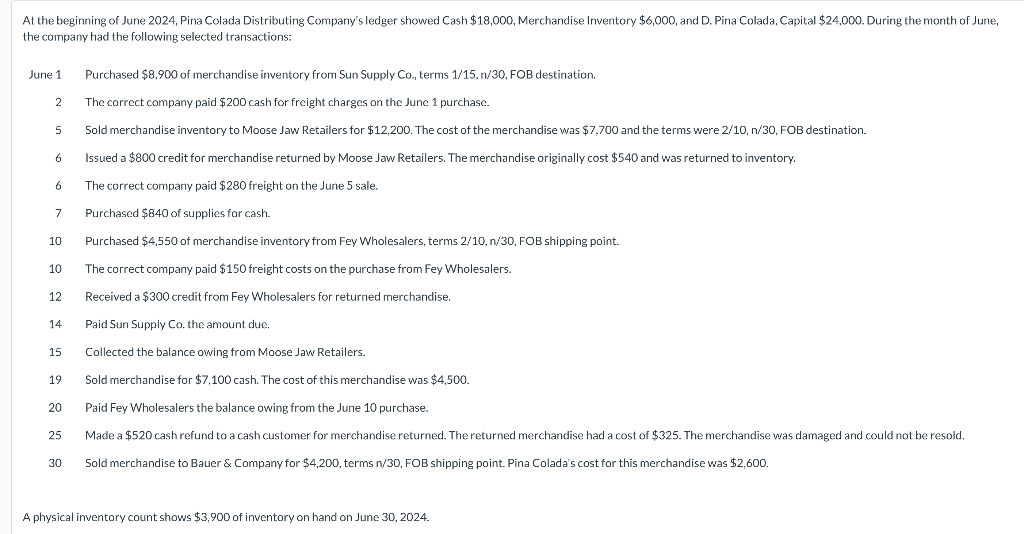

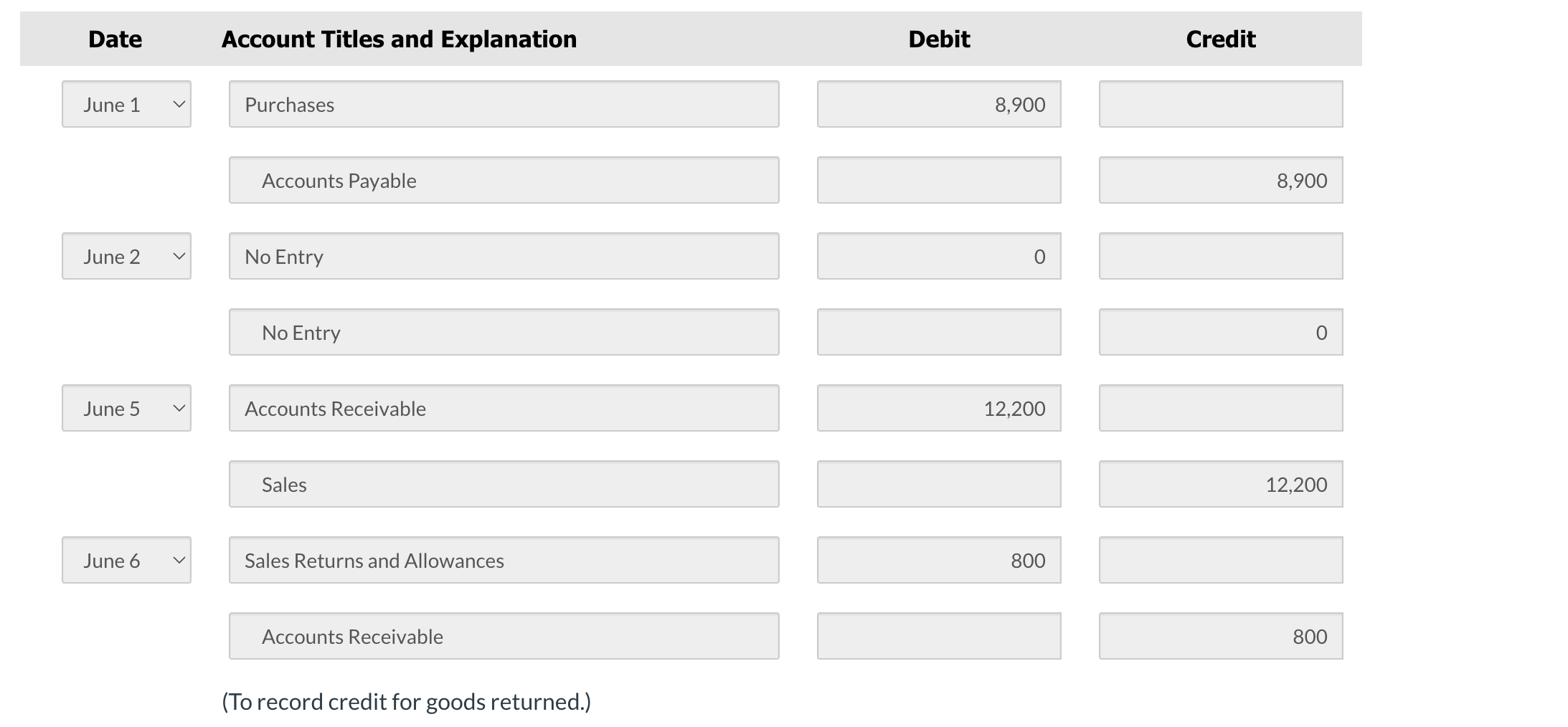

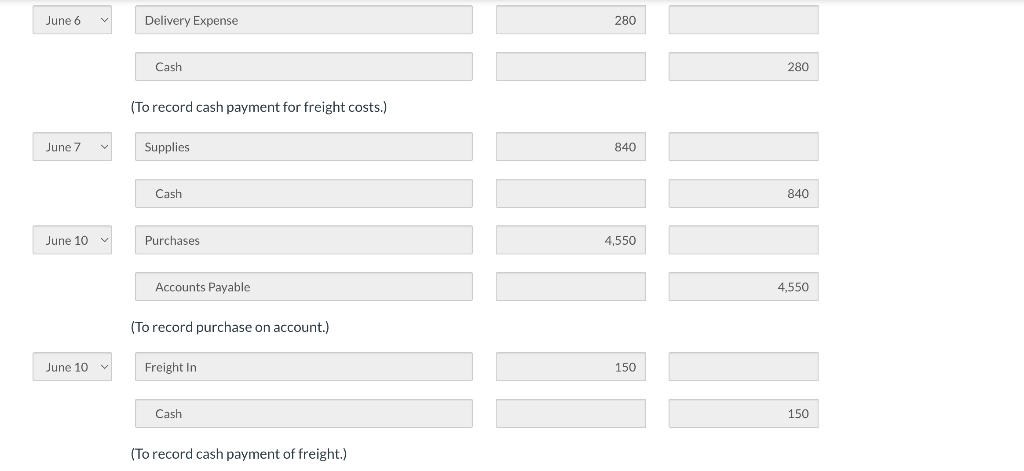

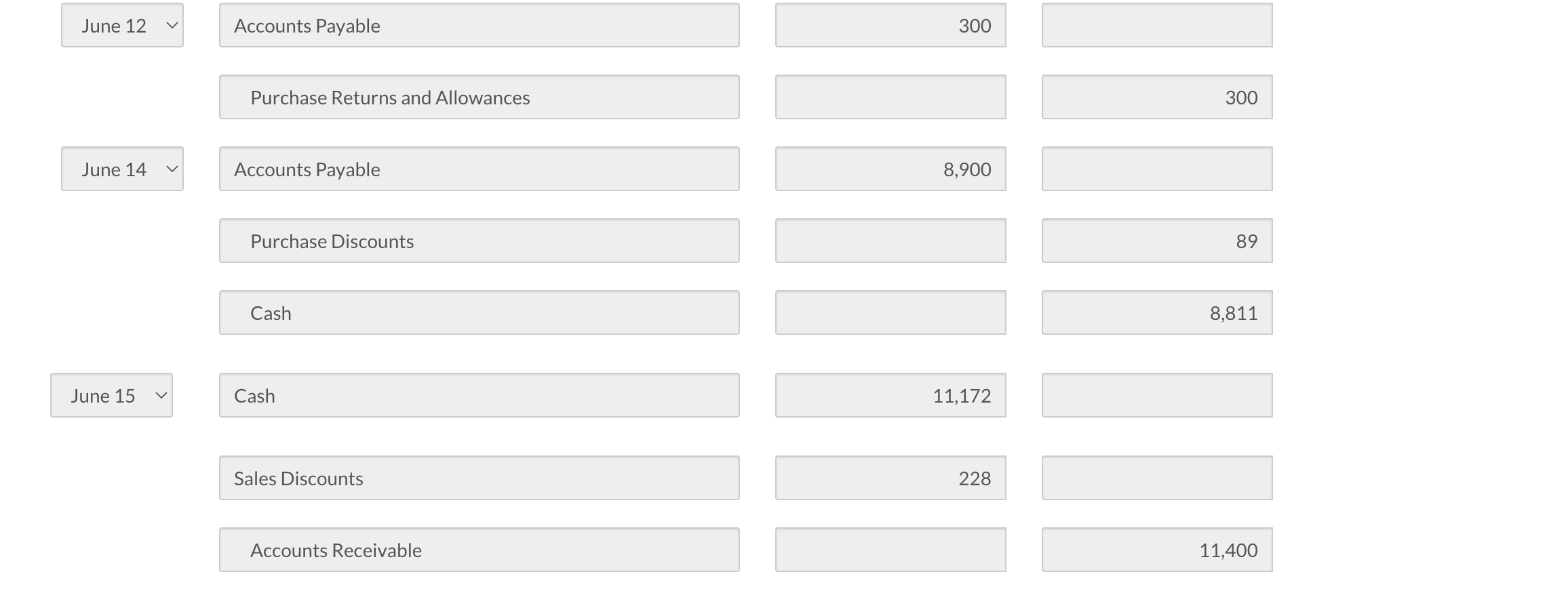

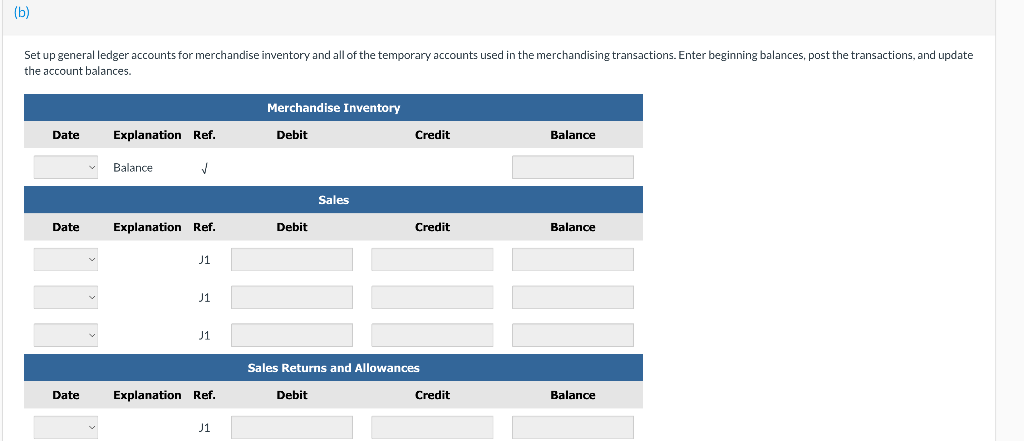

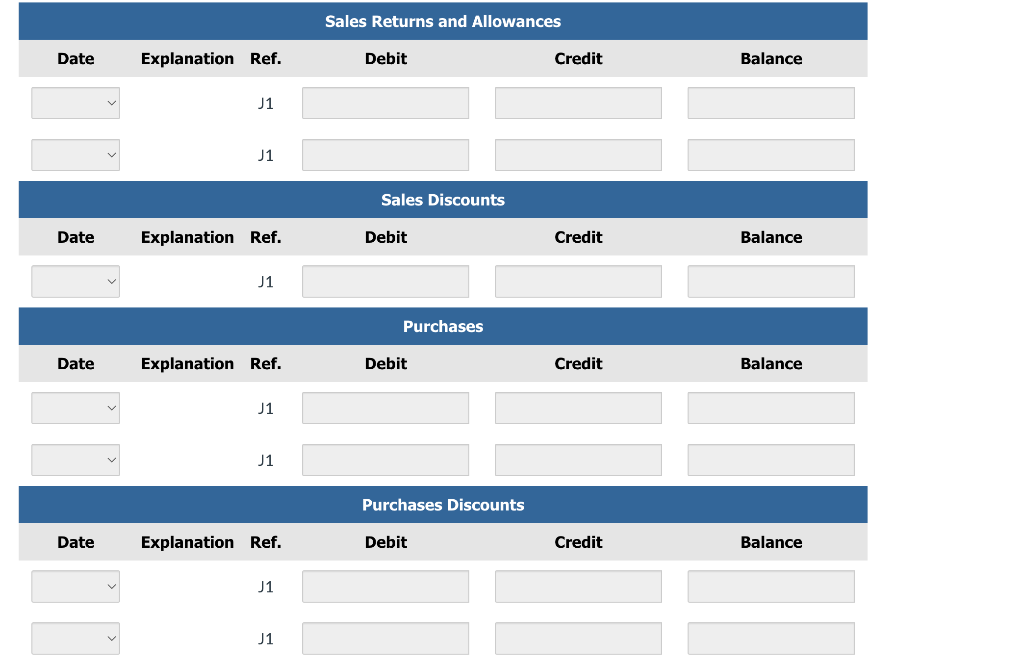

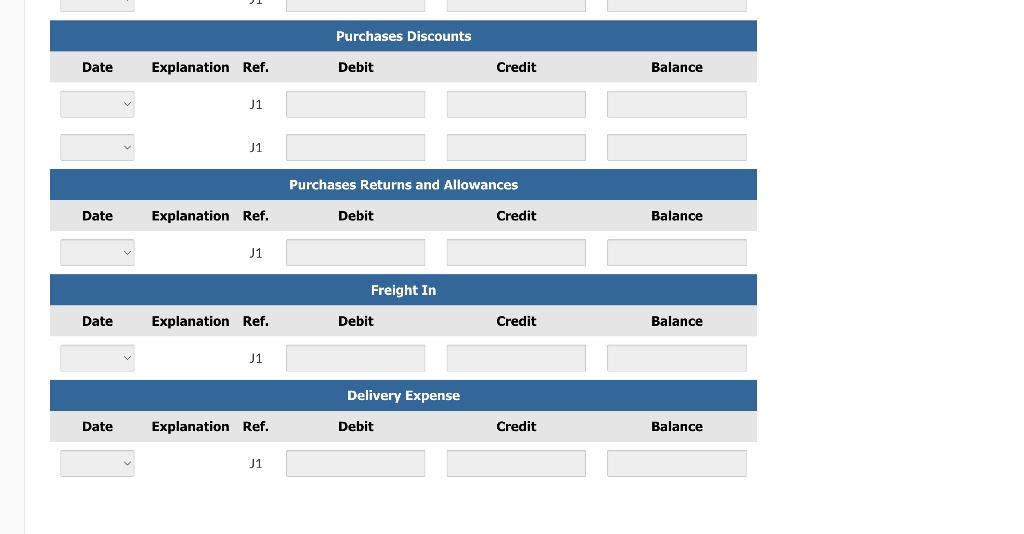

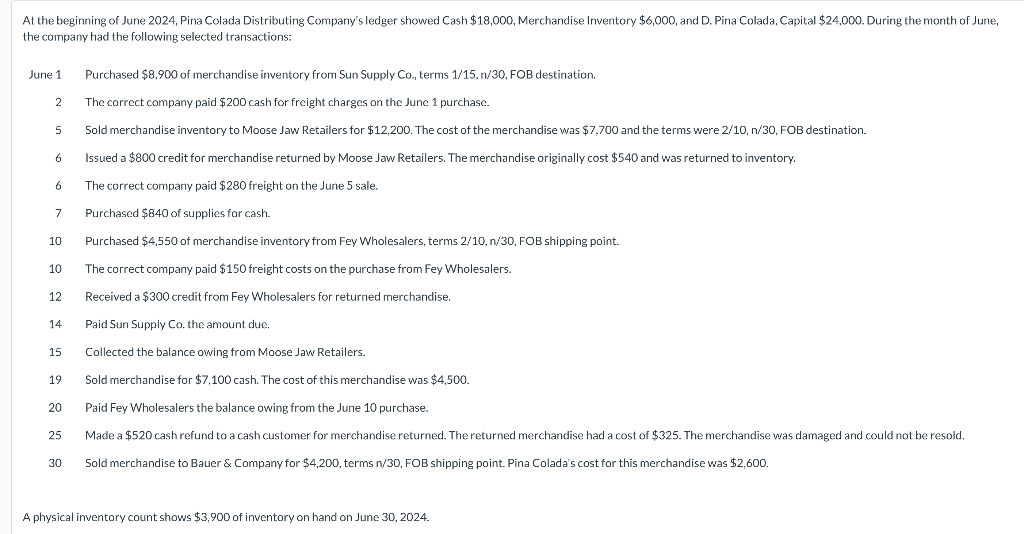

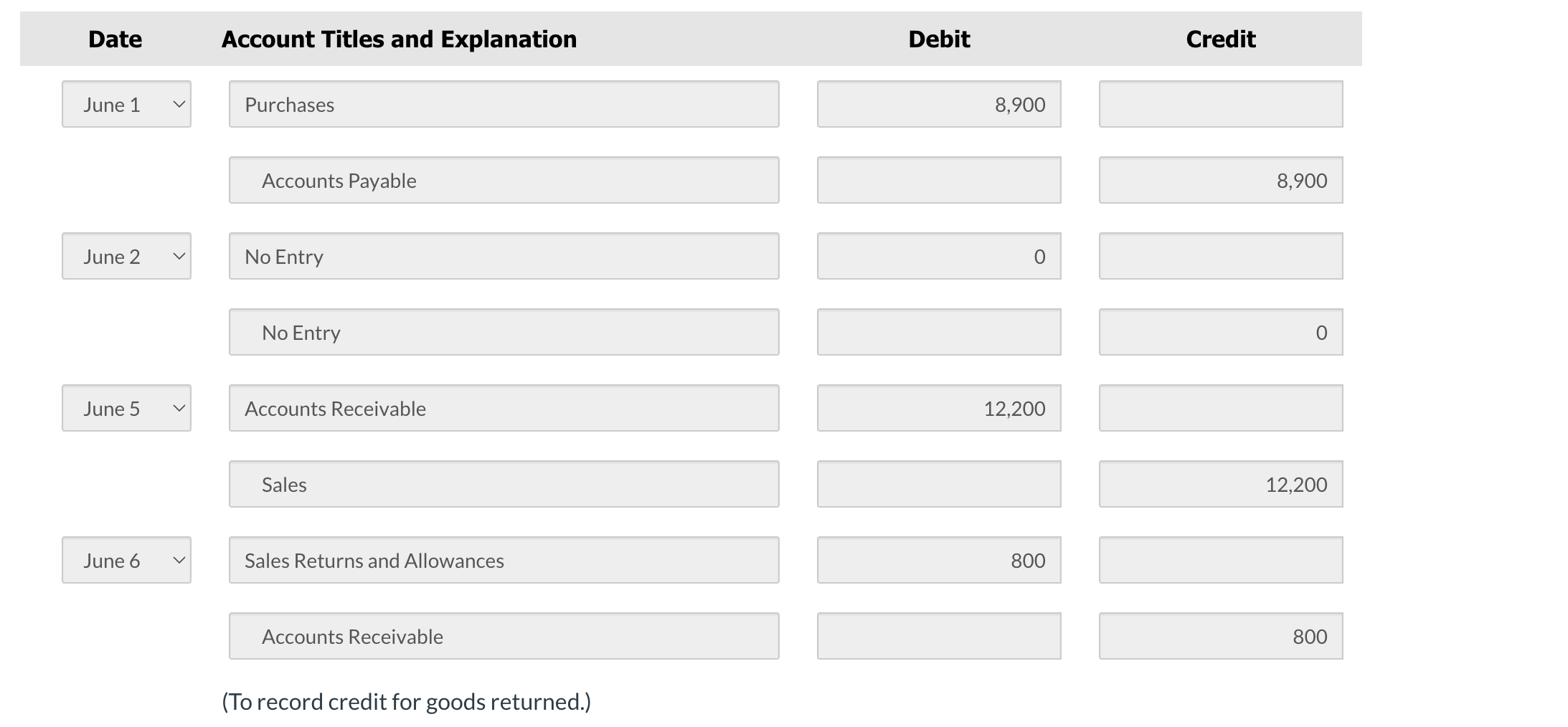

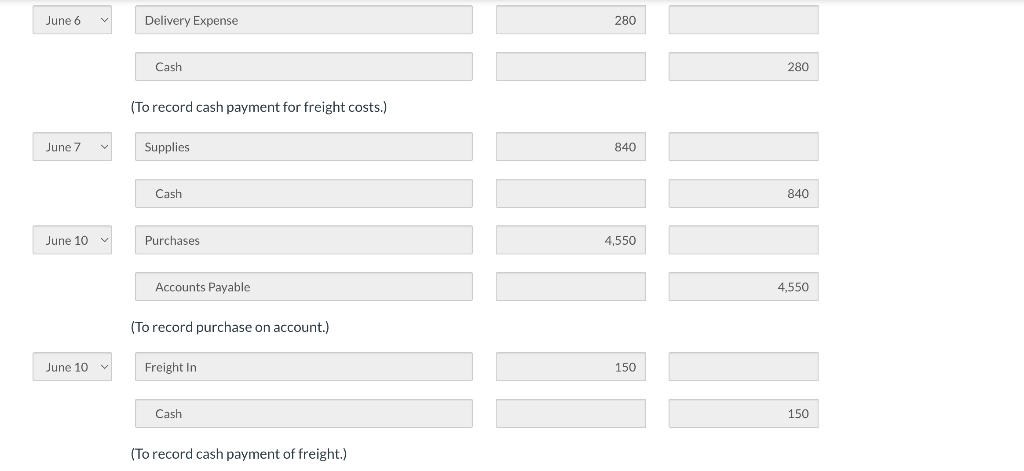

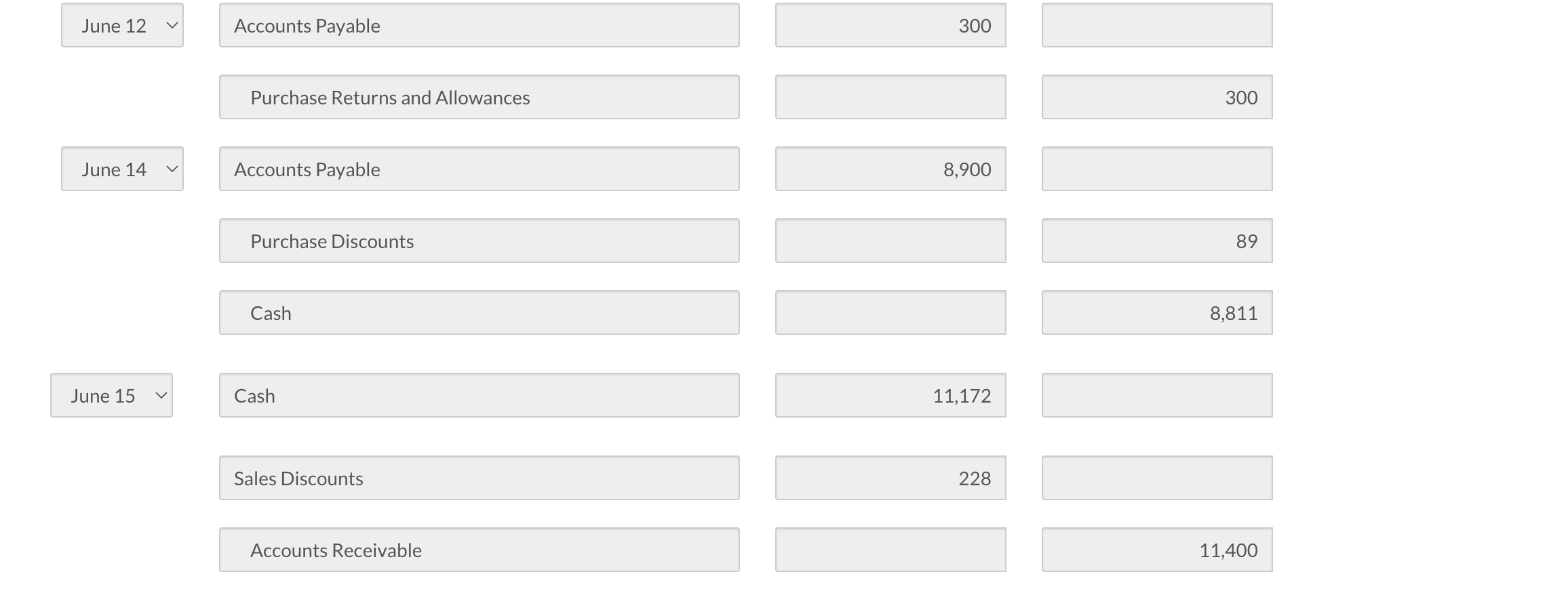

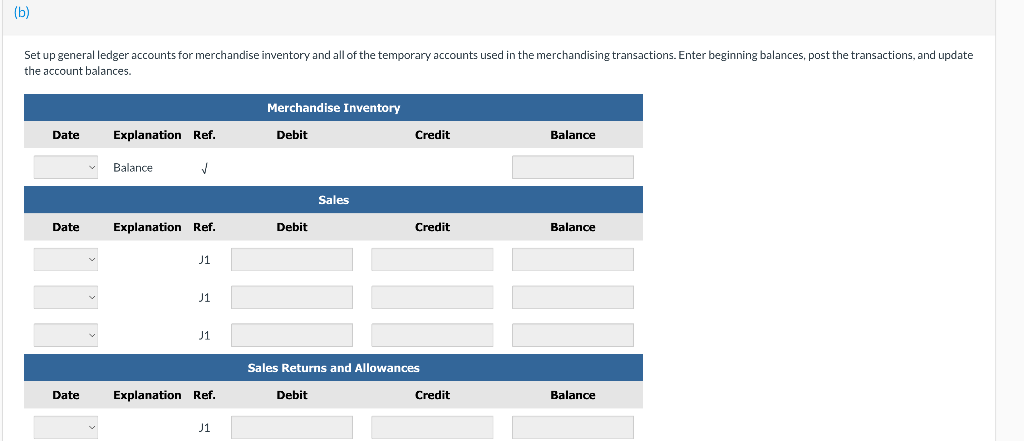

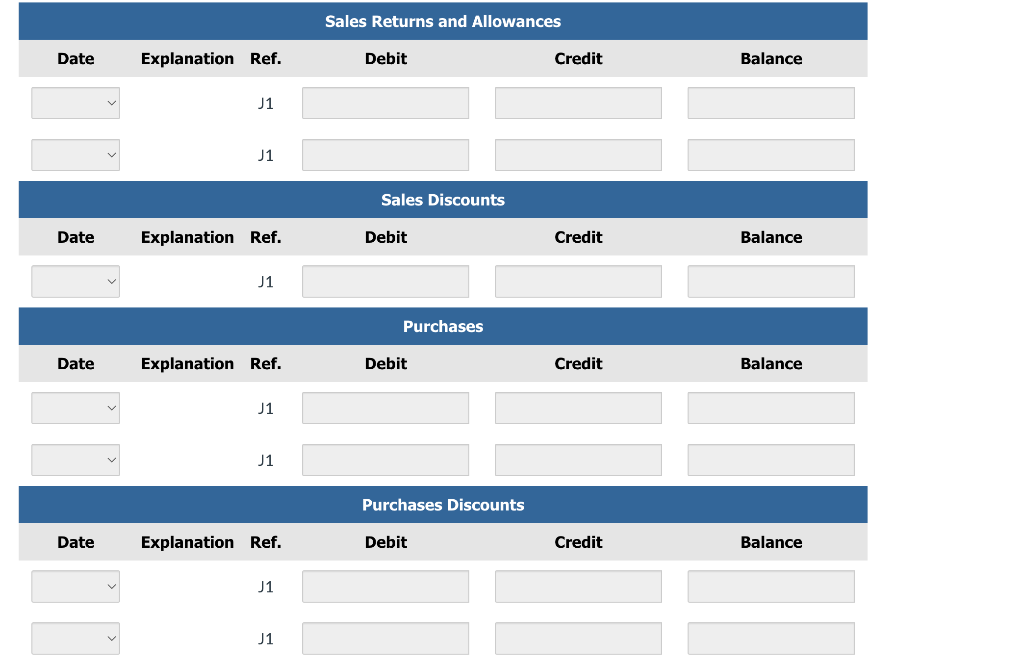

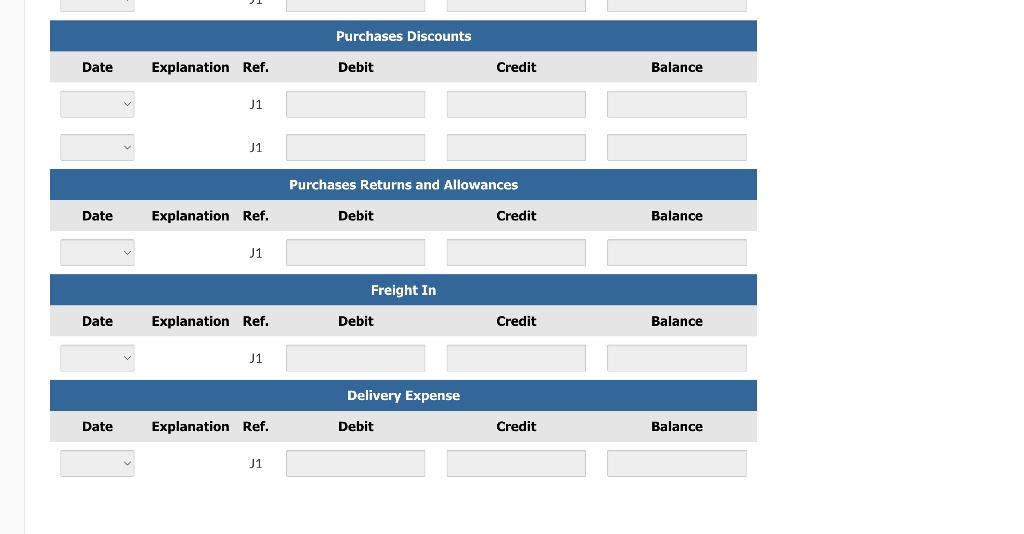

the company had the following selected transactions: June 1 Purchased $8,900 of merchandise inventory from Sun Supply Co1 terms 1/15,n/30,FOB destination. 