Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company bought Nimbus 2015 five years ago for 250,000 and depreciated it to 0 over 10 years by straight-line depreciation. Today, its market value

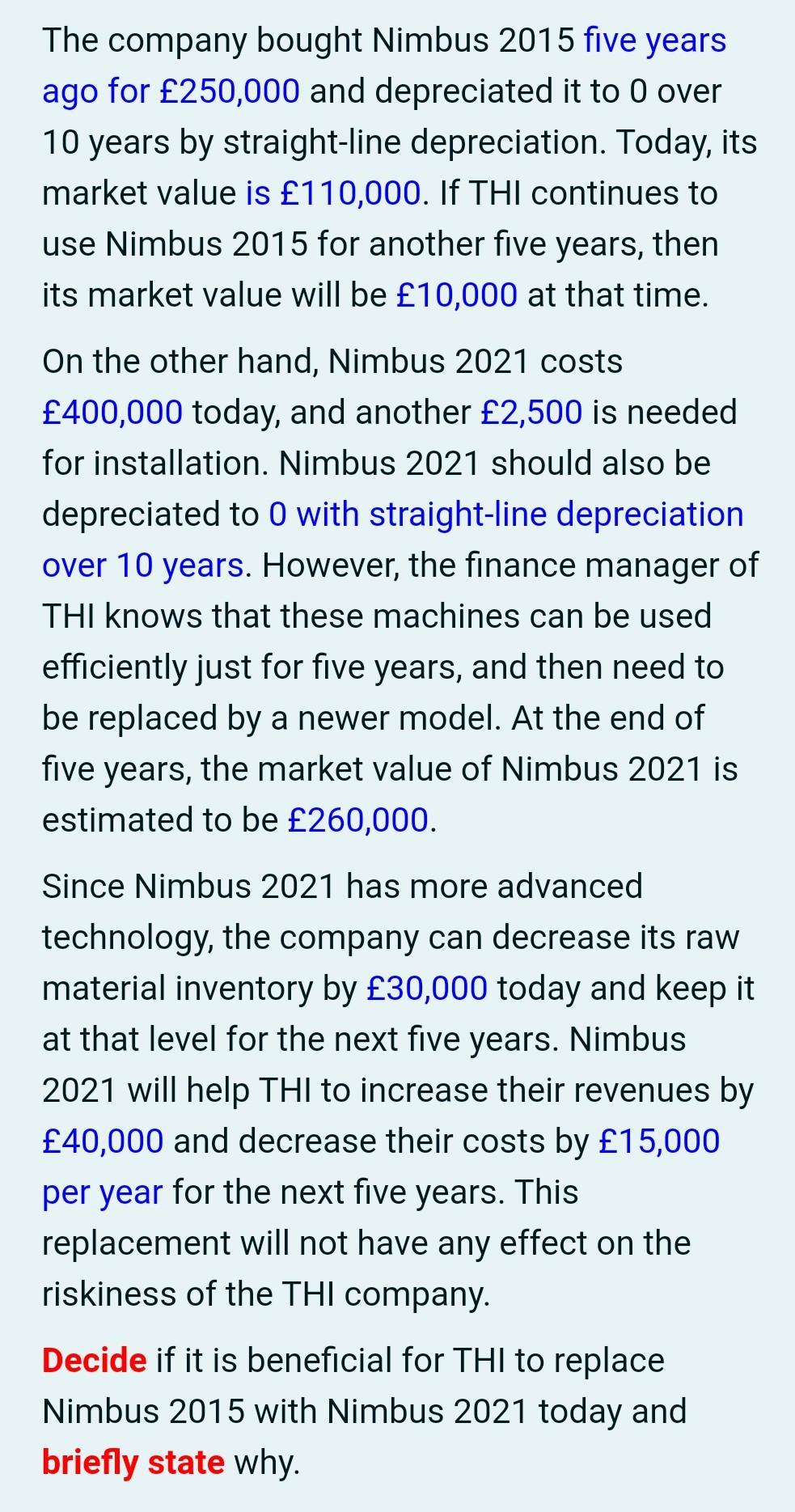

The company bought Nimbus 2015 five years ago for 250,000 and depreciated it to 0 over 10 years by straight-line depreciation. Today, its market value is 110,000. If THI continues to use Nimbus 2015 for another five years, then its market value will be 10,000 at that time. On the other hand, Nimbus 2021 costs 400,000 today, and another 2,500 is needed for installation. Nimbus 2021 should also be depreciated to O with straight-line depreciation over 10 years. However, the finance manager of THI knows that these machines can be used efficiently just for five years, and then need to be replaced by a newer model. At the end of five years, the market value of Nimbus 2021 is estimated to be 260,000. Since Nimbus 2021 has more advanced technology, the company can decrease its raw material inventory by 30,000 today and keep it at that level for the next five years. Nimbus 2021 will help THI to increase their revenues by 40,000 and decrease their costs by 15,000 per year for the next five years. This replacement will not have any effect on the riskiness of the THI company. Decide if it is beneficial for THI to replace Nimbus 2015 with Nimbus 2021 today and briefly state why. The company bought Nimbus 2015 five years ago for 250,000 and depreciated it to 0 over 10 years by straight-line depreciation. Today, its market value is 110,000. If THI continues to use Nimbus 2015 for another five years, then its market value will be 10,000 at that time. On the other hand, Nimbus 2021 costs 400,000 today, and another 2,500 is needed for installation. Nimbus 2021 should also be depreciated to O with straight-line depreciation over 10 years. However, the finance manager of THI knows that these machines can be used efficiently just for five years, and then need to be replaced by a newer model. At the end of five years, the market value of Nimbus 2021 is estimated to be 260,000. Since Nimbus 2021 has more advanced technology, the company can decrease its raw material inventory by 30,000 today and keep it at that level for the next five years. Nimbus 2021 will help THI to increase their revenues by 40,000 and decrease their costs by 15,000 per year for the next five years. This replacement will not have any effect on the riskiness of the THI company. Decide if it is beneficial for THI to replace Nimbus 2015 with Nimbus 2021 today and briefly state why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started