Answered step by step

Verified Expert Solution

Question

1 Approved Answer

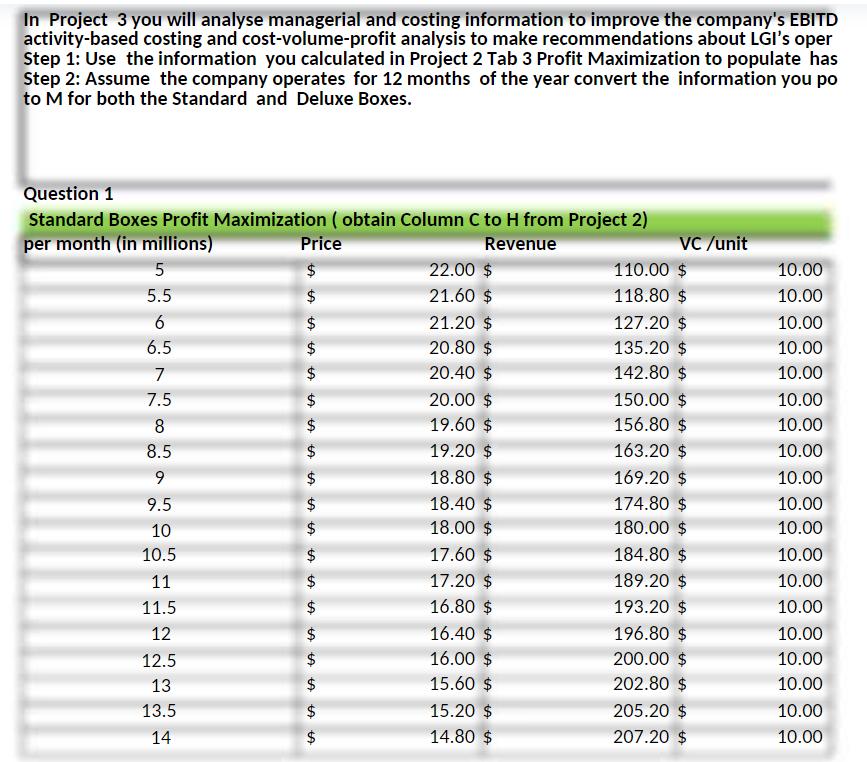

In Project 3 you will analyse managerial and costing information to improve the company's EBITD activity-based costing and cost-volume-profit analysis to make recommendations about

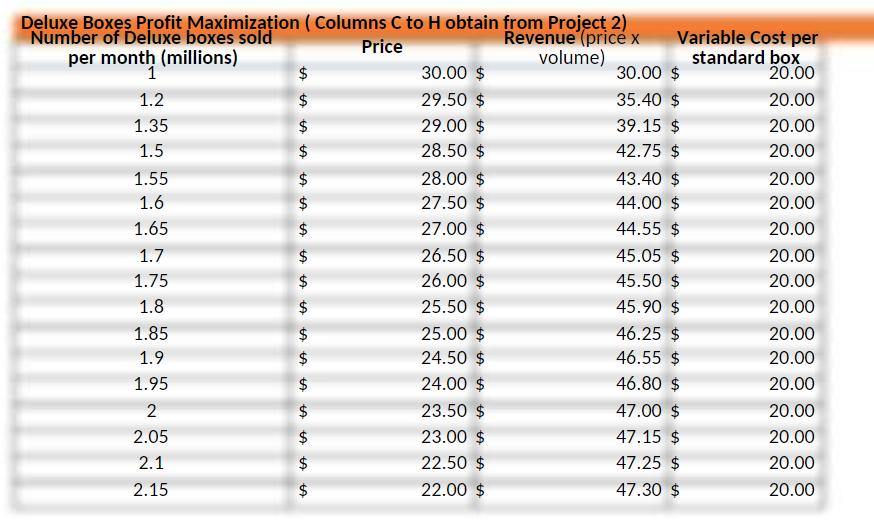

In Project 3 you will analyse managerial and costing information to improve the company's EBITD activity-based costing and cost-volume-profit analysis to make recommendations about LGI's oper Step 1: Use the information you calculated in Project 2 Tab 3 Profit Maximization to populate has Step 2: Assume the company operates for 12 months of the year convert the information you po to M for both the Standard and Deluxe Boxes. Question 1 Standard Boxes Profit Maximization (obtain Column C to H from Project 2) per month (in millions) Revenue 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12 12.5 13 13.5 14 Price LA LA LA LA LA LA LA LA LA LA LA LA LA LA LA LA LA LA LA $ $ $ $ $ 22.00 $ 21.60 $ 21.20 $ 20.80 $ 20.40 $ 20.00 $ 19.60 $ 19.20 $ 18.80 $ 18.40 $ 18.00 $ 17.60 $ 17.20 $ 16.80 $ 16.40 $ 16.00 $ 15.60 $ 15.20 $ 14.80 $ VC /unit 110.00 $ 118.80 $ 127.20 $ 135.20 $ 142.80 $ 150.00 $ 156.80 $ 163.20 $ 169.20 $ 174.80 $ 180.00 $ 184.80 $ 189.20 $ 193.20 $ 196.80 $ 200.00 $ 202.80 $ 205.20 $ 207.20 $ 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 Deluxe Boxes Profit Maximization Number of Deluxe boxes sold per month (millions) 1 1.2 1.35 1.5 1.55 1.6 1.65 1.7 1.75 1.8 1.85 1.9 1.95 2 2.05 2.1 2.15 (Columns C to H obtain from Project 2) Revenue (price x Price volume) LA $ $ LA LA LA LA LA $ $ LA LA LA LA LA LA LA LA LA LA $ 30.00 $ 29.50 $ 29.00 $ 28.50 $ 28.00 $ 27.50 $ 27.00 $ 26.50 $ 26.00 $ 25.50 $ 25.00 $ 24.50 $ 24.00 $ 23.50 $ 23.00 $ 22.50 $ 22.00 $ Variable Cost per standard box 30.00 $ 35.40 $ 39.15 $ 42.75 $ 43.40 $ 44.00 $ 44.55 $ 45.05 $ 45.50 $ 45.90 $ 46.25 $ 46.55 $ 46.80 $ 47.00 $ 47.15 $ 47.25 $ 47.30 $ 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 20.00 2.2 2.25 Millions) (millions) Revenue Subtract: Variable Costs LA LA Equals: Contribution Margin Subtract: Fixed Costs Equals: Profit Question 2 The Company currently operates by selling 9 Million Standard Boxes and 1.5 Million Deluxe Boxes The CEO is convinced that under the current cost allocation which allocates fixed costs on a lump s allocation basis), Deluxe boxes is not contributing much to company profit and with recent threa should consider to no longer produce Deluxe Boxes. Required (place answers in the in the Grey Spaces provided) 1) Calculate how much profit each product makes? 2) Calculate the Profit percentage (based on sales) for each product. HINT Use the annual information calculated in Question 1 to complete Question 2 Contribution Margin Ratio % Profit % (based on revenue) LA LA 21.50 21.00 LA LA LA Standard Boxes $ $ 9 108 $ (in millions) 47.30 $ 47.25 $ 2,030.40 $ 1,080.00 $ 950.40 $ 120.00 $ 830.40 $ 46.81% 40.90% Deluxe Boxes 1,5 18 $ (in millions) 513.00 $ 360.00 $ 153.00 $ 36.00 $ 117.00 $ 29.82% 22.81% 20.00 20.00 Total 10.5 126 $ (in millions) 2,543.40 1,440.00 1,103.40 156.00 947.40 43.38% 37%

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started