Question

The Company is considering investing in a new Compressed Air machine that has an estimated life of 8 years. The cost of the machine is

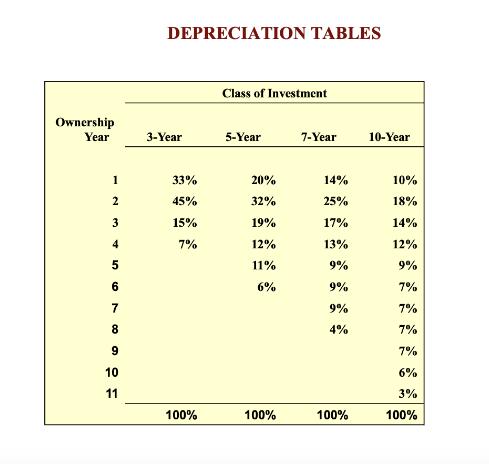

The Company is considering investing in a new Compressed Air machine that has an estimated life of 8 years. The cost of the machine is $6 million, and the machine will be depreciated using MACRS over its life to a residual value of half of a million. The machine will result in sales of $2 million in year 1. Sales are estimated to grow by 5% per year each year through year 8 life. The cost of operation for it is $1million a year and will grow at 3% per year over the life of the machine. Use the 7-year example below for 8 years dep.

Installation of the machine and the resulting increase in manufacturing capacity will require an increase in various net working capital accounts. It is estimated that the Company needs to hold 2% of its annual sales in cash, 6% of its annual sales in accounts receivable, 8% of its annual sales in inventory, and 6% of its annual sales in accounts payable. The firm is in the 30% tax bracket and has a cost of capital of 12%.

1) What is the incremental unlevered net income for the project over eight years?

2) The incremental unlevered cash flow for the project over eight years?

3) The depreciation tax shield for the project over eight years.

4) What is NPV? What is IRR? Should the project be taken?

Ownership Year 1 2 3 4 5 6 7 8 9 10 11 DEPRECIATION TABLES 3-Year 33% 45% 15% 7% 100% Class of Investment 5-Year 20% 32% 19% 12% 11% 6% 100% 7-Year 14% 25% 17% 13% 9% 9% 9% 4% 100% 10-Year 10% 18% 14% 12% 9% 7% 7% 7% 7% 6% 3% 100%

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the analysis step by step to find the incremental unlevered net income incremental unlevered cash flow depreciation tax shield NPV and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started