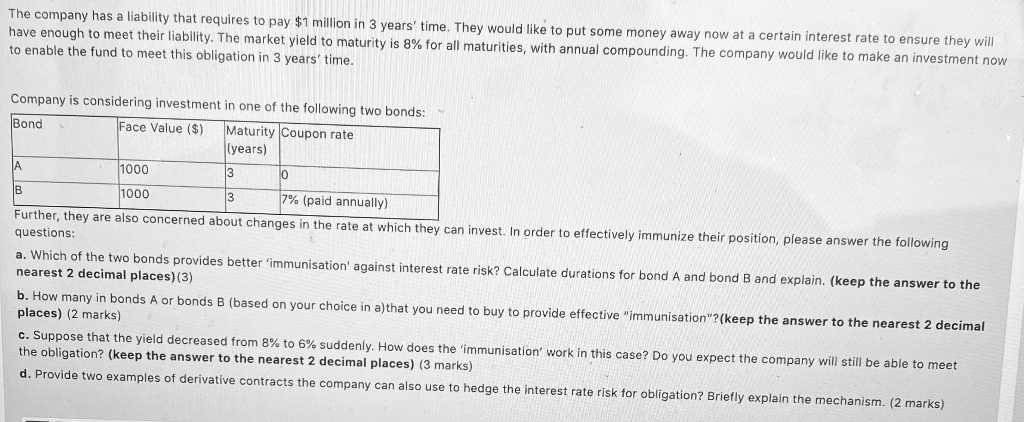

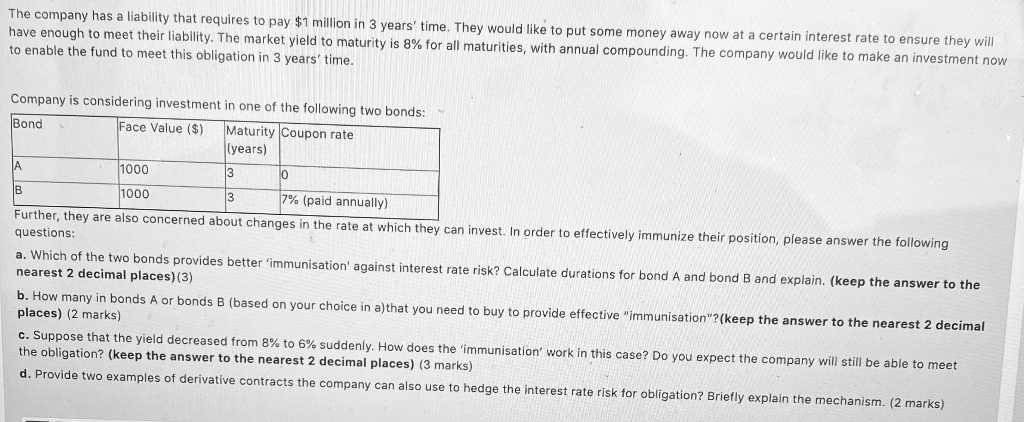

The company has a liability that requires to pay $1 million in 3 years' time. They would like to put some money away now at a certain interest rate to ensure they will have enough to meet their liability. The market yield to maturity is 8% for all maturities, with annual compounding. The company would like to make an investment now to enable the fund to meet this obligation in 3 years' time. Company is considering investment in one of the following two bonds: Bond Face Value ($) Maturity Coupon rate (years) A 3 10 1000 B 1000 3 7% (paid annually) Further, they are also concerned about changes in the rate at which they can invest. In order to effectively immunize their position, please answer the following questions: a. Which of the two bonds provides better 'immunisation' against interest rate risk? Calculate durations for bond A and bond B and explain. (keep the answer to the nearest 2 decimal places) (3) b. How many in bonds A or bonds B (based on your choice in a)that you need to buy to provide effective "immunisation"?(keep the answer to the nearest 2 decimal places) (2 marks) c. Suppose that the yield decreased from 8% to 6% suddenly. How does the immunisation' work in this case? Do you expect the company will still be able to meet the obligation? (keep the answer to the nearest 2 decimal places) (3 marks) d. Provide two examples of derivative contracts the company can also use to hedge the interest rate risk for obligation? Briefly explain the mechanism. (2 marks) The company has a liability that requires to pay $1 million in 3 years' time. They would like to put some money away now at a certain interest rate to ensure they will have enough to meet their liability. The market yield to maturity is 8% for all maturities, with annual compounding. The company would like to make an investment now to enable the fund to meet this obligation in 3 years' time. Company is considering investment in one of the following two bonds: Bond Face Value ($) Maturity Coupon rate (years) A 3 10 1000 B 1000 3 7% (paid annually) Further, they are also concerned about changes in the rate at which they can invest. In order to effectively immunize their position, please answer the following questions: a. Which of the two bonds provides better 'immunisation' against interest rate risk? Calculate durations for bond A and bond B and explain. (keep the answer to the nearest 2 decimal places) (3) b. How many in bonds A or bonds B (based on your choice in a)that you need to buy to provide effective "immunisation"?(keep the answer to the nearest 2 decimal places) (2 marks) c. Suppose that the yield decreased from 8% to 6% suddenly. How does the immunisation' work in this case? Do you expect the company will still be able to meet the obligation? (keep the answer to the nearest 2 decimal places) (3 marks) d. Provide two examples of derivative contracts the company can also use to hedge the interest rate risk for obligation? Briefly explain the mechanism. (2 marks)