2 The correct company paid $200 cash for freight charges on the June 1 purchase. 5 Sold merchandise inventory to Moose Jaw Retailers for $12,200. The cost of the merchandise was $7,700 and the terms were 2/10, n/30, FOB destination. 6 Issued a $800 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $540 and was returned to inventory. 6 The correct company paid $280 freight on the June 5 sale. 7 Purchased $840 of supplies for cash. 10 Purchased $4,550 of merchandise inventory from Fey Wholesalers, terms 2/10, n/30, FOB shipping point. 10 The correct company paid $150 freight costs on the purchase from Fey Wholesalers. 12 Received a $300 credit from Fey Wholesalers for returned merchandise. 14 Paid Sun Supply Co. the amount due. 15 Collected the balance owing from Moose Jaw Retailers. 19 Sold merchandise for $7,100 cash. The cost of this merchandise was $4,500. 20 Paid Fey Wholesalers the balance owing from the June 10 purchase. 30 Sold merchandise to Bauer \& Company for $4,200, terms n/30, FOB shipping point. Pina Colada's cost for this merchandise was $2,600. A physical inventory count shows $3,900 of inventory on hand on June 30,2024 . Accounts Payable No Entry Sales 12,200 June 6v Sales Returns and Allowances Accounts Receivable (To record credit for goods returned.) \begin{tabular}{|l|l|} \hline June 6 Delivery Expense \\ Cash \end{tabular} (To record cash payment for freight costs.) \begin{tabular}{|l|l|} \hline June 7 & Supplies \\ Cash \\ June 10 & Purchases \\ & Accounts Payable \\ & \end{tabular} 4,550 (To record purchase on account.) (To