Question

The company has a cost of capital that ranges from: Rate Project risk 8% low 10% average 13% high risk The coefficient of variation NPV

The company has a cost of capital that ranges from:

Rate Project risk

8% low

10% average

13% high risk

The coefficient of variation NPV for Average risk project is between .8 and 1.2

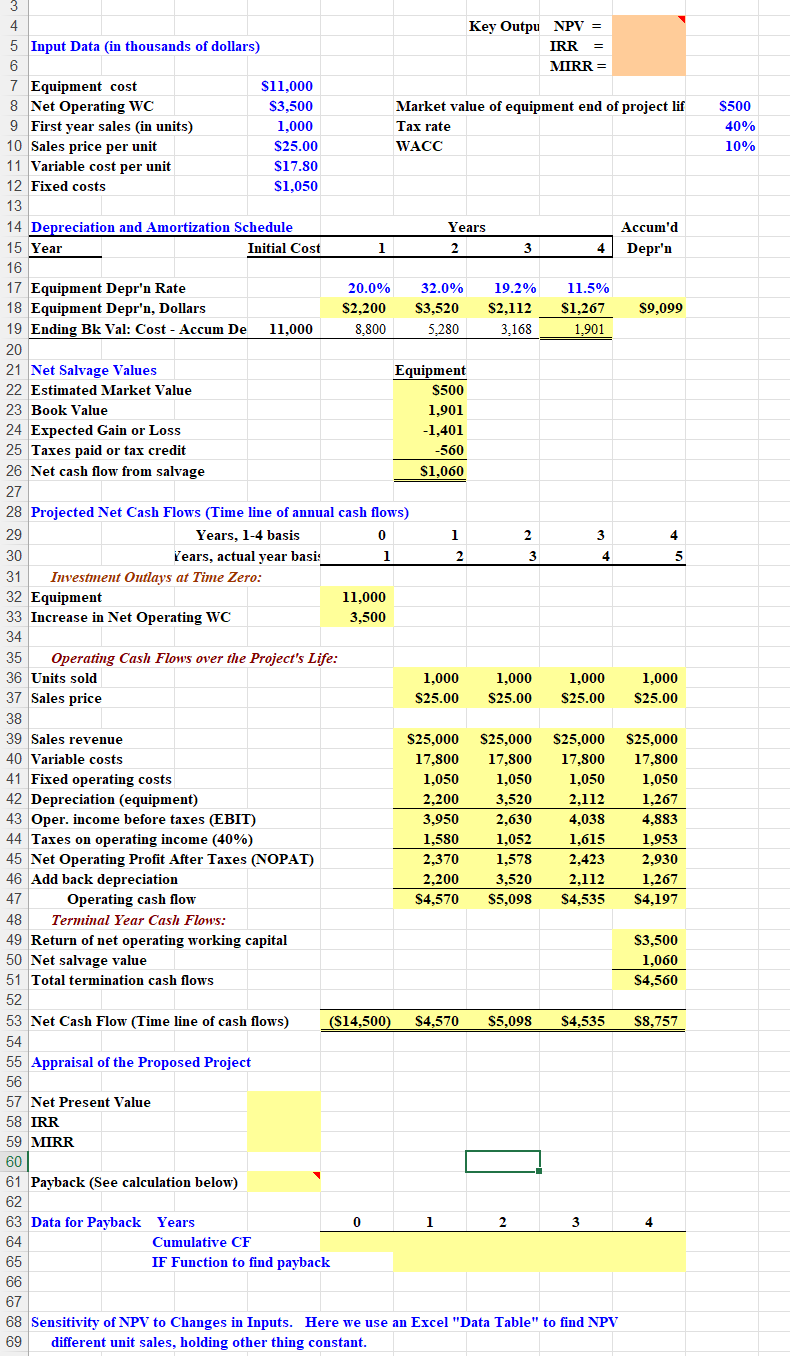

Create a spreadsheet and use it to find the projects NPV, IRR and payback. Your spreadsheet should have the following sections: Input Data (in thousands of dollars), Depreciation and Amortization Schedule, Net Salvage Values, Projected Net Cash Flows (Time line of annual cash flows), Appraisal of the Proposed Project (NPV, IRR, MIRR, Payback (using if statement). Using Excels Data Table Examine the sensitivity of NPV to changes in inputs (sales, WACC, variable costs, fixed costs, sales price). Graph the results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started