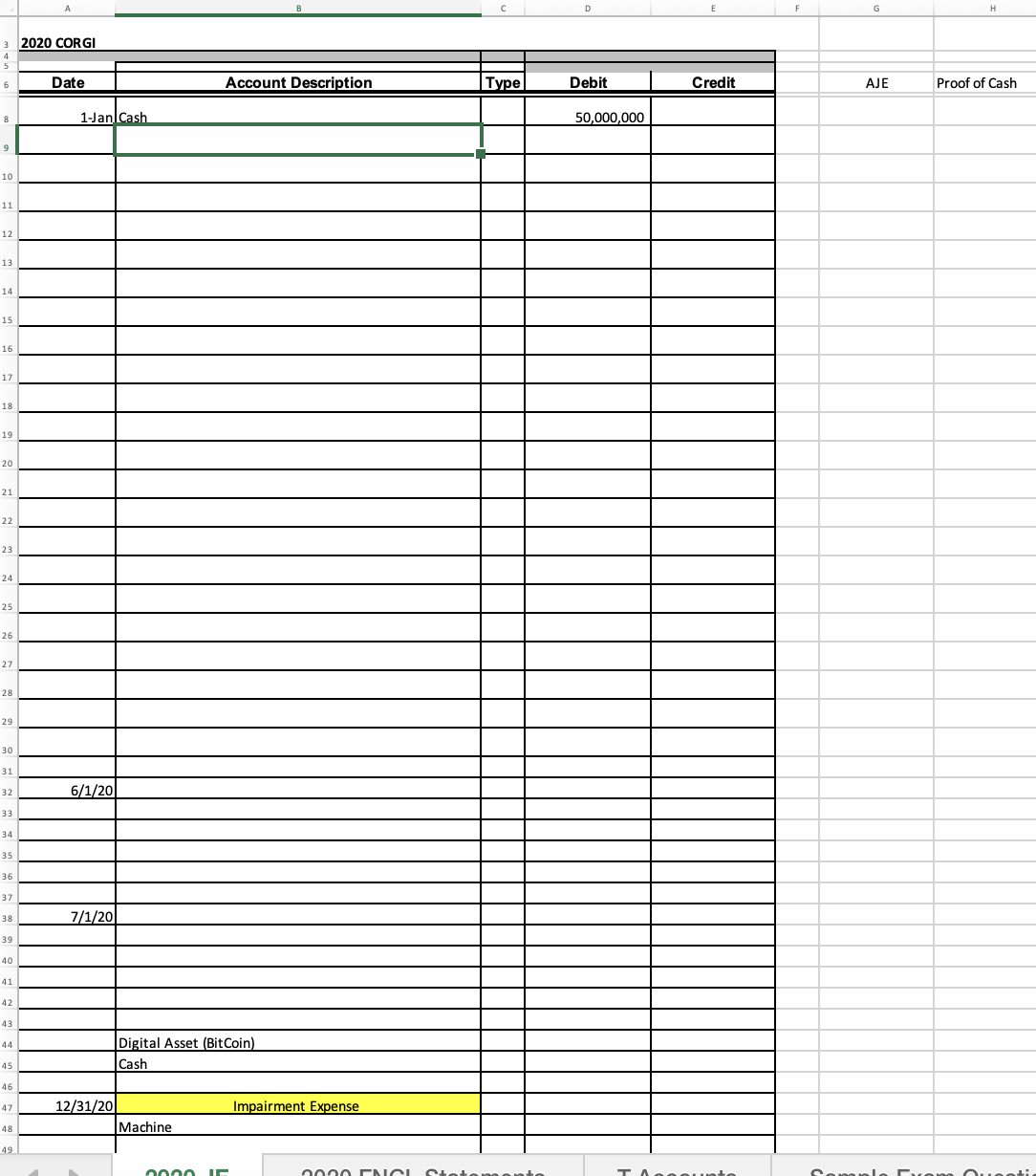

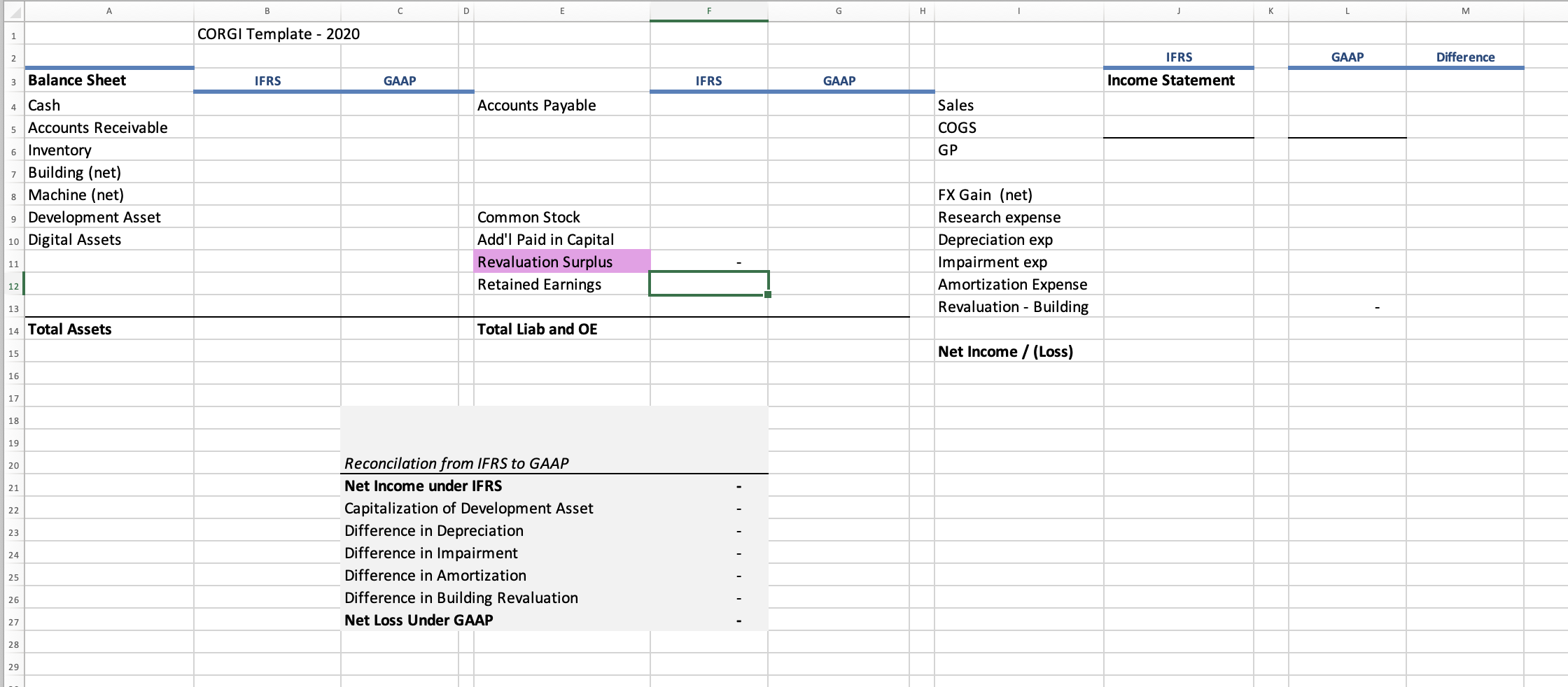

The company begins operations on January 1, 2020. The company is started by issuing 500,000 shares of common stock for $50,000,000 ($1 Par value stock) The company immediately purchases and receives inventory for 800,000 Pesos on credit. The Peso denominated Accounts payable will be due in 2021. The Company sells $300,000 of this inventory on credit to customer #1 for 400,000 Pesos (to be collected in 2021). The Peso spot rate during January is 1.10 Anticipating future purchases to be denominated in Swiss Francs, the company purchases 1 Million Francs when the spot rate was 1.08 On January 1st, the company purchases a small office building (paid in cash) for its own use. The building costs $14,000,000 and has a 28 year estimated life with no salvage value. It is depreciated on a straight-line basis. On January 1st, the company purchases an apartment building (paid in cash) for rent to unrelated third parties. It will be classified as an investment property and accounting for using the fair value method under IAS 40. The building costs $20,000,000 and has a 20-year estimated life with no salvage value. It is depreciated on a straight-line basis. The company purchases a machine for $4,000,000 cash on January 1st and depreciates it over 8 years (depreciation is recorded straight line at year end and there is no salvage value) On June 1, customer #1 pays us 150,000 Pesos of the amount due when the spot rate is 1.09 (adjust AR to fair value before the collection. Assume the company holds the 150,000 pesos through year end) One July 1, $100,000 dollars of research and development expenses are incurred. $60,000 of this amount has not been paid as of yearend (i.e. remains a payable).70 % of these are considered Development Costs to be amortized beginning Immediately over 14 years. On December 1, 2020, the company purchases the following digital assets to diversify the balance sheet: 3,000 Litecoin at $140 each 50 bitcoin at $34,000 