Question

The company has more places to put their new products. According to the research of the storage price, each storage rack is not exceeding RM2,000.

The company has more places to put their new products. According to the research of the storage price, each storage rack is not exceeding RM2,000. Therefore, for the tax purpose, the company is able to claim small value assets as the cost of storage rack is not exceeding RM2,000 each. By referring to Income Tax Act 2021, each business is eligible to claim a full deduction of capital allowance in the year of purchase and it is subject to an aggregate limit of RM20,000 per year. Moreover, AIS is recommended to purchase a new vehicle such as a van via loan for the purpose of delivering their products to their customers. The vehicle will be more helpful to deliver their product in prompt and without delay. As a result, the service provided will increase the reputation of the company. In the tax perspective, if AIS purchases a van via loan, the interest expenses incurred are subject to tax deduction and it is also available to claim capital allowance. A van is classified as a commercial vehicle and it is qualified for capital allowance with a condition that the expenditure must be incurred on or after the commencement date of the business. If such expenditure incurred prior to the commencement of the business, it is not subject to tax deduction. For the capital allowance, it is available for initial allowance in the first year of purchasing the vehicle and annual allowance for each year of assessment. For example, AIS purchased a van via loan of 12% with the cost of RM200,000, it is available for 20% of initial allowance and 20% of annual allowance for the year of assessment. At the same time, it is also eligible for tax deduction on the interest incurred on loan. Therefore, the total claim is the total amount of capital allowance claim and the interest incur. (Show Capital Allowance & interest expense calculation, Chargeable Income, tax payable) ( Below attachemnt is the sample,)

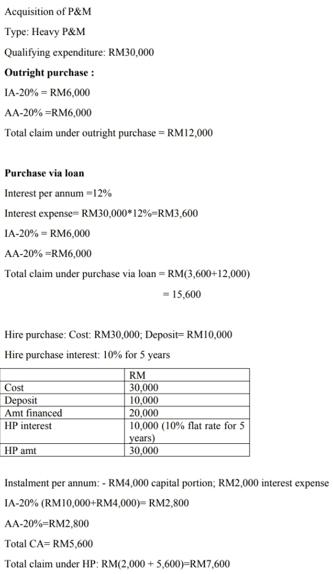

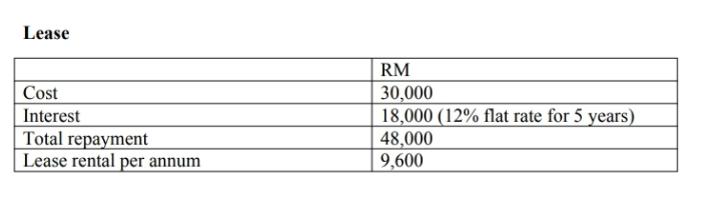

Acquisition of P&M Type: Heavy P&M Qualifying expenditure: RM30,000 Outright purchase: IA-20%= RM6,000 AA-20% =RM6,000 Total claim under outright purchase = RM12,000 Purchase via loan Interest per annum 12% Interest expense- RM30,000*12% -RM3,600 IA-20%= RM6,000 AA-20% -RM6,000 Total claim under purchase via loan = RM(3,600+12,000) - 15,600 Hire purchase: Cost: RM30,000; Deposit RM10,000 Hire purchase interest: 10% for 5 years Cost Deposit Amt financed HP interest HP amt RM 30,000 10,000 20,000 10,000 (10% flat rate for 5 years) 30,000 Instalment per annum: - RM4,000 capital portion; RM2,000 interest expense IA-20% (RM10,000+RM4,000)=RM2,800 AA-20%=RM2,800 Total CA= RM5,600 Total claim under HP: RM(2,000+5,600)-RM7,600

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Capital Allowance Calculation Initial Allowance RM200000 x 20 RM40000 Annual Allowance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started