Question

The company has 100,000 preferred shares issued and outstanding for the entire year. The preferred shares are non-cumulative and non-participating. There is a conversion feature

The company has 100,000 preferred shares issued and outstanding for the entire year. The preferred shares are non-cumulative and non-participating. There is a conversion feature where each preferred share can be converted into 20 common shares.

On January 1, 2021; the company had 600,000 common shares outstanding. On April 1, the company issued 200,000 common shares. There was a 2 for 1 stock split on June 1. These transactions have been accounted for and are included on the trial balance.

The company can issue an unlimited number of common shares.

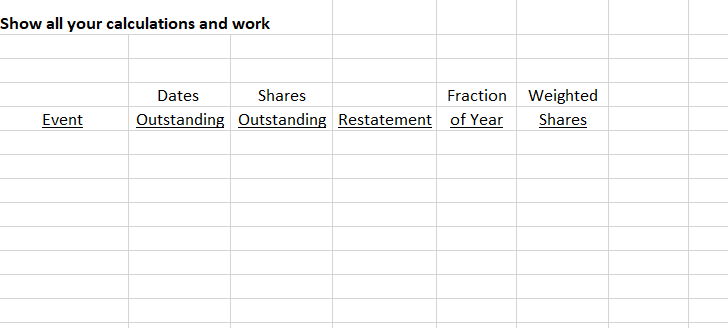

In the Excel spreadsheet, see the tab Diluted EPS Calculation to show your work relating to, weighted average number or shares and Earnings per Share and to make any dividend calculations.

Only calculate EPS and Diluted EPS for 2021.

There was no change in shares during 2020.

- Dividends

On December 31, 2021 the company declared a dividend of $0.23 per share for common shares outstanding and $1.25 per share on preferred shares. The dividends will be paid in January 2022.

There were no dividends declared in 2020.

Show all your calculations and work

Show all your calculations and work Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started