Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company believes that given the level of risk of this project, the WACC method is the appropriate approach to valuing the project. The company's

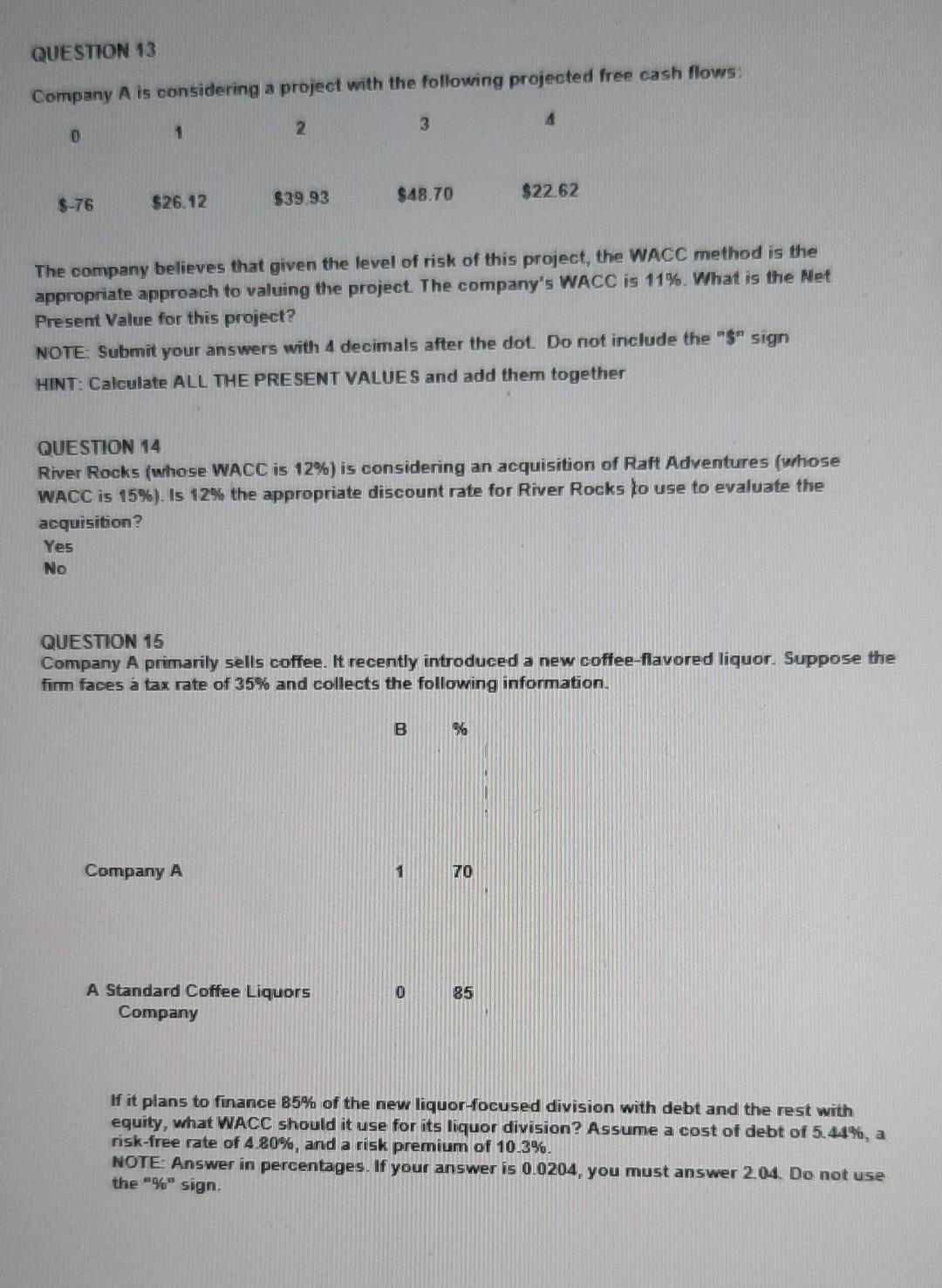

The company believes that given the level of risk of this project, the WACC method is the appropriate approach to valuing the project. The company's WACC is 11%. What is the Net Present Value for this project? NOTE: Submit your answers with 4 decimals after the dot. Do not include the "g" sign HINT: Calculate ALL THE PRESENT VALUES and add them together QUESTION 14 River Rocks (whose WACC is 12% ) is considering an acquisition of Raft Adventures (whose WACC is 15% ). Is 12% the appropriate discount rate for River Rocks to use to evaluate the aequisition? Yes No QUESTION 15 Company A primarily sells coffee. It recently introduced a new coffee-flavored liquor. Suppose the firm faces a tax rate of 35% and collects the following information. If it plans to finance 85% of the new liquor-focused division with debt and the rest with equity, what WACC should it use for its liquor division? Assume a cost of debt of 5.44%, a risk-free rate of 4.80%, and a risk premium of 10.3%. NOTE: Answer in percentages. If your answer is 0.0204, you must answer 2.04. Do not use the " 9% " sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started