Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company has an agreement to lease equipment from 1 July 2018 for five years. The equipment was brought into use on the same

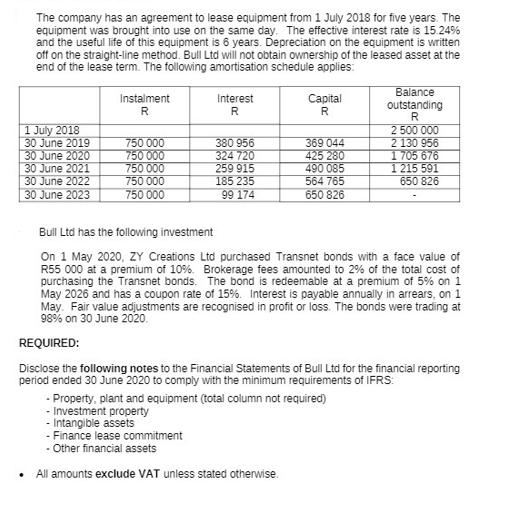

The company has an agreement to lease equipment from 1 July 2018 for five years. The equipment was brought into use on the same day. The effective interest rate is 15.24% and the useful life of this equipment is 6 years. Depreciation on the equipment is written off on the straight-line method. Bull Ltd will not obtain ownership of the leased asset at the end of the lease term. The following amortisation schedule applies: 1 July 2018 30 June 2019 30 June 2020 30 June 2021 30 June 2022 30 June 2023 Instalment R . 750 000 750 000 750 000 750 000 750 000 Interest R 380 956 324 720 259 915 185 235 99 174 Capital R 369 044 425 280 490 085 564 765 650 826 Balance outstanding R 2 500 000 Bull Ltd has the following investment On 1 May 2020, ZY Creations Ltd purchased Transnet bonds with a face value of R55 000 at a premium of 10%. Brokerage fees amounted to 2% of the total cost of purchasing the Transnet bonds. The bond is redeemable at a premium of 5% on 1 May 2026 and has a coupon rate of 15%. Interest is payable annually in arrears, on 1 May. Fair value adjustments are recognised in profit or loss. The bonds were trading at 98% on 30 June 2020. REQUIRED: 2 130 956 1 705 676 1 215 591 650 826 Disclose the following notes to the Financial Statements of Bull Ltd for the financial reporting period ended 30 June 2020 to comply with the minimum requirements of IFRS: - Property, plant and equipment (total column not required) - Investment property - Intangible assets - Finance lease commitment - Other financial assets All amounts exclude VAT unless stated otherwise.

Step by Step Solution

★★★★★

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Notes to the Financial Statements of Bull Ltd For the financial reporting period ended 30 Jun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started