Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company is conducting the sales of merchandise both on cash basis (10% of all customers with 1% discount rate of 1% ) and on

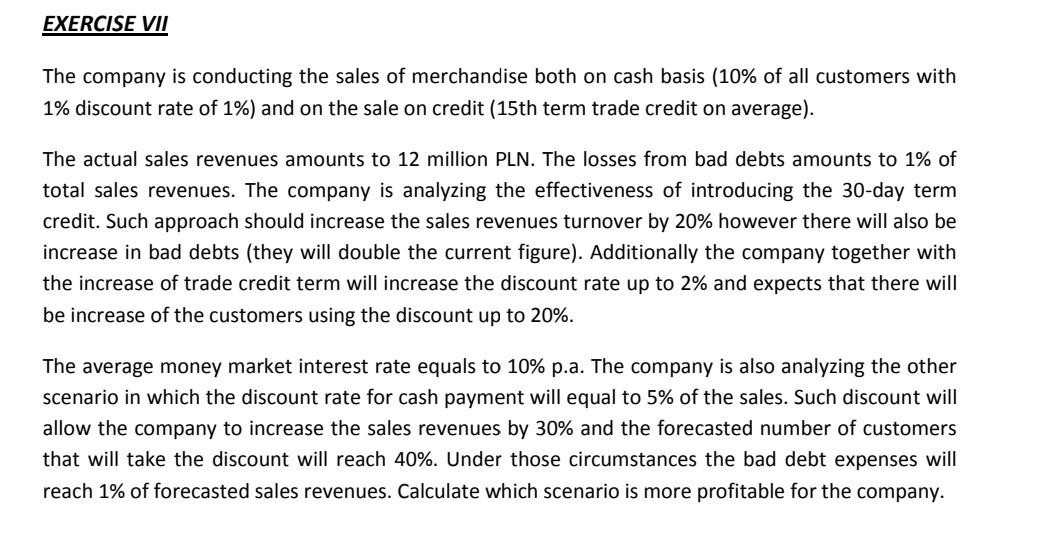

The company is conducting the sales of merchandise both on cash basis (10% of all customers with 1% discount rate of 1% ) and on the sale on credit (15th term trade credit on average). The actual sales revenues amounts to 12 million PLN. The losses from bad debts amounts to 1% of total sales revenues. The company is analyzing the effectiveness of introducing the 30 -day term credit. Such approach should increase the sales revenues turnover by 20% however there will also be increase in bad debts (they will double the current figure). Additionally the company together with the increase of trade credit term will increase the discount rate up to 2% and expects that there will be increase of the customers using the discount up to 20%. The average money market interest rate equals to 10% p.a. The company is also analyzing the other scenario in which the discount rate for cash payment will equal to 5% of the sales. Such discount will allow the company to increase the sales revenues by 30% and the forecasted number of customers that will take the discount will reach 40%. Under those circumstances the bad debt expenses will reach 1% of forecasted sales revenues. Calculate which scenario is more profitable for the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started