Question

The partnership of Carding and Moly was formed on February 28, 20x1. At that date, the following assets were contributed: Carding P35,000 Cash Moly

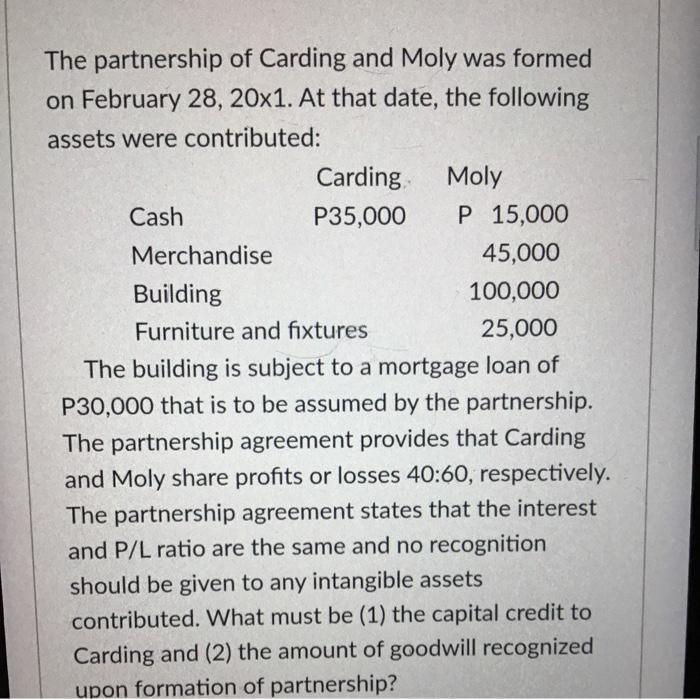

The partnership of Carding and Moly was formed on February 28, 20x1. At that date, the following assets were contributed: Carding P35,000 Cash Moly P 15,000 Merchandise 45,000 Building 100,000 Furniture and fixtures 25,000 The building is subject to a mortgage loan of P30,000 that is to be assumed by the partnership. The partnership agreement provides that Carding and Moly share profits or losses 40:60, respectively. The partnership agreement states that the interest and P/L ratio are the same and no recognition should be given to any intangible assets contributed. What must be (1) the capital credit to Carding and (2) the amount of goodwill recognized upon formation of partnership?

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South-Western Federal Taxation 2019 Essentials Of Taxation Individuals And Business Entities

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

22nd Edition

133770296X, 133770377X, 9781337703772, 978-1337702966

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App