Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider you just graduated college and want to purchase a house. Your dream home is a 4 bedroom, 2 bath, with 2,000 square feet

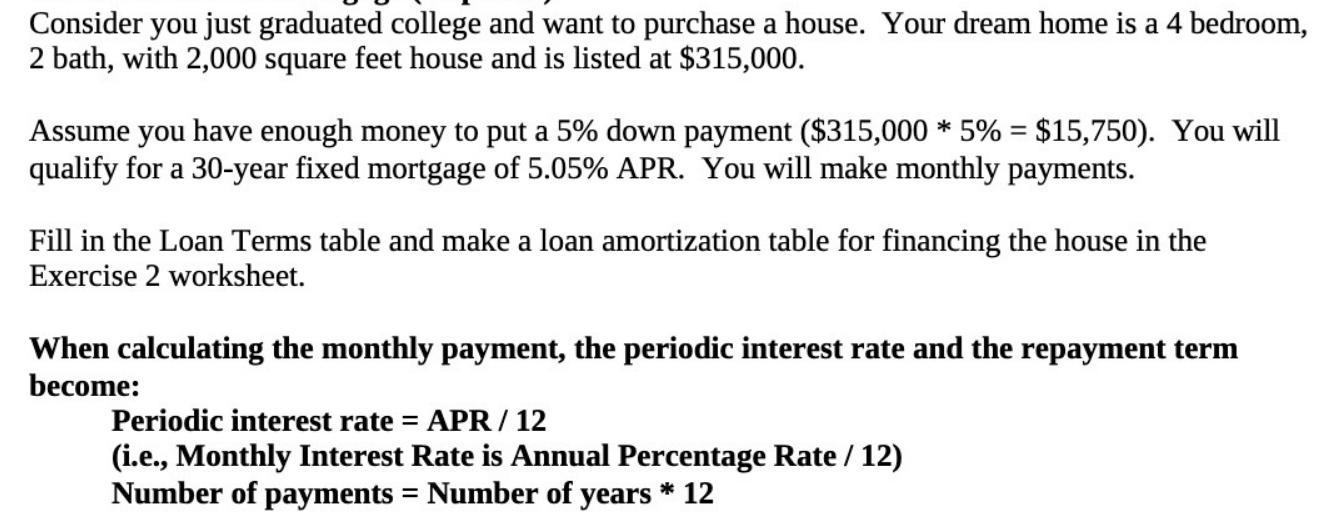

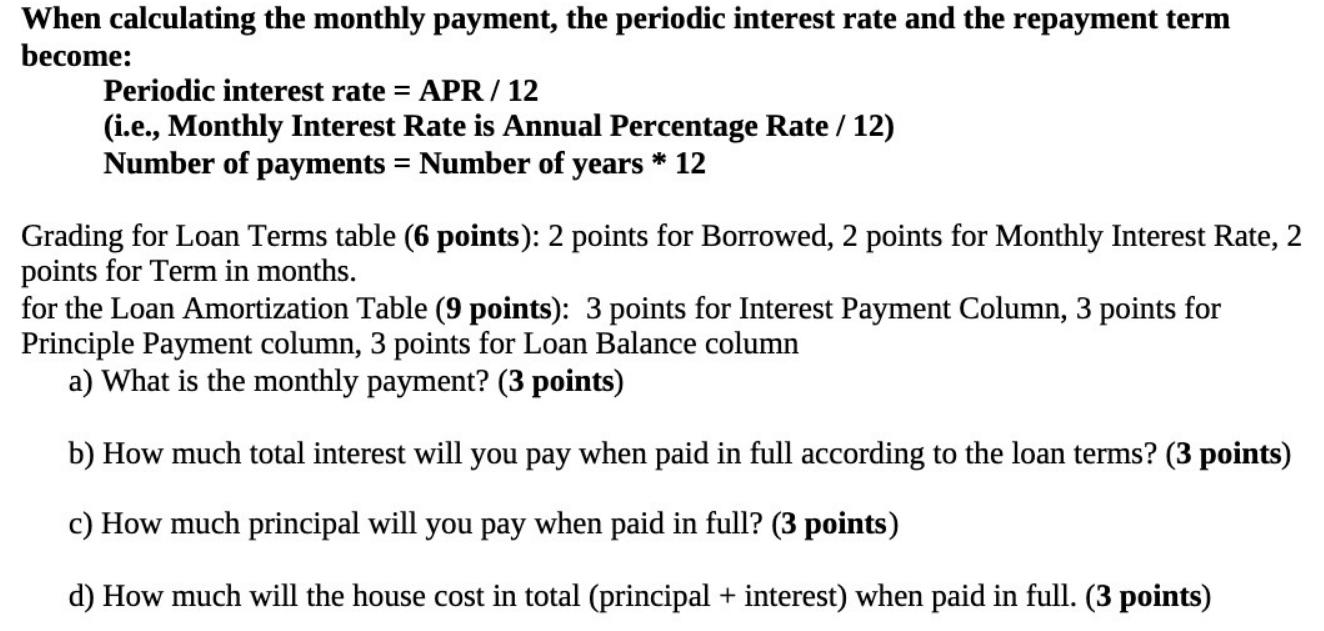

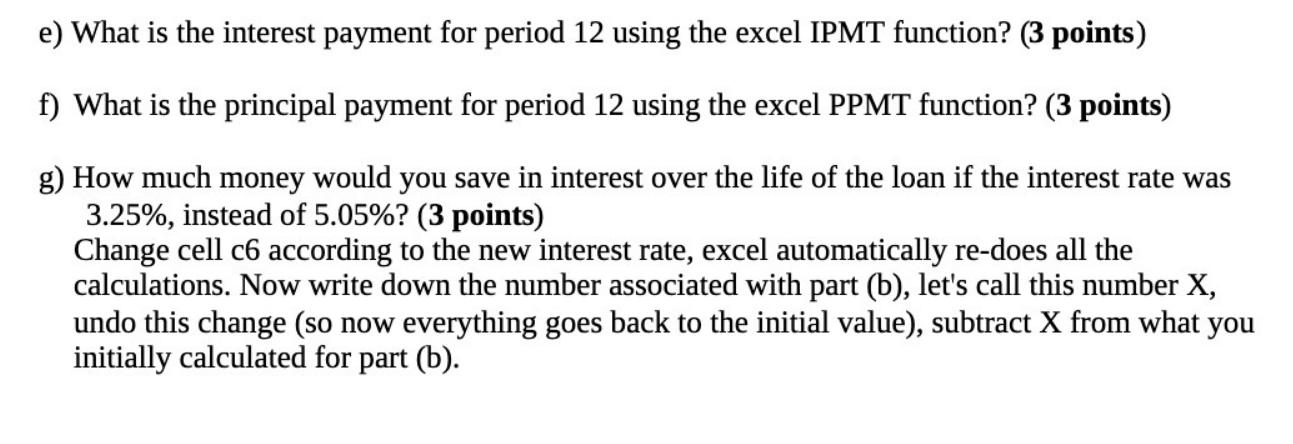

Consider you just graduated college and want to purchase a house. Your dream home is a 4 bedroom, 2 bath, with 2,000 square feet house and is listed at $315,000. Assume you have enough money to put a 5% down payment ($315,000 * 5% = $15,750). You will qualify for a 30-year fixed mortgage of 5.05% APR. You will make monthly payments. Fill in the Loan Terms table and make a loan amortization table for financing the house in the Exercise 2 worksheet. When calculating the monthly payment, the periodic interest rate and the repayment term become: Periodic interest rate = APR / 12 (i.e., Monthly Interest Rate is Annual Percentage Rate / 12) Number of payments = Number of years * 12 When calculating the monthly payment, the periodic interest rate and the repayment term become: Periodic interest rate = APR / 12 (i.e., Monthly Interest Rate is Annual Percentage Rate / 12) Number of payments = Number of years * 12 Grading for Loan Terms table (6 points): 2 points for Borrowed, 2 points for Monthly Interest Rate, 2 points for Term in months. for the Loan Amortization Table (9 points): 3 points for Interest Payment Column, 3 points for Principle Payment column, 3 points for Loan Balance column a) What is the monthly payment? (3 points) b) How much total interest will you pay when paid in full according to the loan terms? (3 points) c) How much principal will you pay when paid in full? (3 points) d) How much will the house cost in total (principal + interest) when paid in full. (3 points) e) What is the interest payment for period 12 using the excel IPMT function? (3 points) f) What is the principal payment for period 12 using the excel PPMT function? (3 points) g) How much money would you save in interest over the life of the loan if the interest rate was 3.25%, instead of 5.05%? (3 points) Change cell c6 according to the new interest rate, excel automatically re-does all the calculations. Now write down the number associated with part (b), let's call this number X, undo this change (so now everything goes back to the initial value), subtract X from what you initially calculated for part (b).

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the loan terms and create a loan amortization table I will follow the given information and formulas Heres the Loan Terms table Loan TermsValue Borrowed299250 Monthly Interest Rate00421 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started