Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Company has some new products that it expects to lead to high growth in the near future. It is given analysts the following forecasts

The Company has some new products that it expects to lead to high growth in the near future.

It is given analysts the following forecasts for the next three years:

2016 2017 2018

Depreciation 35,000 38,000 41,000

EBIT 200,000 250,000 300,000

Investment in operating Assets 50,000 45,000 40,000

The firms debt has a current market value of $500,000 and it has $30,000 in Market securities.

There are 75,000 common shares Outstanding. The expected Tax rate is 35%, and the WACC is estimated to be 11%

I need help with number 6

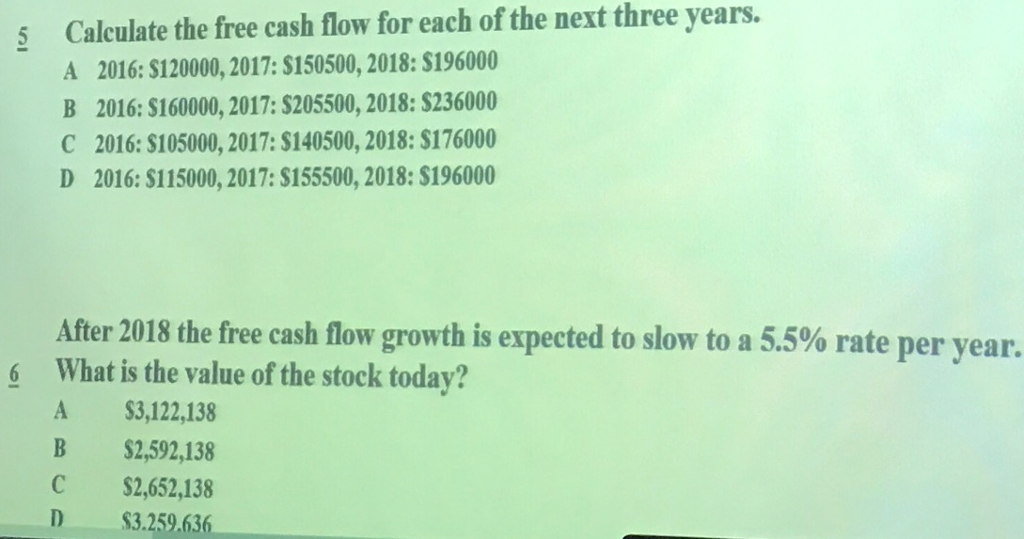

Calculate the free cash years. flow for each of the next three years. A 2016: $120000, 2017: $150500, 2018: $196000 B 2016: 60000, 2017: S205500, 2018: $236000 C 2016: S105000, 2017: S140500, 2018: $176000 D 2016: S115000, 2017: S155500, 2018: S196000 After 2018 the free cash flow growth is expected to slow to a 5.5% rate per year 6 What is the value of the stock today? A $3,122,138 B $2,592,138 C $2,652,138 D $3.259.636

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started