record cash payment of freight.) \begin{tabular}{|l|l|} \hline June 12 & Accounts Payable \\ Purchase Returns and Allowances \\ June 14 Accounts Payable \\ & Purchase Discounts \\ & Cash \end{tabular} 300 June 15 Cash 11,172 Sales Discounts 228 Accounts Receivable June 19 Cash 7,100 \begin{tabular}{|} \hline 4,250 \\ \hline \\ \hline \\ \hline \end{tabular} the account balances. \begin{tabular}{|cccc|} \hline & & Sales Returns and Allowances \\ \hline Date Explanation Ref. & Debit \\ \hline & & 1 & \\ \hline \end{tabular} \begin{tabular}{|ccccc|} \hline & & \multicolumn{2}{c}{ Purchases Returns and Allowances } \\ \hline Date Explanation & Ref. & Debit & Credit \\ \hline\( \hdashline \) & & J1 & \\ \hline \end{tabular} \begin{tabular}{|ccccc|} \hline & & \multicolumn{2}{c|}{ Freight In } \\ \hline Date Explanation & Ref. & Debit & Credit \\ \hline & & J1 & \\ \hline \end{tabular} \begin{tabular}{|ccccc|} \hline & & \multicolumn{1}{c}{ Delivery Expense } \\ \hline Date Explanation & Ref. & Debit & Credit \\ \hline & & & \\ \hline \end{tabular} the company had the following selected transactions: June 1 Purchased $8,900 of merchandise inventory from Sun Supply Co1 terms 1/15,n/30,FOB destination. 2 The correct company paid $200 cash for freight charges on the June 1 purchase. 5 Sold merchandise inventory to Moose Jaw Retailers for $12,200. The cost of the merchandise was $7,700 and the terms were 2/10, n/30, FOB destination. 6 Issued a $800 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $540 and was returned to inventory. 