each At year 2020 the following values are associated with the Machine: Undiscounted cash flows: $3,000,000 Selling Price: $2,500,000 Selling Costs $25,000 PV of future cash flows $2,750,000 The fair value of the office building at year end is $17,000,000. Corgi uses the revaluation method for this class of asset. The fair value of the Apartment building at year end is $22,000,000. Corgi uses the revaluation method for this class of asset The year end Peso spot rate is 1.12 The year end Franc spot rate is 1.11 At 12/31/20 the market price for Litecoin is $150 per unit and Bitcoin is $31,000 per unit Using a separate Excel Spreadsheet, journalize the transactions and create a Balance Sheet and Income Statement for year-end 2020. For each line item of your journal entries classify the amount as an Asset, Liability, Shareholders Equity, Revenue, COGS, Expense, Gain, or Loss. Also reconcile the income statement from IFRS to US GAAP as well as be able do a side-by-side comparison of GAAP Balance sheet and income statement

The company begins operations on January 1, 2020. The company is started by issuing 500,000 shares of common stock for $50,000,000 ($1 Par value stock) The company immediately purchases and receives inventory for 800,000 Pesos on credit. The Peso denominated Accounts payable will be due in 2021. The Company sells $300,000 of this inventory on credit to customer #1 for 400,000 Pesos (to be collected in 2021). The Peso spot rate during January is 1.10 Anticipating future purchases to be denominated in Swiss Francs, the company purchases 1 Million Francs when the spot rate was 1.08 On January 1st, the company purchases a small office building (paid in cash) for its own use. The building costs $14,000,000 and has a 28 year estimated life with no salvage value. It is depreciated on a straight-line basis. On January 1st, the company purchases an apartment building (paid in cash) for rent to unrelated third parties. It will be classified as an investment property and accounting for using the fair