Answered step by step

Verified Expert Solution

Question

1 Approved Answer

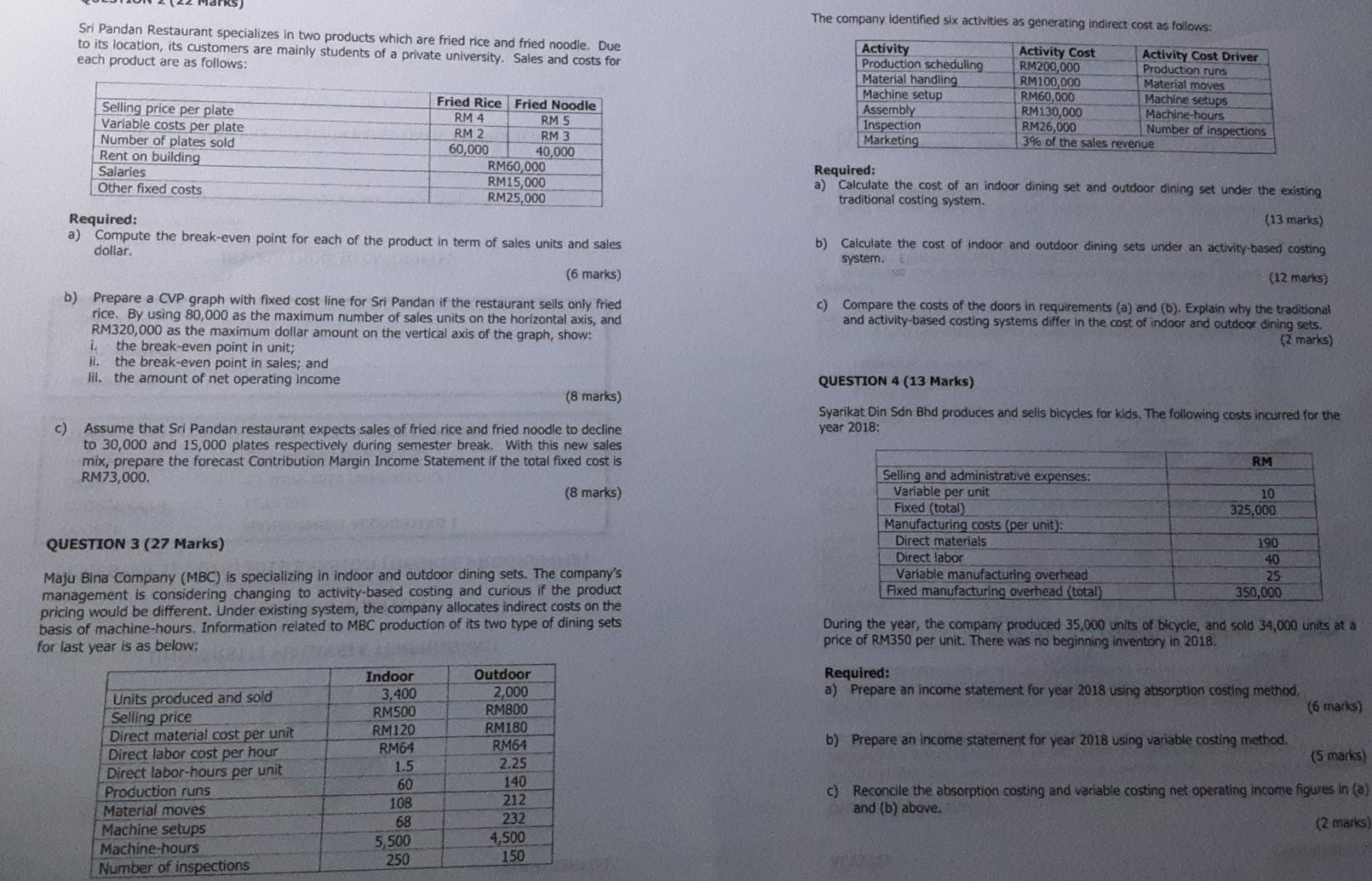

The company identified six activities as generating indirect cost as follows: Sri Pandan Restaurant specializes in two products which are fried rice and fried noodle.

The company identified six activities as generating indirect cost as follows: Sri Pandan Restaurant specializes in two products which are fried rice and fried noodle. Due to its location, its customers are mainly students of a private university. Sales and costs for each product are as follows: Activity Production scheduling Material handling Machine setup Assembly Inspection Marketing Activity Cost Activity Cost Driver RM200,000 Production runs RM100,000 Material moves RM60,000 Machine setups RM130,000 Machine-hours RM26,000 Number of inspections 3% of the sales revenue Selling price per plate Variable costs per plate Number of plates sold Rent on building Salaries Other fixed costs Fried Rice Fried Noodle RM 4 RM 5 RM 2 RM3 40,000 RM60,000 RM15,000 RM25,000 60,000 Required: a) Calculate the cost of an indoor dining set and outdoor dining set under the existing traditional costing system. (13 marks) Required: a) Compute the break-even point for each of the product in term of sales units and sales dollar. (6 marks) b) Calculate the cost of indoor and outdoor dining sets under an activity-based costing system. (12 marks) c) Compare the costs of the doors in requirements (a) and (b). Explain why the traditional and activity-based costing systems differ in the cost of indoor and outdoor dining sets. (2 marks) b) Prepare a CVP graph with fixed cost line for Sri Pandan if the restaurant sells only fried rice. By using 80,000 as the maximum number of sales units on the horizontal axis, and RM320,000 as the maximum dollar amount on the vertical axis of the graph, show: i. the break-even point in unit; ii. the break-even point in sales; and lll. the amount of net operating income (8 marks) QUESTION 4 (13 Marks) Syarikat Din Sdn Bhd produces and sells bicycles for kids. The following costs incurred for the year 2018: c) Assume that Sri Pandan restaurant expects sales of fried rice and fried noodle to decline to 30,000 and 15,000 plates respectively during semester break. With this new sales mix, prepare the forecast Contribution Margin Income Statement if the total fixed cost is RM73,000. (8 marks) RM 10 325,000 Selling and administrative expenses: Variable per unit Fixed (total) Manufacturing costs (per unit): Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead (total) QUESTION 3 (27 Marks) 190 40 25 350,000 Maju Bina Company (MBC) is specializing in indoor and outdoor dining sets. The company's management is considering changing to activity-based costing and curious if the product pricing would be different. Under existing system, the company allocates indirect costs on the basis of machine-hours. Information related to MBC production of its two type of dining sets for last year is as below: During the year, the company produced 35,000 units of bicycle, and sold 34,000 units at a price of RM350 per unit. There was no beginning inventory in 2018. Required: a) Prepare an income statement for year 2018 using absorption costing method (6 marks) b) Prepare an income statement for year 2018 using variable costing method. Units produced and sold Selling price Direct material cost per unit Direct labor cost per hour Direct labor-hours per unit Production runs Material moves Machine setups Machine-hours Number of inspections (5 marks) Indoor 3,400 RM500 RM120 RM64 1.5 60 108 68 5,500 250 Outdoor 2,000 RM800 RM180 RM64 2.25 140 212 232 4,500 150 c) Reconcile the absorption costing and variable costing net operating income figures in @) and (b) above. (2 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started