6 The correct company paid $280 freight on the June 5 sale. 7 Purchased $840 of supplies for cash. 10 Purchased $4,550 of merchandise inventory from Fey Wholesalers, terms 2/10, n/30, FOB shipping point. 10 The correct company paid $150 freight costs on the purchase from Fey Wholesalers. 12 Received a $300 credit from Fey Wholesalers for returned merchandise. 14 Paid Sun Supply Co. the amount due. 15 Collected the balance owing from Moose Jaw Retailers. 19 Sold merchandise for $7,100 cash. The cost of this merchandise was $4,500. 20 Paid Fey Wholesalers the balance owing from the June 10 purchase. 30 Sold merchandise to Bauer \& Company for $4,200, terms n/30, FOB shipping point. Pina Colada's cost for this merchandise was $2,600. A physical inventory count shows $3,900 of inventory on hand on June 30,2024 . Accounts Payable No Entry Sales 12,200 June 6v Sales Returns and Allowances Accounts Receivable (To record credit for goods returned.) \begin{tabular}{|l|l|} \hline June 6 Delivery Expense \\ Cash \end{tabular} (To record cash payment for freight costs.) \begin{tabular}{|l|l|} \hline June 7 & Supplies \\ Cash \\ June 10 & Purchases \\ & Accounts Payable \\ & \end{tabular} 4,550 (To record purchase on account.) (To record cash payment of freight.) \begin{tabular}{|l|l|} \hline June 12 & Accounts Payable \\ Purchase Returns and Allowances \\ June 14 Accounts Payable \\ & Purchase Discounts \\ & Cash \end{tabular} 300 June 15 Cash 11,172 Sales Discounts 228 Accounts Receivable June 19 Cash 7,100 \begin{tabular}{|} \hline 4,250 \\ \hline \\ \hline \\ \hline \end{tabular} the account balances. \begin{tabular}{|cccc|} \hline & & Sales Returns and Allowances \\ \hline Date Explanation Ref. & Debit \\ \hline & & 1 & \\ \hline \end{tabular} \begin{tabular}{|ccccc|} \hline & & \multicolumn{2}{c}{ Purchases Returns and Allowances } \\ \hline Date Explanation & Ref. & Debit & Credit \\ \hline\( \hdashline \) & & J1 & \\ \hline \end{tabular} \begin{tabular}{|ccccc|} \hline & & \multicolumn{2}{c|}{ Freight In } \\ \hline Date Explanation & Ref. & Debit & Credit \\ \hline & & J1 & \\ \hline \end{tabular} \begin{tabular}{|ccccc|} \hline & & \multicolumn{1}{c}{ Delivery Expense } \\ \hline Date Explanation & Ref. & Debit & Credit \\ \hline & & & \\ \hline \end{tabular}