Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company has stock rights outstanding of $40,000 for 10, 000 shares and an exercise price of $20.During the year, the stock rights were

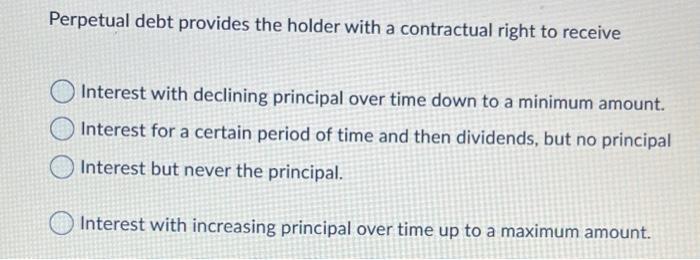

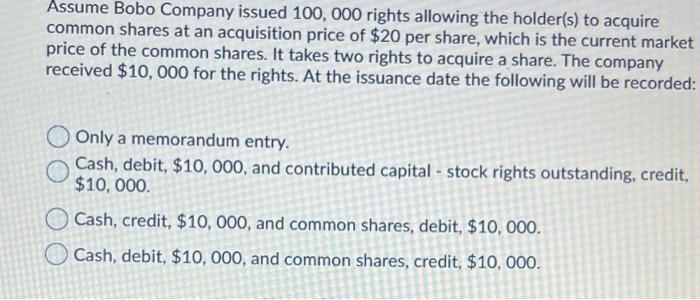

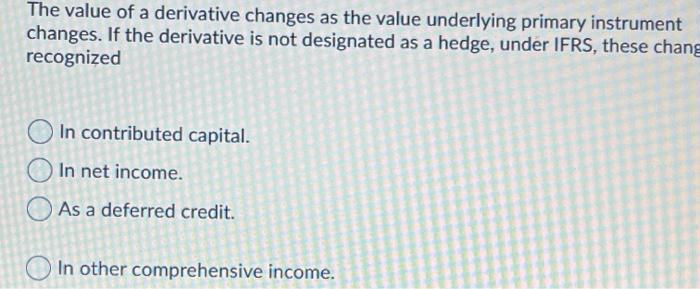

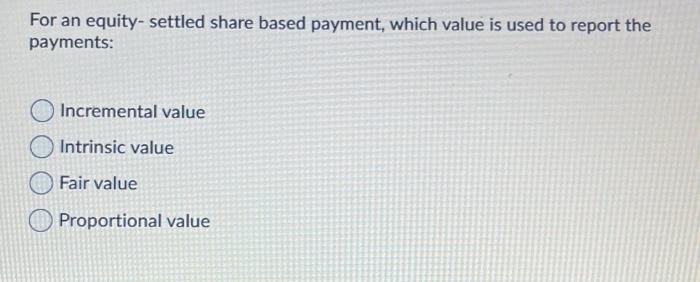

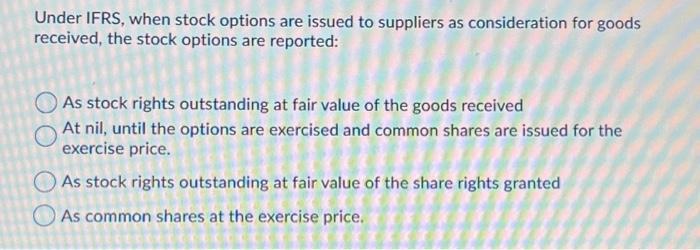

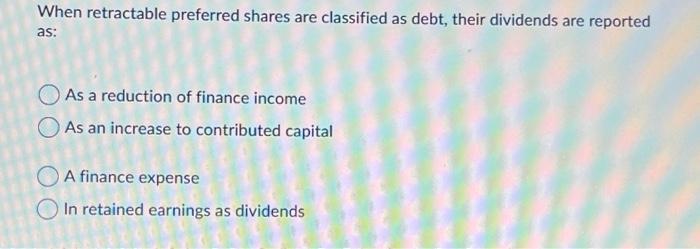

The company has stock rights outstanding of $40,000 for 10, 000 shares and an exercise price of $20.During the year, the stock rights were all exercised when the share was trading at $25. What is the impact on the cash flows statement? Cash inflow of $200, 000 will show in the financing section. Cash inflow of $160, 000 will show in the financing section Cash inflow of $200, 000 will show in the finance section and a non-cash adjustment to net earnings of $40, 000 will show in the operating section. Cash inflow of $250,000 will show in the financing section. Perpetual debt provides the holder with a contractual right to receive Interest with declining principal over time down to a minimum amount. Interest for a certain period of time and then dividends, but no principal Interest but never the principal. Interest with increasing principal over time up to a maximum amount. Assume Bobo Company issued 100, 000 rights allowing the holder(s) to acquire common shares at an acquisition price of $20 per share, which is the current market price of the common shares. It takes two rights to acquire a share. The company received $10,000 for the rights. At the issuance date the following will be recorded: Only a memorandum entry. Cash, debit, $10,000, and contributed capital - stock rights outstanding, credit, $10,000. Cash, credit, $10,000, and common shares, debit, $10,000. Cash, debit, $10, 000, and common shares, credit, $10,000. The value of a derivative changes as the value underlying primary instrument changes. If the derivative is not designated as a hedge, under IFRS, these chang recognized In contributed capital. In net income. As a deferred credit. In other comprehensive income. The convertible bond convertible at the investor's option requires that the option to convert be determined using the: Is deemed to be zero. Proportional method Fair value method Incremental method Options are valued using the Incremental method. Proportional method. Intrinsic value method. Fair value-based method. Under ASPE, a convertible bond is reported as: All equity and assumes that the debt portion is nil Part equity and part debt based on the proportional method. Part equity and part debt, based on the incremental method All debt, and assumes that the equity portion is nil For an equity-settled share based payment, which value is used to report the payments: Incremental value Intrinsic value Fair value Proportional value Under IFRS, when stock options are issued to suppliers as consideration for goods received, the stock options are reported: As stock rights outstanding at fair value of the goods received At nil, until the options are exercised and common shares are issued for the exercise price. As stock rights outstanding at fair value of the share rights granted As common shares at the exercise price. When retractable preferred shares are classified as debt, their dividends are reported as: As a reduction of finance income As an increase to contributed capital A finance expense In retained earnings as dividends

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The company has stock rights outstanding of 40 000 for 10 000 shares and an exercise price of 20 During the year the stock rights were all exercised when the share was trading at 25 What is the impact ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started