Answered step by step

Verified Expert Solution

Question

1 Approved Answer

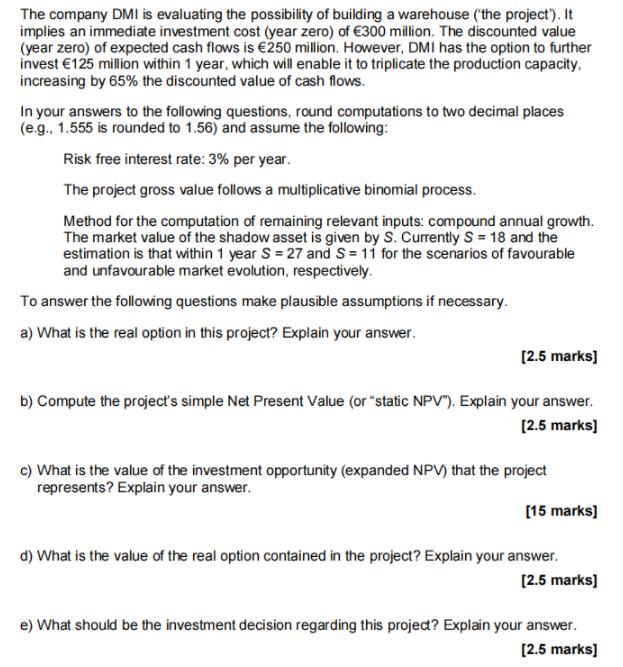

The company DMI is evaluating the possibility of building a warehouse ('the project'). It implies an immediate investment cost (year zero) of 300 million.

The company DMI is evaluating the possibility of building a warehouse ('the project'). It implies an immediate investment cost (year zero) of 300 million. The discounted value (year zero) of expected cash flows is 250 million. However, DMI has the option to further invest 125 million within 1 year, which will enable it to triplicate the production capacity. increasing by 65% the discounted value of cash flows. In your answers to the following questions, round computations to two decimal places (e.g., 1.555 is rounded to 1.56) and assume the following: Risk free interest rate: 3% per year. The project gross value follows a multiplicative binomial process. Method for the computation of remaining relevant inputs: compound annual growth. The market value of the shadow asset is given by S. Currently S = 18 and the estimation is that within 1 year S = 27 and S= 11 for the scenarios of favourable and unfavourable market evolution, respectively. To answer the following questions make plausible assumptions if necessary. a) What is the real option in this project? Explain your answer. [2.5 marks] b) Compute the project's simple Net Present Value (or "static NPV"). Explain your answer. [2.5 marks] c) What is the value of the investment opportunity (expanded NPV) that the project represents? Explain your answer. [15 marks] d) What is the value of the real option contained in the project? Explain your answer. [2.5 marks] e) What should be the investment decision regarding this project? Explain your answer. [2.5 marks]

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The real option in this project is to further invest E125 million within 1 year which will enable it to triplicate the production capacity increasin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started