Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company i have is Cole Group Limited. The competitors are Woolworths, Metcash and Endeavour. the ratios are Current Ratio, P/E, Roa and ROE i

The company i have is Cole Group Limited. The competitors are Woolworths, Metcash and Endeavour.

the ratios are Current Ratio, P/E, Roa and ROE i do not know how to go about this assignment.

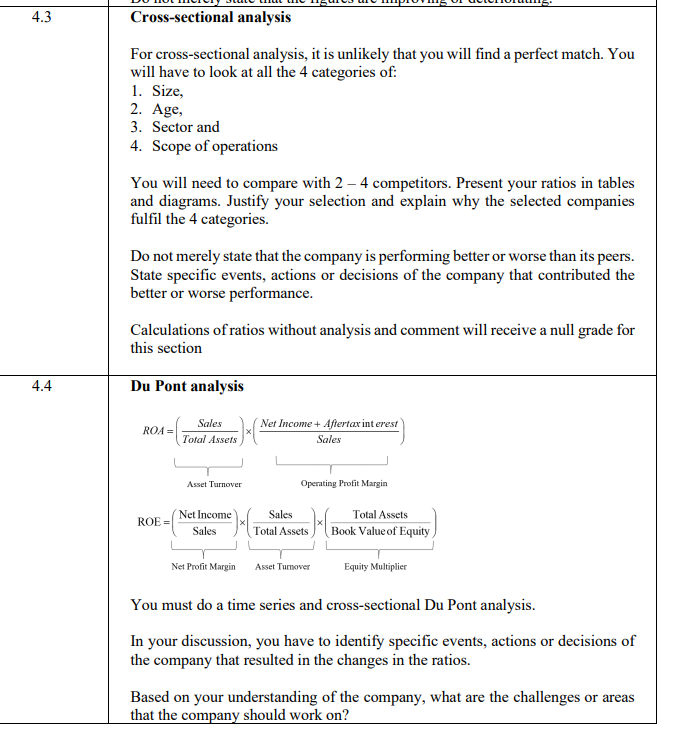

4.3 4.4 14 Cross-sectional analysis For cross-sectional analysis, it is unlikely that you will find a perfect match. You will have to look at all the 4 categories of: 1. Size, 2. Age, 3. Sector and 4. Scope of operations You will need to compare with 2-4 competitors. Present your ratios in tables and diagrams. Justify your selection and explain why the selected companies fulfil the 4 categories. Do not merely state that the company is performing better or worse than its peers. State specific events, actions or decisions of the company that contributed the better or worse performance. Calculations of ratios without analysis and comment will receive a null grade for this section Du Pont analysis ROA= Sales Total Assets Net Income+ Aftertax interest Sales Asset Turnover Operating Profit Margin ROE= Net Income Sales Sales Total Assets Total Assets Book Value of Equity, Net Profit Margin Asset Turnover Equity Multiplier You must do a time series and cross-sectional Du Pont analysis. In your discussion, you have to identify specific events, actions or decisions of the company that resulted in the changes in the ratios. Based on your understanding of the company, what are the challenges or areas that the company should work on?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 CrossSectional Analysis a Competitor Selection To perform a crosssectional analysis select competitors that are relevant and comparable to Cole Group Limited In this case we have chosen Woolworths M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started