Question

The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month,

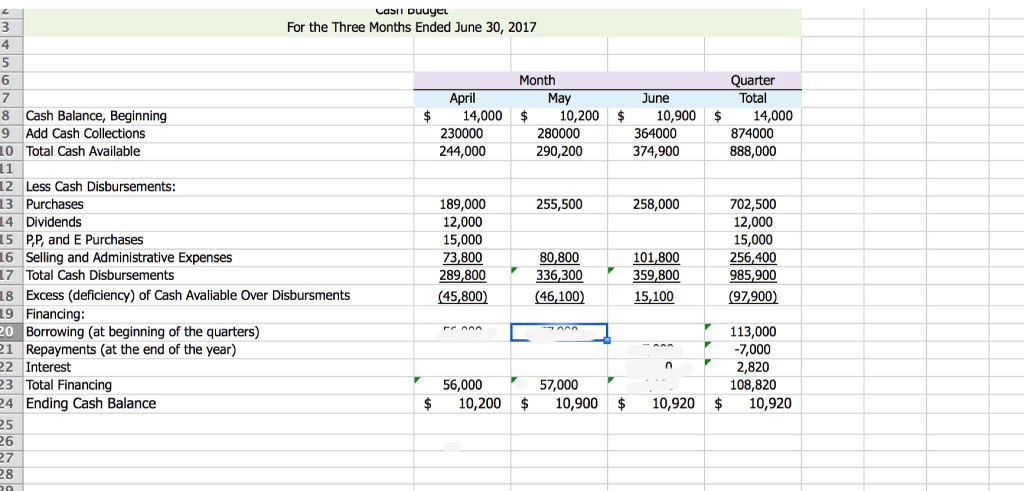

The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $200,000. The interest rate on these loans is 12% per year. For simplicity, assume that the interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000), while still retaining at least $10,000 in cash. how do I find how much I want to borrow for the months of April and May? How do I figure out how much I want to pay back in the month of May? The Ending cash balance in may has to equal $10,280.

Casi I DuuyEL For the Three Months Ended June 30, 2017 Month Quarter May June Tota 8 Cash Balance, Beginning 14,000 10,200 10,900 14,000 9 Add Cash Collections 230000 280000 364000 874000 244,000 290,200 10 Total Cash Available 374,900 888,000 11 12 Less Cash Disbursements: 13 Purchases 189,000 255,500 258,000 702,500 12,000 14 Dividends 12,000 15,000 15,000 15 PP and E Purchases 73,800 80,800 101,800 256400 289,800 359,800 985,900 16 Selling and Administrative Expenses 17 Total Cash Disbursements 15100 (45,800) 18 Excess (deficiency) of Cash Avaliable over Disbursments 19 Financing: 113,000 20 Borrowing (at beginning of the quarters) 21 Repayments (at the end of the year) -7,000 2,820 22 Interest r 56,000 57,000 108,820 23 Total Financing 24 Ending Cash Balance 10,200 10,900 10,920 10,920 25 26 27 28Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started