value method under IAS 40. The building costs $20,000,000 and has a 20-year estimated life with no salvage value. It is depreciated on a straight-line basis. The company purchases a machine for $4,000,000 cash on January 1st and depreciates it over 8 years (depreciation is recorded straight line at year end and there is no salvage value) On June 1, customer #1 pays us 150,000 Pesos of the amount due when the spot rate is 1.09 (adjust AR to fair value before the collection. Assume the company holds the 150,000 pesos through year end) One July 1, $100,000 dollars of research and development expenses are incurred. $60,000 of this amount has not been paid as of yearend (i.e. remains a payable).70 % of these are considered Development Costs to be amortized beginning Immediately over 14 years. On December 1, 2020, the company purchases the following digital assets to diversify the balance sheet: 3,000 Litecoin at $140 each 50 bitcoin at $34,000 each At year 2020 the following values are associated with the Machine: Undiscounted cash flows: $3,000,000 Selling Price: $2,500,000 Selling Costs $25,000 PV of future cash flows $2,750,000 The fair value of the office building at year end is $17,000,000. Corgi uses the revaluation method for this class of asset. The fair value of the Apartment building at year end is $22,000,000. Corgi uses the revaluation method for this class of asset The year end Peso spot rate is 1.12 The year end Franc spot rate is 1.11 At 12/31/20 the market price for Litecoin is $150 per unit and Bitcoin is $31,000 per unit Using a separate Excel Spreadsheet, journalize the transactions and create a Balance Sheet and Income Statement for year-end 2020. For each line item of your journal entries classify the amount as an Asset, Liability, Shareholders Equity, Revenue, COGS, Expense, Gain, or Loss. Also reconcile the income statement from IFRS to US GAAP as well as be able do a side-by-side comparison of GAAP Balance sheet and income statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started